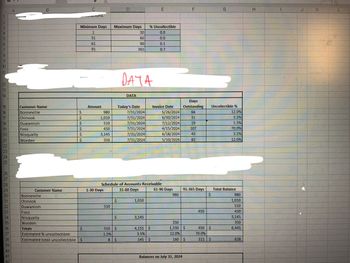

Use this table for calculations: Minimum Days Maximum days % uncollectible 1 30 1.5% 31 60 3.5% 61 90 12% 91 365 70% I need to calculate the number of days each receivable is outstanding look at image to fill in , show work when calculating or using formulas , included all work please. After that fill in the schedule accounts recievable shown in the other image for context. When filling in the schedule of accounts recievable show what the formulas w you use and all work.

Use this table for calculations: Minimum Days Maximum days % uncollectible 1 30 1.5% 31 60 3.5% 61 90 12% 91 365 70% I need to calculate the number of days each receivable is outstanding look at image to fill in , show work when calculating or using formulas , included all work please. After that fill in the schedule accounts recievable shown in the other image for context. When filling in the schedule of accounts recievable show what the formulas w you use and all work.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

100%

Use this table for calculations:

| Minimum Days | Maximum days | % uncollectible |

| 1 | 30 | 1.5% |

| 31 | 60 | 3.5% |

| 61 | 90 | 12% |

| 91 | 365 | 70% |

I need to calculate the number of days each receivable is outstanding look at image to fill in , show work when calculating or using formulas , included all work please.

After that fill in the schedule accounts recievable shown in the other image for context.

When filling in the schedule of accounts recievable show what the formulas w you use and all work.

Transcribed Image Text:27

28

29

30

31

2

3

1

D9

A

>

X✓ fx

Bonneville

Chinook

Duwamish

B

Customer Name

Foss

Nisqually

Worden

Totals

Estimated % uncollectible

Estimated total uncollectible

C

D

1-30 Days

S

Schedule of Accounts Receivable

31-60 Days

Accounts Receivable

6,445

E

61-90 Days

F

91-365 Days

Balances on July 31, 2024

G

Total Balance

Allowance for Bad Debts

H

5

(5)

Transcribed Image Text:1

2

2345

3

4

5

6

7

3

9

O

B8

A

X✓ fx

Customer Name

Bonneville

Chinook

Duwamish

Foss

Nisqually

Worden

B

$

$

$

use the table above for

calculations

$

$

C

$

Minimum Days

1

31

61

91

Amount

Maximum Days

980

1,010

510

450

3,145

350

30

60

90

365

DATA

Today's Date

7/31/2024

7/31/2024

7/31/2024

7/31/2024

7/31/2024

7/31/2024

% Uncollectible

1.5

3.5

12.0

70.0

the

Days

Invoice Date Outstanding

66

31

19

5/26/2024

6/30/2024

7/12/2024

4/15/2024

6/18/2024

5/10/2024

107

43

82

G

Uncollectible %

H

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

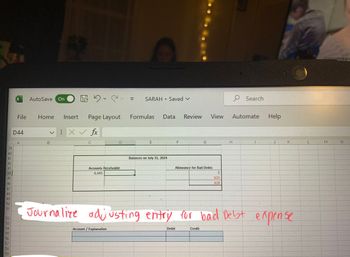

Follow-up Question

Using the imformation already about the schedule of accounts recievable help fill in the balance. -use the image to show the context

also journalize the

Transcribed Image Text:1234567002 F

8

9

11

12

13

14

DETROSANSK

18

21

22

23

24

25

268885883886 8837 G

27

29

31

33

34

39

40

42

Customer Name

Bonneville

Chinook

Duwamish

Foss

Nisqually

Worden

Customer Name

Bonneville

Chinook

Duwamish

Foss

Nisqually

Worden

Totals

--Miations.

Minimum Days

1

31

61

91

$

$

$

$

$

Estimated % uncollectible

Estimated total uncollectible $

Amount

980

1,010

510

450

3,145

350

1-30 Days

Maximum Days

30

60

90

365

510

$

$

510 $

1.5%

8 $

DATA

DATA

Today's Date

Schedule of Accounts Receivable

31-60 Days

7/31/2024

7/31/2024

7/31/2024

7/31/2024

7/31/2024

7/31/2024

1,010

% Uncollectible

0.0

0.0

0.1

0.7.

3,145

E

4,155 $

3.5%

145 $

Invoice Date

5/26/2024

6/30/2024

7/12/2024

4/15/2024

6/18/2024

5/10/2024

61-90 Days

980

Balances on July 31, 2024

F

Days

Outstanding

66

31

19

107

43

82

350

1,330 $

12.0%

160 $

91-365 Days

450

$

450 $

70.0%

315 $

G

Uncollectible %

12.0%

3.5%

1.5%

70.0%

3.5%

12.0%

Total Balance

980

1,010

510

450

3,145

350

6,445

628

Transcribed Image Text:39

40

41

42

43

44

45 46 47 48 4 50 51

52 3 4 55 56 57 58 59

53

54

X

File

D44

AutoSave On

Home Insert Page Layout

X✓ fx

B

C

C

Accounts Receivable

6,445

Account / Explanation

O

SARAH

E

.

Formulas Data Review

Saved V

Balances on July 31, 2024

F

Debit

G

Allowance for Bad Debts

View

Credit

5

623

628

H

Search

Automate

Help

Journalize adjusting entry for bad Debt expense

J

K

L

M

N

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education