FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:nces

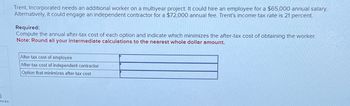

Trent, Incorporated needs an additional worker on a multiyear project. It could hire an employee for a $65,000 annual salary.

Alternatively, it could engage an independent contractor for a $72,000 annual fee. Trent's income tax rate is 21 percent.

Required:

Compute the annual after-tax cost of each option and indicate which minimizes the after-tax cost of obtaining the worker.

Note: Round all your intermediate calculations to the nearest whole dollar amount.

After-tax cost of employee

After-tax cost of independent contractor

Option that minimizes after-tax cost

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Your factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $5.17 million per year. Your upfront setup costs to be ready to produce the part would be $7.81 million. Your discount rate for this contract is 8.4%. a. What does the NPV rule say you should do? b. If you take the contract, what will be the change in the value of your firm?arrow_forwardJohn Red is the managing partner of a partnership that has just finished building 60-room motel. Beck anticipates that he will rent these rooms for 16,000 nights next year (or 16,000 room-nights). All rooms are similar and will rent for the same price. Beck estimates the following operating costs for next year: Variable operating costs P30 per room-night Fixed costs Salaries and wages P1,750,000 Maintenance of building and pool 370,000 Other operating and administration costs 1,400,000 Total fixed costs P 3,520,000 The capital invested in the motel is P9,600,000. The partnership's target return on investment is 25%. Beck expects demand for rooms to be about uniform throughout the year. He…arrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $4.93 million per year. Your upfront setup costs to be ready to produce the part would be $7.95 million. Your discount rate for this contract is 7.9%. a. What does the NPV rule say you should do? b. If you take the contract, what will be the change in the value of your firm? a. What does the NPV rule say you should do? The NPV of the project is $ million. (Round to two decimal places.)arrow_forward

- You are an employee of University Consultants, Limited, and have been given the following assignment. You are to present an investment analysis of a small retail income-producing property for sale to a potential investor. The asking price for the property is $1,430,000; rents are estimated at $183,040 during the first year and are expected to grow at 2.5 percent per year thereafter. Vacancies and collection losses are expected to be 10 percent of rents. Operating expenses will be 35 percent of effective gross income. A fully amortizing 70 percent loan can be obtained at 8 percent interest for 30 years (total annual payments will be monthly payments × 12). The property is expected to appreciate in value at 4 percent per year and is expected to be owned for five years and then sold. Required: a. What is the first-year debt coverage ratio? b. What is the terminal capitalization rate? c. What is the investor's expected before-tax internal rate of return on equity invested (BTIRR)? d. What…arrow_forwardYou are an employee of University Consultants, Ltd., and have been given the following assignment. You are to present an investment analysis of a new small residential income-producing property for sale to a potential investor. The asking price for the property is $1,250,000; rents are estimated at $200,000 during the first year and are expected to grow at 3percent per year thereafter. Vacancies and collection losses are expected to be 10 percent of rents. Operating expenses will be 35 percent of effective gross income. A 70 percent loan can be obtained at 11 percent interest for 30 years. The property is expected to appreciate in value at 3 percent per year and is expected to be owned for five years and then sold. a. What is the investor’s expected before-tax internal rate of return on equity invested (BTIRR)?b. What is the first-year debt coverage ratio?c. What is the terminal capitalization rate?d. What is the NPV using a 14 percent discount rate? What does this mean?arrow_forwardThe NPV is? Round to nearest dollararrow_forward

- Manjiarrow_forwardYour storage firm has been offered $96,900 in one year to store some goods for one year. Assume your costs are $95,200, payable immediately, and the cost of capital is 8.1%. Should you take the contract? The NPV will be $ Should you take the contract? The contract (Round to the nearest cent.) be taken (Select from the drop-down menu.)arrow_forwardA mechanical engineer at Anode Metals is considering five equivalent projects, some of which have different life expectations. Salvage value is nil for all alternatives. Assuming that the company’s MARR is 13% per year, determine which should be selected (a) if they are independent, and (b) if they are mutually exclusive. (c) Explain why your selection in part (b) is correct. First Cost, $ Net Annual Income, $/Year Life, Years A −20,000 +5,500 4 B −10,000 +2,000 6 C −15,000 3,800 6 D −60,000 +11,000 12 E −80,000 +9,000 12arrow_forward

- GeoWorld Systems uses a subset of the following questions during the interview process for new engineers. For each of the following cases, determine if “the project” or “do nothing” is preferred. The value of MARR in each case is 14%.arrow_forwardFranklin Camps, Incorporated leases the land on which it builds camp sites. Franklin is considering opening a new site on land that requires $2,450 of rental payment per month. The variable cost of providing service is expected to be $6 per camper. The following chart shows the number of campers Franklin expects for the first year of operation of the new site: January February March 150 260 210 February August April 210 Price May 330 June 510 Required Assuming that Franklin wants to earn $7 per camper, determine the price it should charge for a camp site in February and August. Note: Do not round intermediate calculations. July August September October November December Total 660 660 360 390 150 310 4,200arrow_forwardAn entrepreneur is offered a service contract that will cost him $700,000 initially. The contract has a 5 years of life and will generate an after tax cash inflow of $180,000 per year. The cost of capital of this project is 12%. What’s the NPV of the project? Should the entrepreneur accept the contract? Group of answer choices $51,140; accept $68,418; accept $648,860; reject -$48,524; reject -$51,140; rejectarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education