FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

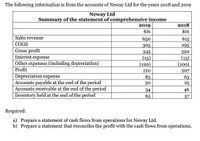

Transcribed Image Text:The following information is from the accounts of Neway Ltd for the years 2018 and 2019

Neway Ltd

Summary of the statement of comprehensive income

2019

2018

$m

$m

Sales revenue

650

615

COGS

305

295

Gross profit

Interest expense

Other expenses (including depreciation)

Profit

320

(13)

(100)

345

(15)

(120)

210

207

63

Depreciation expense

Accounts payable at the end of the period

Accounts receivable at the end of the period

|Inventory held at the end of the period

85

30

25

34

46

65

57

Required:

a) Prepare a statement of cash flows from operations for Neway Ltd.

b) Prepare a statement that reconciles the profit with the cash flows from operations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The primary objective of the statement of cash flows is to provide information about a company's: O Cash receipts and disbursements. O Noncash financing and investing activities. O Financial position. O Profitability.arrow_forwardUsing accrual accounting, when is revenue recognized?A. When cash transfers B. When the performance obligation is fulfilled C. When products is received FOB shipping point D. When the products is shipped FOB destinarrow_forwardWhich of the following best describes the information reported in the income statement? Multiple Choice The current resources available to pay current obligations. The portion of profits paid in cash to stockholders. The extent to which cash inflows exceed cash outflows. The amount recognized from providing goods and services to customers compared to the cost of doing so.arrow_forward

- _______ is comprised of operating cash flow, capital spending, and additions to NWC A. Op cash flow B. Net fixed assets C. Cash flow to shareholders D. Free cash flow E. Cash flow from assetsarrow_forwardThe three categories of a firm's statement of cash flows are________. A. cash flow from operating activities, cash flow from noncash activities, and cash flow from financing activities B. cash flow from operating activities, cash flow from investmentactivities, and cash flow from noncash activities C. cash flow from equity activities, cash flow from investment activities, and cash flow from financing activities D. cash flow from operatingactivities, cash flow from investment activities, and cash flow from financing activitiesarrow_forwardWhich of the following statements is false?A. Noncash activities should be reported in accrual basis financial statements.B. Net cash flow from operating activities relates to normal business operations.C. Net income usually equals net cash flow from operating activities.D. The statement of cash flows is an essential part of the basic financial statements.arrow_forward

- (participation expected < You would find asset, liability, and equity accounts on which of the following statements? OA. Statement of cash flows B. Balance sheet OC. Statement of retained earnings OD. Income statementarrow_forwardOne output of the accounting information system is the balance sheet. Transactions commonly associated with an organization's purchases and cash disbursements cycle are most likely to be reflected in which sections of balance sheet? A Current assets and current liabilities B Current assets and long-term liabilities C Long-term assets and current liabilities D Long-term assets and long-term liabilitiesarrow_forwardSelect the item that matches with the description. Descriptions a. Begins with net income and then lists adjustments to net income in order to arrive at operating cash flows. b. Item included in net income, but excluded from net operating cash flows. c. Net cash flows from operating activities divided by average total assets. d. Cash transactions involving lenders and investors. e. Cash transactions involving net income. f. Cash transactions for the purchase and sale of long-term assets. g. Purchase of long-term assets by issuing stock to seller. h. Shows the cash inflows and outflows from operations such as cash received from customers and cash paid for inventory, salaries, rent, interest, and taxes. Termsarrow_forward

- Create a cash-flow statement. Make sure all three areas (operating, investment, and Financing activities) are includedarrow_forwardWhich of the following would not be on the statement of cash flow? A. Cash flows from operating activities B. Cash flows from financing activities C. Cash flows from Contingent activities D. Cash flows from investingarrow_forwardIndicate in which financial statement each item would most likely appear: income statement (I), balancesheet (B), or statement of cash flows (CF). Equipmentarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education