FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

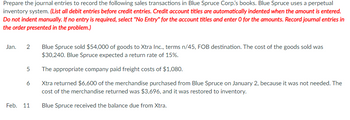

Transcribed Image Text:Prepare the journal entries to record the following sales transactions in Blue Spruce Corp's books. Blue Spruce uses a perpetual

inventory system. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered.

Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in

the order presented in the problem.)

Jan. 2

5

6

Feb. 11

Blue Spruce sold $54,000 of goods to Xtra Inc., terms n/45, FOB destination. The cost of the goods sold was

$30,240. Blue Spruce expected a return rate of 15%.

The appropriate company paid freight costs of $1,080.

Xtra returned $6,600 of the merchandise purchased from Blue Spruce on January 2, because it was not needed. The

cost of the merchandise returned was $3,696, and it was restored to inventory.

Blue Spruce received the balance due from Xtra.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prepare the journal entries to record the following transactions on Wildhorse Company’s books using a perpetual inventory system. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) (a) On March 2, Windsor Company sold $947,600 of merchandise to Wildhorse Company on account, terms 3/10, n/30. The cost of the merchandise sold was $534,200. (b) On March 6, Wildhorse Company returned $105,700 of the merchandise purchased on March 2. The cost of the merchandise returned was $68,600. (c) On March 12, Windsor Company received the balance due from Wildhorse Company. No. Date Account Titles and Explanation Debit Credit (a) choose a transaction date March 2March 6March 12 enter an account title…arrow_forwarddon't give answer in image formatarrow_forwardsarrow_forward

- You are to enter up the sale, purchases, return inwards and returns outwards day book" from the following details. then to post the items to the relevant accounts in the sales and purchases ledgern, The total of the day books are then to be transferred to the account in the general Ledger. 2009 in drawing May 1 Credit sales: T 0mpson Tshs 56,000; L Rodriguez Tshs 148,000; K Barton Tshs 145.000. 3 Credit purchase: P Potter 144.000'. H Harris Tshs 25000 Spencer Tshs 76.000. 7 credit sales K Kelly 89.000; N Mendes Toho 78.000; N lee Tshs 237,000. 9 Credit purchases: B Perkins 24,000; H Haris Tshs 58000 H miles Tshs 123000 11 Good return by to: p Potter Tshs 12000 B. Spencer Tshs22.000. 14 Goods returned to by: T. Thompson Tshs 5.000; K Barton Tshs 11,000; K Kelly Tshs 14000. 17 Credit purchases: H Harris Tshs 54,000; B Perkins Tshs 65000L Nixon Tshs 75.000. 20 Goods returned by us to B Spences Tshs 14000 24 credit sales: K Muhammed Tshs 57000 , K Kelly Tshs 65000, O . Green Tshs 112000 28…arrow_forwardInstructions In this assignment you will record eight transactions related to the sale and purchase of merchandise. You will record each transaction according to the procedures of a periodic inventory system. You will record each transaction according to the procedures of a perpetual inventory system. Include the date for each transaction. Include a brief explanation for each entry similar to the sample entry example. Please skip a line between each transaction entry. You may use the journals provided or create your own journals. If you create your own journals they must have a date column, description column, a debit column and a credit column. You may hand write the journal entries or type them. Transactions to Record Sample Ace Company issues a $200 Sales Allowance to a customer who received damaged merchandise purchased in Feb from Ace. Mar 1 Ace Company sells merchandise totaling $1,500 on account with terms 2/15, n/30, FOB destination. Cost of goods is…arrow_forwardConsider the following transactions for Brighton Drug Store: View the transactions. Requirements 1. Journalize the purchase transactions. Explanations are not required. 2. In the final analysis, how much did the inventory cost Brighton Drug Store? ... Requirement 1. Journalize the purchase transactions. Explanations are not required. (Assume the company uses a perpetual inventory system. Round the answers to the nearest whole dollar. Record debits first, then credits. Exclude explanations from journal entries.) Jan. 2: Brighton Drug Store purchased $20,300 worth of inventory on account with credit terms of 2/15, n/45, FOB shipping point from Birch Medical Supplies. Date Jan. 2 Accounts Debit Credit Transactions Jan. 2 Jan. 3 Brighton Drug Store purchased $20,300 worth of inventory on account with credit terms of 2/15, n/45, FOB shipping point from Birch Medical Supplies. Brighton Drug Store paid a $160 freight charge. Jan. 8 Brighton Drug Store returned $6,500 of the merchandise due to…arrow_forward

- PLEASE DO NOT PROVIDE HAND WRITTEN ANSWERarrow_forwardNix'It Company's ledger on July 31, its fiscal year-end, includes the following selected accounts that have normal balances. Nix'It uses the perpetual inventory system. Retained earnings Dividends Sales Sales discounts Sales returns and allowances Prepare the company's year-end closing entries. View transaction list Journal entry worksheet 1 2 Date July 31 3 4 Record the entry to close the income statement accounts with credit balances. Note: Enter debits before credits. $ 120,300 Cost of goods sold 7,000 Depreciation expense 175,000 Salaries expense 3,400 Miscellaneous expenses 6,000 Record entry General Journal Clear entry Debit Credit $ 106,500 10,800 35,000 5,000 View general journal >arrow_forwardUse the following purchases journal to record the transactions. (If a box is not used in the journal leave the box empty; do not select any information and do not enter a zero. Abbreviation used: Supp. = Supplies) a (Click the icon to view the transactions.) Purchases Journal Page 6 Other Accounts DR Vendor Post. Accounts Merchandise Office Account Post. Date Account Credited Terms Ref. Payable CR Inventory DR Supp. DR Title Ref. Amount 2024 Oct. More Info Oct. 1 Purchased merchandise inventory on account with credit terms of 2/10, n/30 from Milk Co., $2.700, Oct. 11 Purchased office supplies on account from Book Co., $400. Terms were n/EOM. Oct. 24 Purchased furniture on account with credit terms of 4/10, n/60 from Slip Co., $1,600. Print Donearrow_forward

- 12, please read the qestion and answer b1arrow_forwardPlease don't provide answer in image format thank you.arrow_forwardCarla Vista Company uses the allowance method for estimating uncollectible accounts. Prepare journal entries to record the following transactions. Omit cost of goods sold entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) January 5 April 15 August 21 October 5 Date Sold merchandise to Ryan Seacrest for $2,800, terms n/15. Received $480 from Ryan Seacrest on account. Wrote off as uncollectible the balance of the Ryan Seacrest account when he declared bankruptcy. Unexpectedly received a check for $690 from Ryan Seacrest. V Account Titles and Explanation (To reverse write-off of Ryan Seacrest account) (To record collection from Ryan Seacrest account) Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education