FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Module pute Net Operating Profit after Tax

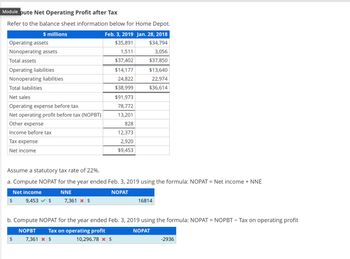

Refer to the balance sheet information below for Home Depot.

Feb. 3, 2019 Jan. 28, 2018

$35,891

$34,794

1,511

3,056

$37,402

$37,850

$14,177

$13,640

24,822

22,974

$38,999

$36,614

Operating assets

Nonoperating assets

Total assets

$ millions

Operating liabilities

Nonoperating liabilities

Total liabilities

Net sales

Operating expense before tax

Net operating profit before tax (NOPBT)

Other expense

Income before tax

Tax expense

Net income

Assume a statutory tax rate of 22%.

a. Compute NOPAT for the year ended Feb. 3, 2019 using the formula: NOPAT = Net income + NNE

Net income

NNE

NOPAT

$

9,453 $

$

$91,973

78,772

13,201

828

12,373

2,920

$9,453

7,361 * $

16814

b. Compute NOPAT for the year ended Feb. 3, 2019 using the formula: NOPAT = NOPBT - Tax on operating profit

NOPBT Tax on operating profit

7,361 * $

10,296.78 x $

NOPAT

-2936

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The pretax financial income (or loss) figures for Shamrock Company are as follows. 2017 81,000 2018 (51,000 ) 2019 (35,000 ) 2020 111,000 2021 95,000 Pretax financial income (or loss) and taxable income (loss) were the same for all years involved. Assume a 25% tax rate for 2017 and a 20% tax rate for the remaining years.Prepare the journal entries for the years 2017 to 2021 to record income tax expense and the effects of the net operating loss carryforwards. All income and losses relate to normal operations. (In recording the benefits of a loss carryforward, assume that no valuation account is deemed necessary.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Credit 2017 enter an account title to record carryback enter a debit amount enter a…arrow_forwardCompute and Interpret Ratios Selected balance sheet and income statement information from Illinois Tool Works follows. $ millions 2019 2018 2017 Net operating profit after tax (NOPAT) $2,480 $2,575 Net income 2,395 2,435 Total assets 13,561 13,383 $15,102 Equity 2,723 2,929 2,929 Net operating profit after tax (NOA) 7,982 8,516 9,080 Treasury stock 18,033 16,668 14,784 Compute profitability measures: RNOA, ROA and ROE for 2019 and 2018 using the numbers as reported by the company. Note: Round answers to one decimal place (ex: 0.2345 = 23.5%). b. Adjust equity and total assets for the amount of treasury stock. Using these restated numbers, recompute RNOA, ROA and ROE for both years.Note: Round answers to one decimal place (ex: 0.2345 = 23.5%).arrow_forwardOak Corporation has the following general business credit carryovers: 2016 $7,250 2017 21,750 2018 8,250 2019 25,750 Total carryovers $63,000 The general business credit generated by activities during 2020 equals $50,400 and the total credit allowed during the current year is $87,000 (based on tax liability). a. Enter the amount (if any) of each year's carryover utilized in 2020. Year Amount ofCarryoverUtilized 2016 $ 2017 $ 2018 $ 2019 $ 2020 $ b. What is the amount of any unused credits carried forward to 2021?arrow_forward

- How much is the restated balance of AMSTERDAM's retained earnings account at January 1, 2021?arrow_forwardDo parts a to d Accounting for Income Taxes Yoda Company is in the process of accounting for its income taxes for the year ended December 31, 2020. The following information came from Yoda's accounting and taxation records: Accounting income before income taxes for 2020 $ 98,967 Depreciation expense for property, plant, and equipment for 2020 $ 222,227 Capital cost allowance to be claimed on Yoda's 2020 income tax return $ 244,450 Book value of property, plant, and equipment at December 31, 2019 $ 1,399,268 Undepreciated capital cost of property, plant, and equipment at December 31, 2019 $ 1,203,370 Assume that there were no additions or disposals of property, plant, and equipment during 2020. In 2020, Yoda began offering a 1-year warranty on all merchandise sold. Following are details pertaining to this warranty: Warranty expense for 2020 for accounting purposes $ 38,860…arrow_forwardPlease answer in good accounting form. Thankyouarrow_forward

- The following balances were taken from the books of Skysong Corp. on December 31, 2025. Interest revenue Cash Sales revenue Accounts receivable Prepaid insurance Sales returns and allowances Allowance for doubtful accounts Sales discounts Land Equipment Buildings Cost of goods sold $87,250 52,250 1,381,250 151,250 21,250 151,250 8,250 46,250 101,250 201,250 141,250 622,250 Assume the total effective tax rate on all items is 20%. Accumulated depreciation-equipment Accumulated depreciation-buildings Notes receivable Selling expenses Accounts payable Bonds payable Administrative and general expenses Accrued liabilities Interest expense Notes payable Loss from earthquake damage Common stock Retained earnings $41,250 29,250 156,250 195,250 171,250 101,250 98,250 33,250 61,250 101,250 151,250 501,250 22,250 Prepare a multiple-step income statement; 100,000 shares of common stock were outstanding during the year. (Round earnings perarrow_forwardThe following information has been obtained for Sheridan Corporation. 1. Prior to 2020, taxable income and pretax financial income were identical. 2. Pretax financial income is $1,634,000 in 2020 and $1,359,000 in 2021. On January 1, 2020, equipment costing $1,260,000 is purchased. It is to be depreciated on a straight-line basis over 5 years for tax purposes and over 8 years for financial reporting purposes. (Hint: Use the half-year convention for tax purposes, as discussed in Appendix 11A.) 3. 4. Interest of $57,000 was earned on tax-exempt municipal obligations in 2021. 5. Included in 2021 pretax financial income is a gain on discontinued operations of $195,000, which is fully taxable. 6. The tax rate is 20% for all periods. 7. Taxable income is expected in all future years.arrow_forwardplease help me to solve this problemarrow_forward

- 302. Subject : - financearrow_forwardBonita Inc. reports the following pretax income (loss) for both book and tax purposes. Pretax Year Income (Loss) Tax Rate 2018 $124,000 20 % 2019 86,000 20 % 2020 (89,000 ) 25 % 2021 126,000 25 % The tax rates listed were all enacted by the beginning of 2018. Prepare the journal entries for years 2018-2021 to record income tax expense (benefit) and income taxes payable, and the tax effects of the loss carryforward, assuming that based on the weight of available evidence, it is more likely than not that one-half of the benefits of the loss carryforward will not be realized. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)arrow_forwardWhich cost flow assumption generally results in the highest reported amount for ending inventory when inventory costs are rising? Explain.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education