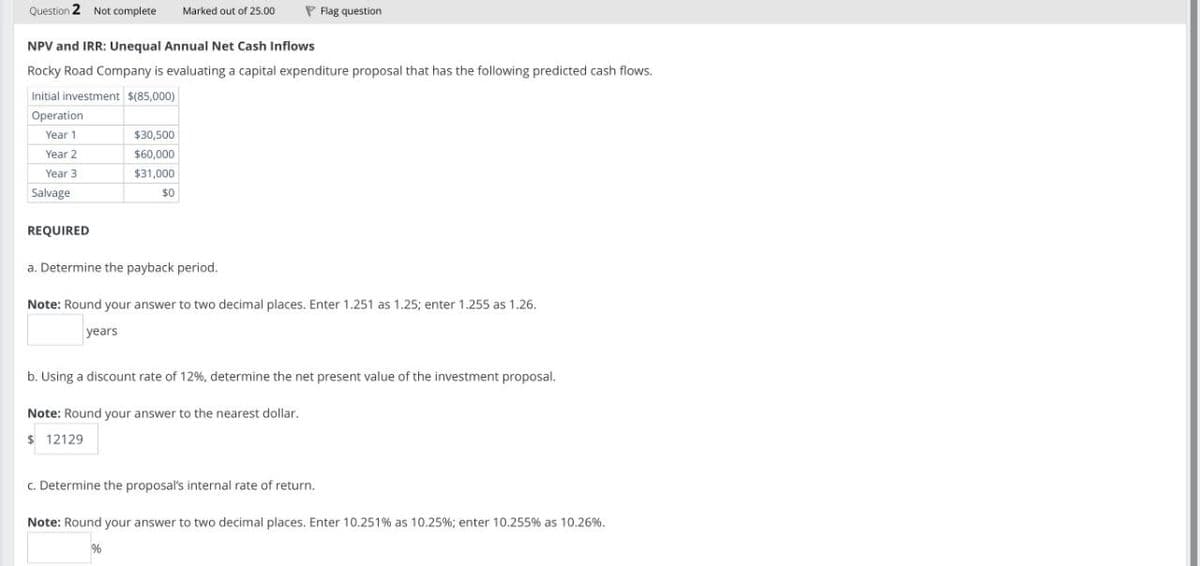

Question 2 Not complete Marked out of 25.00 Flag question NPV and IRR: Unequal Annual Net Cash Inflows Rocky Road Company is evaluating a capital expenditure proposal that has the following predicted cash flows. Initial investment $(85,000) Operation Year 1 $30,500 Year 2 $60,000 Year 3 $31,000 $0 Salvage REQUIRED a. Determine the payback period. Note: Round your answer to two decimal places. Enter 1.251 as 1.25; enter 1.255 as 1.26. years b. Using a discount rate of 12%, determine the net present value of the investment proposal. Note: Round your answer to the nearest dollar. $ 12129 c. Determine the proposal's internal rate of return. Note: Round your answer to two decimal places. Enter 10.251% as 10.25%; enter 10.255 % as 10.26%. %

Question 2 Not complete Marked out of 25.00 Flag question NPV and IRR: Unequal Annual Net Cash Inflows Rocky Road Company is evaluating a capital expenditure proposal that has the following predicted cash flows. Initial investment $(85,000) Operation Year 1 $30,500 Year 2 $60,000 Year 3 $31,000 $0 Salvage REQUIRED a. Determine the payback period. Note: Round your answer to two decimal places. Enter 1.251 as 1.25; enter 1.255 as 1.26. years b. Using a discount rate of 12%, determine the net present value of the investment proposal. Note: Round your answer to the nearest dollar. $ 12129 c. Determine the proposal's internal rate of return. Note: Round your answer to two decimal places. Enter 10.251% as 10.25%; enter 10.255 % as 10.26%. %

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter26: Capital Investment Analysis

Section: Chapter Questions

Problem 2MAD: Assume San Lucas Corporation in MAD 26-1 assigns the following probabilities to the estimated annual...

Related questions

Question

Transcribed Image Text:Question 2 Not complete

Marked out of 25.00

Flag question

NPV and IRR: Unequal Annual Net Cash Inflows

Rocky Road Company is evaluating a capital expenditure proposal that has the following predicted cash flows.

Initial investment $(85,000)

Operation

Year 1

$30,500

Year 2

$60,000

Year 3

$31,000

$0

Salvage

REQUIRED

a. Determine the payback period.

Note: Round your answer to two decimal places. Enter 1.251 as 1.25; enter 1.255 as 1.26.

years

b. Using a discount rate of 12%, determine the net present value of the investment proposal.

Note: Round your answer to the nearest dollar.

$ 12129

c. Determine the proposal's internal rate of return.

Note: Round your answer to two decimal places. Enter 10.251% as 10.25%; enter 10.255 % as 10.26%.

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning