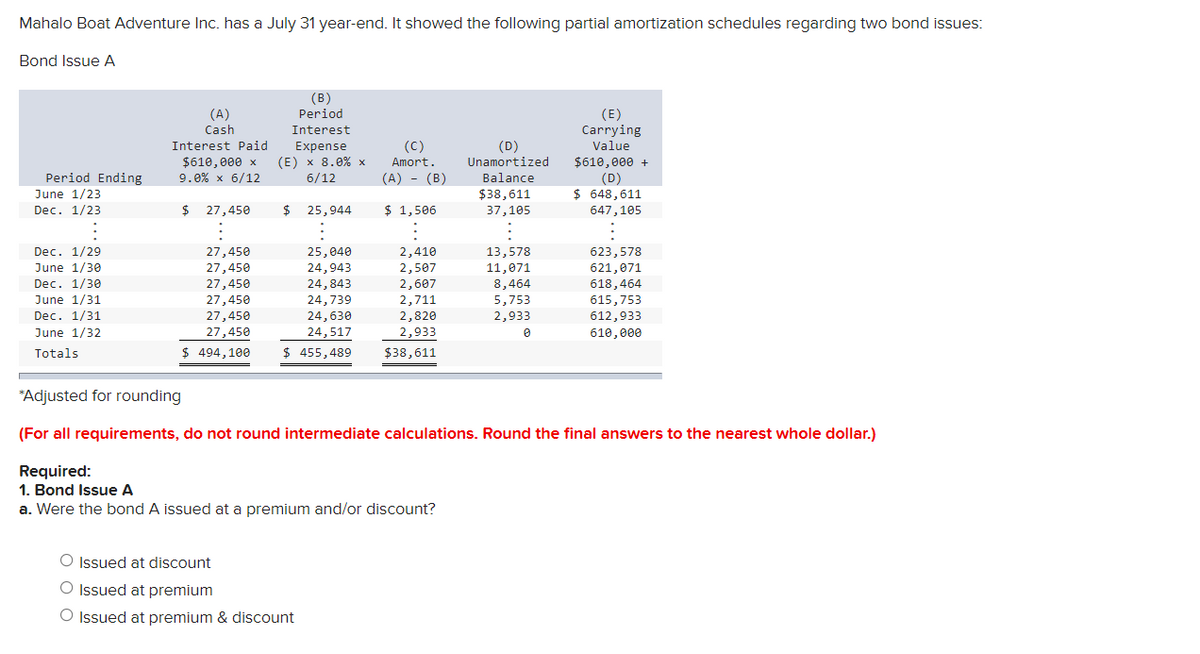

Mahalo Boat Adventure Inc. has a July 31 year-end. It showed the following partial amortization schedules regarding two bond issues: Bond Issue A Period Ending June 1/23 (A) Cash Interest Paid $610,000 x 9.0% x 6/12 (B) Period Interest Expense (E) x 8.0% x 6/12 (c) Amort. (D) Unamortized (A) - (B) Balance $38,611 (E) Carrying Value $610,000 + (D) $ 648,611 Dec. 1/23 $ 27,450 $ 25,944 $ 1,506 37,105 647,105 Dec. 1/29 27,450 25,040 2,410 13,578 623,578 June 1/30 27,450 24,943 2,507 11,071 621,071 Dec. 1/30 27,450 24,843 2,607 8,464 618,464 June 1/31 27,450 24,739 2,711 5,753 615,753 Dec. 1/31 27,450 24,630 2,820 2,933 612,933 June 1/32 Totals 27,450 24,517 2,933 0 610,000 $ 494,100 $ 455,489 $38,611 "Adjusted for rounding (For all requirements, do not round intermediate calculations. Round the final answers to the nearest whole dollar.) Required: 1. Bond Issue A a. Were the bond A issued at a premium and/or discount? O Issued at discount O Issued at premium O Issued at premium & discount

Mahalo Boat Adventure Inc. has a July 31 year-end. It showed the following partial amortization schedules regarding two bond issues: Bond Issue A Period Ending June 1/23 (A) Cash Interest Paid $610,000 x 9.0% x 6/12 (B) Period Interest Expense (E) x 8.0% x 6/12 (c) Amort. (D) Unamortized (A) - (B) Balance $38,611 (E) Carrying Value $610,000 + (D) $ 648,611 Dec. 1/23 $ 27,450 $ 25,944 $ 1,506 37,105 647,105 Dec. 1/29 27,450 25,040 2,410 13,578 623,578 June 1/30 27,450 24,943 2,507 11,071 621,071 Dec. 1/30 27,450 24,843 2,607 8,464 618,464 June 1/31 27,450 24,739 2,711 5,753 615,753 Dec. 1/31 27,450 24,630 2,820 2,933 612,933 June 1/32 Totals 27,450 24,517 2,933 0 610,000 $ 494,100 $ 455,489 $38,611 "Adjusted for rounding (For all requirements, do not round intermediate calculations. Round the final answers to the nearest whole dollar.) Required: 1. Bond Issue A a. Were the bond A issued at a premium and/or discount? O Issued at discount O Issued at premium O Issued at premium & discount

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 7MCQ

Related questions

Question

Transcribed Image Text:Mahalo Boat Adventure Inc. has a July 31 year-end. It showed the following partial amortization schedules regarding two bond issues:

Bond Issue A

Period Ending

June 1/23

Dec. 1/23

$610,000 x

9.0% x 6/12

(A)

Cash

Interest Paid

(B)

Period

Interest

Expense

(E) x 8.0% x

(c)

Amort.

(D)

Unamortized

6/12

(A) - (B)

Balance

$38,611

$ 27,450

$ 25,944

$ 1,506

37,105

(E)

Carrying

Value

$610,000 +

(D)

$ 648,611

647,105

Dec. 1/29

27,450

25,040

2,410

13,578

623,578

June 1/30

27,450

24,943

2,507

11,071

621,071

Dec. 1/30

27,450

24,843

2,607

8,464

618,464

June 1/31

27,450

24,739

2,711

5,753

615,753

Dec. 1/31

27,450

24,630

2,820

2,933

612,933

June 1/32

Totals

27,450

24,517

2,933

Ө

610,000

$ 494,100

$ 455,489

$38,611

"Adjusted for rounding

(For all requirements, do not round intermediate calculations. Round the final answers to the nearest whole dollar.)

Required:

1. Bond Issue A

a. Were the bond A issued at a premium and/or discount?

Issued at discount

O Issued at premium

◇ Issued at premium & discount

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning