FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

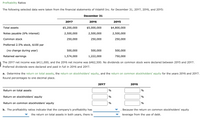

Transcribed Image Text:Profitability Ratios

The following selected data were taken from the financial statements of Vidahill Inc. for December 31, 20Y7, 20Y6, and 20Y5:

December 31

20Υ7

20Y6

20Y5

Total assets

$5,200,000

$5,000,000

$4,800,000

Notes payable (6% interest)

2,500,000

2,500,000

2,500,000

Common stock

250,000

250,000

250,000

Preferred 2.5% stock, $100 par

(no change during year)

500,000

500,000

500,000

Retained earnings

1,574,000

1,222,000

750,000

The 20Y7 net income was $411,000, and the 20Y6 net income was $462,500. No dividends on common stock were declared between 20Y5 and 20Y7.

Preferred dividends were declared and paid in full in 20Y6 and 20Y7.

a. Determine the return on total assets, the return on stockholders' equity, and the return on common stockholders' equity for the years 20Y6 and 20Y7.

Round percentages to one decimal place.

20Υ7

20Y6

Return on total assets

%

%

Return on stockholders' equity

%

Return on common stockholders' equity

%

%

b. The profitability ratios indicate that the company's profitability has

Because the return on common stockholders' equity

the return on total assets in both years, there is

leverage from the use of debt.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Current Position Analysis The following data were taken from the balance sheet of Nilo Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash $395,200 $324,000 Marketable securities 457,600 364,500 Accounts and notes receivable (net) 187,200 121,500 Inventories 617,800 411,800 Prepaid expenses 318,200 263,200 Total current assets $1,976,000 $1,485,000 Current liabilities: Accounts and notes payable (short-term) $301,600 $315,000 Accrued liabilities 218,400 135,000 Total current liabilities $520,000 $450,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year 1. Working capital %24 2. Current ratio 3. Quick ratioarrow_forwardMeasures of liquidity, Solvency, and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 67 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Υ1 Retained earnings, January 1 $3,595,450 $3,035,750 Net income 851,200 621,800 Dividends: On preferred stock On common stock (10,500) (10,500) (51,600) (51,600) Retained earnings, December 31 $4,384,550 $3,595,450 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Υ2 20Υ1 Sales $4,847,930 $4,466,640 Cost of merchandise sold 1,594,320 1,466,770 Gross profit $3,253,610 $2,999,870 Selling expenses $1,112,980 $1,377,430 Administrative expenses 948,100 808,960 Total operating expenses $2,061,080 $2,186,39o Income from operations $1,192,530 $813,480 Other revenue and expense: Other revenue 62,770 51,920 Other expense (interest) (288,000) (158,400)…arrow_forwardProfitability Ratios The following selected data were taken from the financial statements of Vidahill Inc. for December 31, 20Y7, 20Y6, and 20Y5: December 31 20Y7 20Y6 20Y5 Total assets $250,000 $225,000 $200,000 Notes payable (8% interest) 80,000 80,000 80,000 Common stock 32,000 32,000 32,000 Preferred 7% stock, $100 par 16,000 16,000 16,000 (no change during year) Retained earnings 88,510 64,380 48,000 The 20Y7 net income was $25,250, and the 20Y6 net income was $17,500. No dividends on common stock were declared between 20Y5 and 20Y7. Preferred dividends were declared and paid in full in 20Y6 and 20Y7. a. Determine the return on total assets, the return on stockholders' equity, and the return on common stockholders’ equity for the years 20Y6 and 20Y7. When required, round to one decimal place. 20Y7 20Y6 Return on total assets fill in the blank 1 % fill in the blank 2 % Return on stockholders’ equity fill…arrow_forward

- Measures of liquidity, Solvency, and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 65 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $1,173,375 $995,425 Net income 259,200 203,900 Total $1,432,575 $1,199,325 Dividends: On preferred stock $8,400 $8,400 On common stock 17,550 17,550 Total dividends $25,950 $25,950 Retained earnings, December 31 $1,406,625 $1,173,375 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $1,622,790 $1,495,130 Cost of goods sold 611,010 562,130 Gross profit $1,011,780 $933,000 Selling expenses $341,930 $416,290 Administrative expenses 291,280 244,490 Total operating…arrow_forwardCurrent Position Analysis The following data were taken from the balance sheet of Albertini Company at the end of two recent fiscal years: Current Year Previous Year Current assets: Cash $486,400 $392,000 Marketable securities 563,200 441,000 Accounts and notes receivable (net) 230,400 147,000 Inventories 792,000 469,700 Prepaid expenses 408,000 300,300 Total current assets $2,480,000 $1,750,000 Current liabilities: Accounts and notes payable (short-term) $464,000 $490,000 Accrued liabilities 336,000 210,000 Total current liabilities $800,000 $700,000 a. Determine for each year (1) the working capital, (2) the current ratio, and (3) the quick ratio. Round ratios to one decimal place. Current Year Previous Year 1. Working capital $fill in the blank 1 $fill in the blank 2 2. Current ratio fill in the blank 3 fill in the blank 4…arrow_forwardMeasures of liquidity, solvency, and profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $82.60 on December 31, 20Y2. Marshall Inc.Comparative Retained Earnings StatementFor the Years Ended December 31, 20Y2 and 20Y1 Line Item Description 20Y2 20Y1 Retained earnings, January 1 $3,704,000 $3,264,000 Net income $600,000 $550,000 Dividends: On preferred stock (10,000) (10,000) On common stock (100,000) (100,000) Increase in retained earnings $490,000 $440,000 Retained earnings, December 31 $4,194,000 $3,704,000 Marshall Inc.Comparative Income StatementFor the Years Ended December 31, 20Y2 and 20Y1 Line Item Description 20Y2 20Y1 Sales $10,850,000 $10,000,000 Cost of goods sold (6,000,000) (5,450,000) Gross profit $4,850,000 $4,550,000 Selling expenses $(2,170,000) $(2,000,000) Administrative expenses (1,627,500) (1,500,000) Total…arrow_forward

- Measures of liquidity, Solvency, and Profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was $ 63 on December 31, 20Y2. Marshall Inc. Comparative Retained Earnings Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Retained earnings, January 1 $1,022,050 $862,950 Net income 233,600 176,800 Total $1,255,650 $1,039,750 Dividends: On preferred stock $7,700 $7,700 On common stock 10,000 10,000 Total dividends $17,700 $17,700 Retained earnings, December 31 $1,237,950 $1,022,050 Marshall Inc. Comparative Income Statement For the Years Ended December 31, 20Y2 and 20Y1 20Y2 20Y1 Sales $1,470,220 $1,354,620 Cost of goods sold 571,590 525,860 Gross profit $898,630 $828,760 Selling expenses $291,610 $366,610 Administrative expenses 248,400 215,310 Total operating expenses…arrow_forwardSelected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION Balance Sheet As of December 31 Year 7 Year 6 Current Assets Cash and cash equivalents $ 634,527 $ 335,597 Marketable securities 166,106 187,064 Accounts receivable (net) 284,226 318,010 Inventories 466,942 430,249 Prepaid expenses 60,906 28,060 Other current assets 83,053 85,029 Total Current Assets 1,695,760 1,384,009 Property, plant and equipment 1,384,217 625,421 Long-term investment 568,003 425,000 Total Assets $3,647,980 $2,434,430 Current Liabilities Short-term borrowings $ 306,376 $ 170,419 Current portion of long-term debt 155,000 168,000 Accounts payable 279,522 314,883 Accrued liabilities 301,024 183,681 Income taxes payable 107,509 196,802 Total Current Liabilities 1,149,431…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education