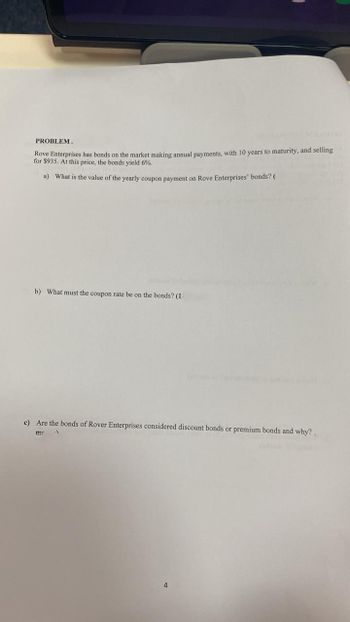

PROBLEM. Rove Enterprises has bonds on the market making annual payments, with 10 years to maturity, and selling for $935. At this price, the bonds yield 6%. a) What is the value of the yearly coupon payment on Rove Enterprises' bonds? ( b) What must the coupon rate be on the bonds? (1 c) Are the bonds of Rover Enterprises considered discount bonds or premium bonds and why? m

PROBLEM. Rove Enterprises has bonds on the market making annual payments, with 10 years to maturity, and selling for $935. At this price, the bonds yield 6%. a) What is the value of the yearly coupon payment on Rove Enterprises' bonds? ( b) What must the coupon rate be on the bonds? (1 c) Are the bonds of Rover Enterprises considered discount bonds or premium bonds and why? m

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

It looks like you may have submitted a graded question that, per our Honor Code, experts cannot answer. We've credited a question to your account.

Your Question:

Transcribed Image Text:PROBLEM.

Rove Enterprises has bonds on the market making annual payments, with 10 years to maturity, and selling

for $935. At this price, the bonds yield 6%.

a) What is the value of the yearly coupon payment on Rove Enterprises' bonds? (

b) What must the coupon rate be on the bonds? (1

c) Are the bonds of Rover Enterprises considered discount bonds or premium bonds and why?

m

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,