FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

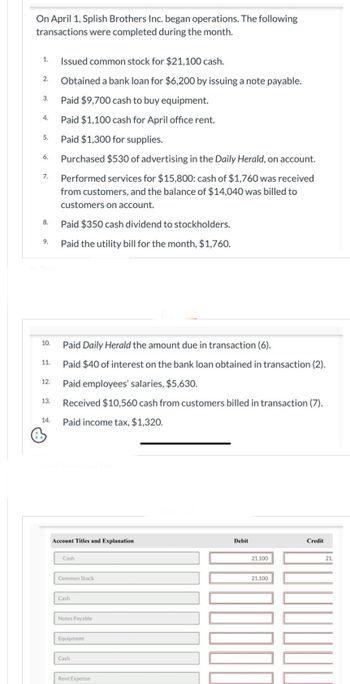

Transcribed Image Text:On April 1, Splish Brothers Inc. began operations. The following

transactions were completed during the month.

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

13.

14.

+

Issued common stock for $21,100 cash.

Obtained a bank loan for $6,200 by issuing a note payable.

Paid $9,700 cash to buy equipment.

Paid $1,100 cash for April office rent.

Paid $1,300 for supplies.

Purchased $530 of advertising in the Daily Herald, on account.

Performed services for $15,800: cash of $1,760 was received

from customers, and the balance of $14,040 was billed to

customers on account.

Paid $350 cash dividend to stockholders.

Paid the utility bill for the month, $1,760.

Paid Daily Herald the amount due in transaction (6).

Paid $40 of interest on the bank loan obtained in transaction (2).

Paid employees' salaries, $5,630.

Received $10,560 cash from customers billed in transaction (7).

Paid income tax, $1,320.

Account Titles and Explanation

Cash

Common Stock

Cash

Notes Payable

Equipment

Cash

Rent Expense

Debit

21,100

21,100

Credit

21.

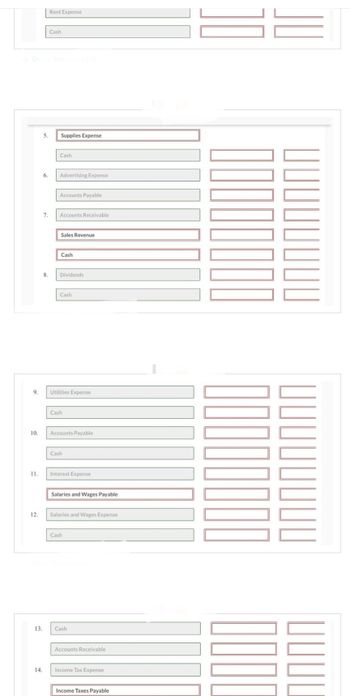

Transcribed Image Text:9.

Show Transcribed Tex

10.

11.

12.

13.

14.

6.

Rent Expense

5. Supplies Expense

7.

Cash

8.

Cash

Advertising Expense

Accounts Payable

Accounts Receivable

Sales Revenue

Cash

Dividends

Cash

Utilities Expense

Cash

Accounts Payable.

Cash

Interest Expense

Salaries and Wages Payable

Salaries and Wages Expense

Cash

Cash

Accounts Receivable

Income Tax Expense

Income Taxes Payable

00000000

E

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year: The following transactions relating to payroll, payroll deductions, and payroll taxes occurred dur ing December:Dec 2. Issued Chedc No. 410 for $3,400 to Jay Bank to purchase U5. savings bonds for employees.2. Issued Check Na 411 to Jay Bank for $27,046 in payment of $9,273 of social security tax, $2,318 of Medicare tax, and $15,455 of employees'federal income tax due. Dec. 13. Journalized the entry to record the biweekly payroll. A summary of the payroll record follows: 13. Issued Check No. 420 in payment of the net amount of the biweekly payroll.13. Journalized the entry to record payroll taxes on employees' eamings of December 13: social security tax, $4,632; Medicare tax, $1,158; state unemployment tax, $350; federal unemployment tax. $125.16. Issued Check No. 424 to Jay Bank for $27,020, in payment of $9,264 of social security tax. $2316 of Medicare tax. and…arrow_forwardInfinity Emporium Company received the monthly statement for its bank account, showing a balance of $67,300 on August 31. The balance in the Cash account in the company's accounting system at that date was $72,628. The company's accountant reviewed the statement and the company's accounting records and noted the following. 1. 2. 3. After comparing the cheques written by the company with those deducted from the bank account in August, the accountant determined that all six cheques (totalling $6,180) that had been outstanding at the end of July were processed by the bank in August. However, five cheques written in August, totalling $4,500, were outstanding on August 31. A review of the deposits showed that a deposit made by the company on July 31 for $11,532 was recorded by the bank on August 1, and an August 31 deposit of $13,300 was recorded in the company's accounting system but had not yet been recorded by the bank. The August bank statement also showed: a service fee of $24 a…arrow_forwardBrangelina Adoption Agency's general ledger shows a cash balance of $4,586. The balance of cash in the March-end bank statement is $7,331. A review of the bank statement reveals the following information: checks outstanding of $2,796, bank service fees of $78, and interest earned of $27. Calculate the correct balance of cash at the end of March. (Amounts to be deducted should be indicated with a minus sign.)arrow_forward

- Help with Correct Answerarrow_forwardThe accounting records and bank statement of Orison Supply Store provide the following information at the end of April. The closing 'Cash' account balance was $28,560, and the bank statement shows a closing balance of $32,000. On reviewing the bank statement it is found an account customer has deposited $2,000 into the bank account for a March sale and the monthly insurance premium of $4,500 was automatically charged to the account. Interest of $5,10 was paid by the bank and a bank fee of $50 was charged to the account. A payment of $1,500 to a supplier has been recorded twice in the accounts. After the ,calculation of the "ending reconciled cash balance", what is the balance of the 'cash' account?arrow_forwardJournal Entries for Accounts and Notes ReceivablePittsburgh, Inc., began business on January 1. Certain transactions for the year follow: Jun.8 Received a $33,000, 60 day, eight percent note on account from J. Albert. Aug.7 Received payment from J. Albert on her note (principal plus interest). Sep.1 Received an $39,000, 120 day, nine percent note from R.T. Matthews Company on account. Dec.16 Received a $31,800, 45 day, ten percent note from D. Leroy on account. Dec.30 R.T. Matthews Company failed to pay its note. Dec.31 Wrote off R.T. Matthews account as uncollectible. Pittsburgh, Inc. uses the allowance method of providing for credit losses. Dec.31 Recorded expected credit losses for the year by an adjusting entry. Accounts written off during this first year have created a debit balance in the Allowance for Doubtful Accounts of $48,200. An analysis of aged receivables indicates that the desired balance of the allowance account should be $43,000.…arrow_forward

- Subject:- accountingarrow_forwardBridgeport Company's bank statement for the month ended January 31 showed a balance per bank of $34,728. The company's Cash balance at January 31 was $16,398. Other information is as follows: 1. 2. 3. 4. 5. 6. 7. Cash receipts for January were $87,679, of which $5,295 was outstanding at January 31. The bank statement shows a debit memorandum for $135 for cheque printing charges. Cheque no. 119 payable to Sunland Company was recorded in the general journal and cleared the bank for $343. A review of the Accounts Payable subsidiary ledger shows a $131 credit balance in the account of Sunland Company and that the payment to it should have been for $474. The total amount of cheques written during January was $75,126, of which $5,979 was outstanding at January 31. Cheque No. 127 was correctly written and paid by the bank for $109. The general journal reflects an entry for cheque no. 127 as a debit to Accounts Payable and a credit to Cash for $190. The bank returned an NSF cheque from a…arrow_forwardRecording Note Transactions The following information is extracted from Tara Corporation’s accounting records: May 1 Received a $6,000, 12%, 90-day note from V. Leigh, a customer. May 6 Received a $9,000, 10%, 120-day note from C. Gable, a customer. May 11 Sold the Leigh and Gable notes with recourse at the bank at 13%. In addition, borrowed $10,000 from the bank for 90 days at 12%. The bank remits the face value less the interest. The estimated recourse liability for Leigh and Gable is $84 and $110, respectively. July 31 The July bank statement indicated that the Leigh note had been paid. Aug. 10 Repaid the $10,000 borrowed on May 11. Sept. 4 Received notice that Gable had defaulted on the May 6 note. The bank charged a fee of $10. Paid the amount due on the Gable note to the bank. Informed Gable to pay Tara the entire amount due plus 11% interest on the total of the face amount of the note, the accrued interest, and the fee from the maturity date until Gable remits the amount owed.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education