FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

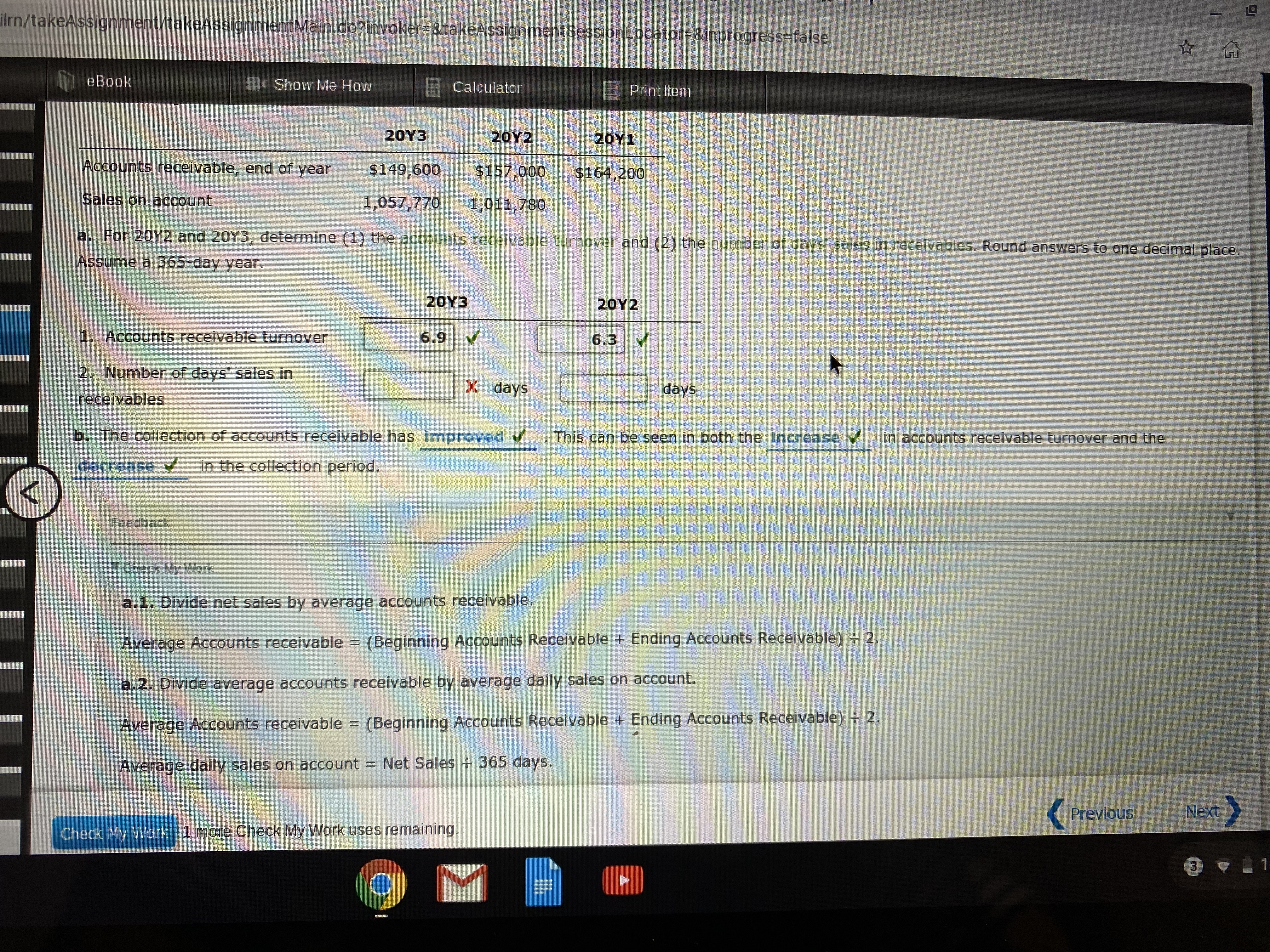

Hi, I'm having trouble with number of days sales in receivables. Can someone help me?

Transcribed Image Text:ilrn/takeAssignment/takeAssignmentMain.do?invoker-&takeAssignmentSessionLocator=&inprogress%-false.

eBook

Show Me How

Calculator

E Print Item

2ΟΥ3

20Y2

2ΟΥ 1

Accounts receivable, end of year

$149,600

$157,000

$164,200

Sales on account

1,057,770

1,011,780

a. For 20Y2 and 20Y3, determine (1) the accounts receivable turnover and (2) the number of days sales in receivables. Round answers to one decimal place.

Assume a 365-day year.

20Υ3

20Y2

1. Accounts receivable turnover

6.9

6.3

2. Number of days' sales in

X days

days

receivables

b. The collection of accounts receivable has Imnproved

This can be seen in both the increase y

in accounts receivable turnover and the

decrease V

in the collection period.

Feedback

YCheck My Work

a.1. Divide net sales by average accounts receivable.

Average Accounts receivable =

(Beginning Accounts Receivable + Ending Accounts Receivable) 2.

a.2. Divide average accounts receivable by average daily sales on account.

Average Accounts receivable =

(Beginning Accounts Receivable + Ending Accounts Receivable) 2.

Average daily sales on account Net Sales 365 days.

Previous

Next

Check My Work 1 more Check My Work uses remaining.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help me to solve this problemarrow_forwardI need help with 6 and 10arrow_forwardCalculation of Net Realizable Value K. L. Dearborn owns a department store that has a $45,500 balance in Accounts Receivable and a $3,000 credit balance in Allowance for Doubtful Accounts. 1. Determine the net realizable value of the accounts receivable? 2. Assume that an account receivable in the amount of $500 was written off using the allowance method. Determine the net realizable value of the accounts receivable after the write-off?arrow_forward

- In June, Widgets, Inc. makes on account sales to Customs Motors of $800 and receives a payment of $500 from them. How would this affect the Accounts Receivable control account? O A. The AR total would be decreased by $300. O B. The AR total would be decreased by $500. O C. The AR total would be increased by $800. O D. The AR total would be increased by $300.arrow_forwardPlease helparrow_forwardIf a $335.00 debit item in the general journal is posted as a credit: By how much will the trial balance be out of balance? Explain how you might detect such an error.arrow_forward

- Using the Allowance method supply the journal entries to bring back the written off Account Receivable and the payment for it. Direct Write Off Method Allowance Method Bad debt expense $500 Allowance for doubtful accounts $500 Accounts Receivable $500 Accounts Receivable $500arrow_forwardSuppose a co-worker has recorded a cash disbursement twice (Supplies Expense was debited twice for $100 and Cash was credited twice for $100) and wants you to record a correcting entry that will reverse the mistake. The correcting entry will record a debit to the Cash account and a credit to the Supplies account. Would you make this correcting entry? What should you investigate before making a decision about the correcting entry? Are there any other steps you would take to address this issue?arrow_forwardif your supervisor tells you to change the aging category of a large account from over 120 days to current status and prepare a new invoice to the customer with the revised date that agrees with this new category this will change the required allowance from for uncollectible accounts from $180, 000 to $135,000. How do you think this misstatement of funds will impact your income statement and your balance sheet?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education