FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

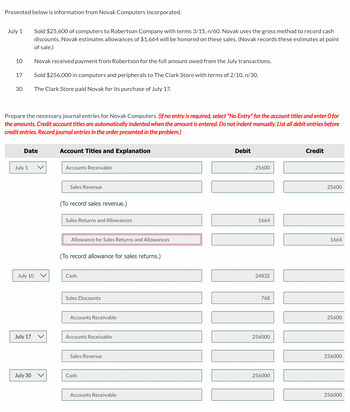

What should I put for the red marked box if the answer is not "Allowance for sales returns and allowances"?

Transcribed Image Text:Presented below is information from Novak Computers Incorporated.

July 1

10

17

30

Prepare the necessary journal entries for Novak Computers. (If no entry is required, select "No Entry" for the account titles and enter O for

the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before

credit entries. Record journal entries in the order presented in the problem.)

Date

July 1

July 10

Sold $25,600 of computers to Robertson Company with terms 3/15, n/60. Novak uses the gross method to record cash

discounts. Novak estimates allowances of $1,664 will be honored on these sales. (Novak records these estimates at point

of sale.)

Novak received payment from Robertson for the full amount owed from the July transactions.

Sold $256,000 in computers and peripherals to The Clark Store with terms of 2/10, n/30.

The Clark Store paid Novak for its purchase of July 17.

July 17

July 30

Account Titles and Explanation

Accounts Receivable

Sales Revenue

(To record sales revenue.)

Sales Returns and Allowances

Allowance for Sales Returns and Allowances

(To record allowance for sales returns.)

Cash

Sales Discounts

Accounts Receivable

Accounts Receivable

Sales Revenue

Cash

Accounts Receivable

Debit

25600

1664

24832

768

256000

256000

Credit

25600

1664

25600

256000

256000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How does an inventory error effect the financial statements?arrow_forwardDecreases in the seller's receivable from a customer's return of merchandise or from granting the customer an allowance from the amount owed to the seller. Select one: O a. Freight Out b. Purchases Discount and Allowances c. Freight In d. Sales Discount and Allowancesarrow_forwardHow do you determine the invoice of merchandise returned?arrow_forward

- A receiving report is filled out when we receive: An inventory shipment from a vendor. Items that a customer is authorized to return from a previous sale. A payment on a customer's account. a and b only. Answer is not the First option!arrow_forwardIf a customer purchases merchandise on credit and returns the defective merchandise beforepayment, what accounts would recognize this transaction?A. sales discount, cashB. sales returns and allowances, cashC. accounts receivable, sales discountD. accounts receivable, sales returns and allowancesarrow_forwardwhat are the most significant differences between uncollectible account expense and allowance for uncollectible accounts?arrow_forward

- explain your answer and do not plagraized form anywherearrow_forwardWhen goods are sold on a bill-and-hold basis, what conditions must be met to recognize revenue upon receipt of the order?arrow_forwardYour landscaping company can lease a truck for $9,000 a year (paid at year-end) for 7 years. It can instead buy the truck for $48,000. The truck will be valueless after 7 years. The interest rate your company can earn on its funds is 8%. a. What is the present value of the cost of leasing? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. Is it cheaper to buy or lease? c. What is the present value of the cost of leasing if the lease payments are an annuity due, so the first payment comes immediately? (Do not round intermediate calculations. Round your answer to 2 decimal places.) d. Is it now cheaper to buy or lease?arrow_forward

- Which of the following is a limitation of the direct write-off method of accounting for uncollectible? The direct write-off method overstates assets on the balance sheet. The direct write-off method does not match expenses against revenue very well. The direct write-off method does not set up an allowance for uncollectible. All of the abovearrow_forwardWhat can be the effect of inventory errors on the financial reports? How can these errors be corrected?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education