FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

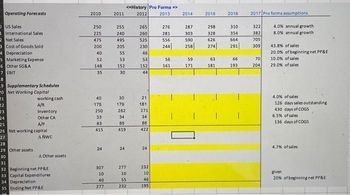

Please solve for hightlighted areas and show how to get the answer in excel. Thank you!

Transcribed Image Text:Operating Forecasts

OUS Sales

1 International Sales

2 Net Sales

3 Cost of Goods Sold

4 Depreciation

5 Marketing Expense

6 Other SG&A

7 EBIT

8

9 Supplementary Schedules

20 Net Working Capital

21

22

23

24

working cash

A/R

Inventory

Other CA

25

A/P

26 Net working capital

27

28

29 Other assets

30

ANWC

A Other assets

31

32 Beginning net PP&E

33 Capital Expenditures

34 Depreciation

35 Ending Net PP&E

2010

250

225

475

200

40

52

148

35

40

175

250

33

83

415

24

307

10

40

277

2011

255

240

495

205

55

53

152

30

30

179

262

34

<History Pro Forma">

2012

2013

85

419

24

277

10

55

232

265

260

525

230

46

53

152

44

21

181

271

34

86

422

24

232

10

46

195

276

281

556

244|

56

161

2014

287

303

590

258

59

171

2015

298

328

626

274

63

181

2016

310

354

664

291

66

193

2017 Pro forma assumptions

322

382

705

309

70

204

4.0% annual growth

8.0% annual growth

43.8% of sales

20.0% of beginning net PP&E

10.0% of sales

29.0% of sales

4.0% of sales

126 days sales outstanding

430 days of COGS

6.5% of sales

136 days of COGS

4.7% of sales

given

20% of beginning net PP&E

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Is it possible to get a solution with formulas instead of excel?arrow_forwardEducate these stakeholders on the advantages of utilizing a spreadsheet solution and how simple it was to process data in order to generate the information provided in the report in Excelarrow_forwardHi can you show how to input in excel using the pmt formula thank you so mucharrow_forward

- Hi, Could you please show me how to solve this with formulas? not excel, I should have clarified. Thanksarrow_forwardPlease answer ASAP if you can please. Thank you! Please Please write expression or formula used Set up expression initially with functional notation (e.g.,(P/F,I,n))arrow_forwardHi can you show how to input in excel using the PV formula thank you so mucharrow_forward

- is there a way to do this question with formulas and a calculator instead of excel? if so please upload the solution this wayarrow_forwardFurther info is in the attached images For the Excel part of the question give the solutions in the form of the Excel equations. Please and thank you! :) Download the Applying Excel form and enter formulas in all cells that contain question marks. For example, in cell B34 enter the formula "= B9". After entering formulas in all of the cells that contained question marks, verify that the dollar amounts match the example in the text. Check your worksheet by changing the beginning work in process inventory to 100 units, the units started into production during the period to 2,500 units, and the units in ending work in process inventory to 200 units, keeping all of the other data the same as in the original example. If your worksheet is operating properly, the cost per equivalent unit for materials should now be $152.50 and the cost per equivalent unit for conversion should be $145.50. Thank you!arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education