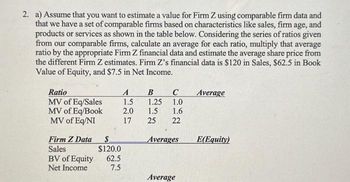

2. a) Assume that you want to estimate a value for Firm Z using comparable firm data and that we have a set of comparable firms based on characteristics like sales, firm age, and products or services as shown in the table below. Considering the series of ratios given from our comparable firms, calculate an average for each ratio, multiply that average ratio by the appropriate Firm Z financial data and estimate the average share price from the different Firm Z estimates. Firm Z's financial data is $120 in Sales, $62.5 in Book Value of Equity, and $7.5 in Net Income. Ratio MV of Eq/Sales MV of Eq/Book MV of Eq/NI Firm Z Data Sales BV of Equity Net Income $ $120.0 62.5 7.5 A B C 1.5 1.25 1.0 2.0 1.5 1.6 17 25 22 Averages Average Average E(Equity)

2. a) Assume that you want to estimate a value for Firm Z using comparable firm data and that we have a set of comparable firms based on characteristics like sales, firm age, and products or services as shown in the table below. Considering the series of ratios given from our comparable firms, calculate an average for each ratio, multiply that average ratio by the appropriate Firm Z financial data and estimate the average share price from the different Firm Z estimates. Firm Z's financial data is $120 in Sales, $62.5 in Book Value of Equity, and $7.5 in Net Income. Ratio MV of Eq/Sales MV of Eq/Book MV of Eq/NI Firm Z Data Sales BV of Equity Net Income $ $120.0 62.5 7.5 A B C 1.5 1.25 1.0 2.0 1.5 1.6 17 25 22 Averages Average Average E(Equity)

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

Our experts are unable to provide you with a solution at this time. Try rewording your question, and make sure to submit one question at a time. We've credited a question to your account.

Your Question:

Transcribed Image Text:2. a) Assume that you want to estimate a value for Firm Z using comparable firm data and

that we have a set of comparable firms based on characteristics like sales, firm age, and

products or services as shown in the table below. Considering the series of ratios given

from our comparable firms, calculate an average for each ratio, multiply that average

ratio by the appropriate Firm Z financial data and estimate the average share price from

the different Firm Z estimates. Firm Z's financial data is $120 in Sales, $62.5 in Book

Value of Equity, and $7.5 in Net Income.

Ratio

MV of Eq/Sales

MV of Eq/Book

MV of Eq/NI

Firm Z Data

Sales

BV of Equity

Net Income

$

$120.0

62.5

7.5

A

B C

1.5 1.25 1.0

2.0

1.5

1.6

17

25 22

Averages

Average

Average

E(Equity)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning