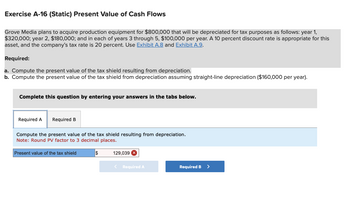

Exercise A-16 (Static) Present Value of Cash Flows Grove Media plans to acquire production equipment for $800,000 that will be depreciated for tax purposes as follows: year 1, $320,000; year 2, $180,000; and in each of years 3 through 5, $100,000 per year. A 10 percent discount rate is appropriate for this asset, and the company's tax rate is 20 percent. Use Exhibit A.8 and Exhibit A.9. Required: a. Compute the present value of the tax shield resulting from depreciation. b. Compute the present value of the tax shield from depreciation assuming straight-line depreciation ($160,000 per year). Complete this question by entering your answers in the tabs below. Required A Required B Compute the present value of the tax shield resulting from depreciation. Note: Round PV factor to 3 decimal places. Present value of the tax shield $ 129,039 X < Required A Required B >

Exercise A-16 (Static) Present Value of Cash Flows Grove Media plans to acquire production equipment for $800,000 that will be depreciated for tax purposes as follows: year 1, $320,000; year 2, $180,000; and in each of years 3 through 5, $100,000 per year. A 10 percent discount rate is appropriate for this asset, and the company's tax rate is 20 percent. Use Exhibit A.8 and Exhibit A.9. Required: a. Compute the present value of the tax shield resulting from depreciation. b. Compute the present value of the tax shield from depreciation assuming straight-line depreciation ($160,000 per year). Complete this question by entering your answers in the tabs below. Required A Required B Compute the present value of the tax shield resulting from depreciation. Note: Round PV factor to 3 decimal places. Present value of the tax shield $ 129,039 X < Required A Required B >

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts need more information to provide you with a solution. Please resubmit your question with the required exhibit, making sure it's detailed and complete. We've credited a question to your account.

Your Question:

Transcribed Image Text:Exercise A-16 (Static) Present Value of Cash Flows

Grove Media plans to acquire production equipment for $800,000 that will be depreciated for tax purposes as follows: year 1,

$320,000; year 2, $180,000; and in each of years 3 through 5, $100,000 per year. A 10 percent discount rate is appropriate for this

asset, and the company's tax rate is 20 percent. Use Exhibit A.8 and Exhibit A.9.

Required:

a. Compute the present value of the tax shield resulting from depreciation.

b. Compute the present value of the tax shield from depreciation assuming straight-line depreciation ($160,000 per year).

Complete this question by entering your answers in the tabs below.

Required A

Required B

Compute the present value of the tax shield resulting from depreciation.

Note: Round PV factor to 3 decimal places.

Present value of the tax shield

$

129,039 X

< Required A

Required B

>

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you