FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

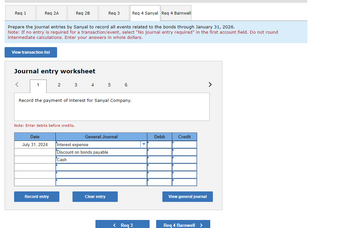

Transcribed Image Text:Req 1

Req 2A

View transaction list

<

Prepare the journal entries by Sanyal to record all events related to the bonds through January 31, 2026.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round

intermediate calculations. Enter your answers in whole dollars.

Journal entry worksheet

1

Req 2B

Note: Enter debits before credits.

Date

July 31, 2024

Record the payment of interest for Sanyal Company.

Record entry

2 3 4 5 6

Req 3

General Journal

Interest expense

Discount on bon payable

Cash

Clear entry

Req 4 Sanyal Req 4 Barnwell

< Req 3

Debit

Credit

View general journal

Req 4 Barnwell >

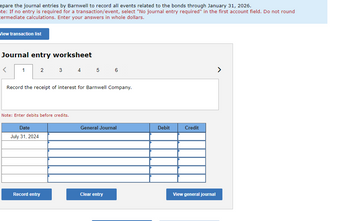

Transcribed Image Text:epare the journal entries by Barnwell to record all events related to the bonds through January 31, 2026.

te: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round

termediate calculations. Enter your answers in whole dollars.

View transaction list

Journal entry worksheet

<

1

2

Date

July 31, 2024

3

Record the receipt of interest for Barnwell Company.

Note: Enter debits before credits.

Record entry

4 5 6

General Journal

Clear entry

Debit

Credit

View general journal

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Crane Company issued $1,730,000 of bonds on January 1, 2022. (a) Prepare the journal entry to record the issuance of the bonds if they are issued at (1) 100, (2) 97, and (3) 105. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) No. Account Titles and Explanation (1) (2) (3) Debit Creditarrow_forwardI need fast answer and show work without plagiarism pleasearrow_forwardView transaction list Journal entry worksheet 2 Record the first installment payment on October 31, 2021. Assume no reversing entries were prepared. Note: Enter debits before credits. Date October 31 General Journal Debit Credit View general journal Record entry Clear entryarrow_forward

- Part 1 Prepare journal entries to the following. (Do not round intermediate calculations. Round the final answers to the nearest whole dollar.) a. Issuance of the bonds on June 1, 2023 b. Payment of interest on December 1, 2023 c. Adjusting entry to accrue bond interest and discount amortization on January 31, 2024 d. Payment of interest on June 1, 2024 Assume JetCom Inventors Inc. has a January 31 year-end. View transaction list Journal entry worksheet 1 2 3 4 Record issued bond at discount. Note: Enter debits before credits. Date June 01, 2023 General Journal Debit Credit >arrow_forwardNonearrow_forwardhttps://education.wiley.com/content/Kieso_Intermediate_Accounting_17e/media/simulations/interest_rate_tables.pdfarrow_forward

- K McKean Company has a three-month, $16,000, 6% note receivable from L. Stow that was signed on June 1, 2016. Stow defaults on the loan on September 1. Journalize the entry for McKean to record the default of the loan. (Record debits first, then, credits. Select the explanation on the last line of the journal entry table.) Date 2016 Sept. 1 Accounts Debit Credit HOarrow_forwardPrepare the journal entries to record the mortgage loan and the first two installment payments. (Round answers to O decimal places, e.g. 15,250. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Dec. 31, 2017 Dec. 31, 2018 Dec. 31, 2019 Debit Creditarrow_forwardPlease proper solution no plagiarism pleasearrow_forward

- Cullumber Corporation issues $430,000 of bonds for $447,200. (a) Prepare the journal entry to record the issuance of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation eTextbook and Media List of Accounts Debit Creditarrow_forwardDomesticarrow_forwardOn September 30, 2012, Cullumber Company issued 10% bonds with a par value of $460,000 due in 20 years. They were issued at 98 and were callable at 105 at any date after September 30, 2017. Because Cullumber Company was able to obtain financing at lower rates, it decided to call the entire issue on September 30, 2018, and to issue new bonds. New 9% bonds were sold in the amount of $780,000 at 102; they mature in 20 years. Cullumber Company uses straight-line amortization. Interest payment dates are March 31 and September 30.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education