FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

| (ii) Prepare the Income Statement and 1. Closing Stock as on 31st March is 200,000. 2. Salary outstanding for the month of March is 30,000. 3. |

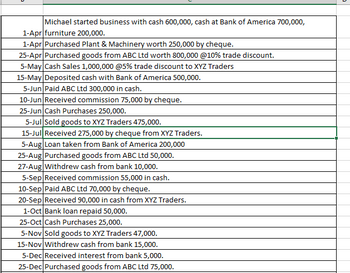

Transcribed Image Text:Michael started business with cash 600,000, cash at Bank of America 700,000,

1-Apr furniture 200,000.

1-Apr Purchased Plant & Machinery worth 250,000 by cheque.

25-Apr Purchased goods from ABC Ltd worth 800,000 @10% trade discount.

5-May Cash Sales 1,000,000 @5% trade discount to XYZ Traders

15-May Deposited cash with Bank of America 500,000.

5-Jun Paid ABC Ltd 300,000 in cash.

10-Jun Received commission 75,000 by cheque.

25-Jun Cash Purchases 250,000.

5-Jul Sold goods to XYZ Traders 475,000.

15-Jul Received 275,000 by cheque from XYZ Traders.

5-Aug Loan taken from Bank of America 200,000

25-Aug Purchased goods from ABC Ltd 50,000.

27-Aug|Withdrew cash from bank 10,000.

5-Sep Received commission 55,000 in cash.

10-Sep Paid ABC Ltd 70,000 by cheque.

20-Sep Received 90,000 in cash from XYZ Traders.

1-Oct Bank loan repaid 50,000.

25-Oct Cash Purchases 25,000.

5-Nov Sold goods to XYZ Traders 47,000.

15-Nov Withdrew cash from bank 15,000.

5-Dec Received interest from bank 5,000.

25-Dec Purchased goods from ABC Ltd 75,000.

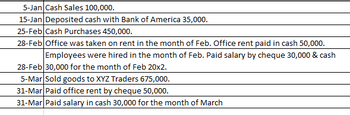

Transcribed Image Text:5-Jan Cash Sales 100,000.

15-Jan Deposited cash with Bank of America 35,000.

25-Feb Cash Purchases 450,000.

28-Feb Office was taken on rent in the month of Feb. Office rent paid in cash 50,000.

Employees were hired in the month of Feb. Paid salary by cheque 30,000 & cash

28-Feb 30,000 for the month of Feb 20x2.

5-Mar Sold goods to XYZ Traders 675,000.

31-Mar Paid office rent by cheque 50,000.

31-Mar Paid salary in cash 30,000 for the month of March

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- table belom shows the financial statements of a fan components supplier company that started it's operation in 1st January 2021.Calculate the profit and loss statement for the year ended December 2021.arrow_forwardShields Company is preparing its interim report for the first quarter ending March 31. The following payments were made during the first quarter: The amount that will be reported in the quarter is the Expenditure Date Amount Annual advertising January $800,000 Property tax for the fiscal year February 350,000 March 260,000 Annual equipment repairs O a $352,500 Ob$1,410,000 Oc. $0 Od $1,060,000arrow_forwardFrom the following data, prepare a profit and loss a/c and a balance sheet as on 31-3-2023. Particulars Shs. Particulars Shs. Drawings 10,000 Capital 30, 000 Purchases 30,000 Purchase returns 1,000 Sales Returns 5,000 Sales 60, 000 Carriage in 2,000 Wages outstanding 2,000 Carriage out 3, 000 Rent received 1,000 Depreciation on Plant 4,000 Reserve for doubtful 1,000 debts Plant account 20,000 Interest (Cr) 5,000 Salaries & wages 3,000 Sundry creditors 6, 000 Bad debts 2,000 Loans 38,000 Premises 20, 000 Interest 5,000 Stock 1.4.95 25,000 Sundry debtors 15,000 1,44,000 1, 44,000 Adjustment: a) Stock on 31-3-23 was Shs.40,000. A fire broke -out in the godown and destroyed stock worth Shs.5, 000. Insurance company had accepted the claim in full. b) Provide for bad debts @ 10% and provide for discount on debtors @ 5% and on creditors @ 10% c) Depreciate buildings at the rate of 15% p.a. d) Rent outstanding amounted to Shs.1,000 e) Closing stock includes samples worth of Shs.2,000. f)…arrow_forward

- K Herbert Sampson manages a Dairy World drive-in. His straight-time pay is $18 per hour, with time-and-a-half for hours in excess of 40 per week. Sampson's payroll deductions include withheld income tax of 30%, FICA tax, and a weekly deduction of $9 for a charitable contribution to United Way. Sampson worked 54 hours during the week. i (Click the icon to view payroll tax rate information.) Read the requirements. Requirement 1. Compute Sampson's gross pay and net pay for the week. Assume earnings to date are $13,000. (Round all amounts to the nearest cent.) Begin by computing Sampson's gross pay for the week. Gross Pay More info xt pages For all payroll calculations, use the following tax rates and round amounts to the nearest cent: Employee: Employer: OASDI: 6.2% on first $132,900 earned; Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. OASDI: 6.2% on first $132,900 earned; Medicare: 1.45%; FUTA: 0.6% on first $7,000 earned; SUTA: 5.4% on first $7,000 earned. Print Get…arrow_forwardThe following are trial balance of Clarissa Amanda Sdn. Bhd. as at 31 December 2021. Debit Credit RM RM Opening stock, 1 Jan 2021 Purchases Sales return Carriage inwards Plant and machinery Furnitures and fixtures Land Cash in hand Carriage outwards Wages Salaries Duty on purchases Account receivable Travelling expenses Rent and assessment Drawings Insurance General expenses Capital Sales return Purchases return Discount received Loan Account payables 16,000 75,000 5,000 1,500 40,000 5,000 45,650 5,000 400 30,000 18,000 800 28,000 1,200 4,800 5,000 450 12,200 294,000 80,000 200,000 2,000 500 10,000 1,500 294,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education