Historical nominal returns for Coca-Cola have been 8% and -20%. The nominal returns for the market index S&P500 over the same periods were -15% and 28%. Calculate the beta for Coca-cola. Can you do this with Excel and without Excel (using formulae please)

Q: Calculate the average stock return from 2005–2007, the standard deviation and coefficient of…

A: “Hi There, Thanks for posting the questions. As per our Q&A guidelines, must be answered only…

Q: Historical nominal returns for Coca-Cola have been 8% and -20%. The nominal returns for the market…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: A company's annual profits have a trend line given by Y = 20,000t – 10,000, where Y is the trend and…

A: In this question future value or expected profit is to be find out given the equation.

Q: You've observed the following returns on Yamauchi Corporation's stock over the past five years:…

A: Information Provided: Return = -27.9%, 15.6%, 34.2%, 3.3%, 22.3%

Q: Suppose Sohar, Inc., reports earnings per share of around (OMR 0.75). If Sohar is in an industry…

A: P/E Ratio is also known as the price-earning ratio which states the comparison of market price and…

Q: You’ve observed the following returns on Crash-n-Burn Computer’s stock over the past five years: 16…

A: The question is based on the calculation of average return and risk associated with the past data of…

Q: An index model regression applied to past monthly returns in Ford’s stock price produces the…

A: Estimated price of Ford's Price = 0.10% + (1.10) * (8.40%) Estimated price of Ford's Price = 0.10% +…

Q: Consider the following annual returns of Molson Coors and International Paper: Molson Coors…

A:

Q: Consider the two (excess return) index-model regression results for stocks A and B. The risk-free…

A: Generally, investor invest in different stocks to reduce the risk. Each stock has its own measures.…

Q: A)The following are monthly percentage price changes for four market indexes. Month…

A: “Since you have posted multiple sub-parts, we will solve the first three sub-parts for you. To get…

Q: Historical nominal returns for Coca-Cola have been 8% and -20%. The nominal returns for the market…

A: Computation of beta using excel: Hence the beta is -0.65.

Q: You've observed the following returns on Crash-n-Burn Computer's stock over the past five years: 13…

A:

Q: The monthly rates of return for two corporations are given below: Month ABC Ltd. XYZ Ltd. January…

A: Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the question and…

Q: Hallo Ltd. is presently enjoying relatively high growth because of a surge in the demand for its new…

A: Current price of the common stock is calculated using the dividend discount model. For that first we…

Q: Consider the two (excess return) index-model regression results for stocks A and The risk-free…

A: William F. Sharpe, a Nobel Laureate, devised the Sharpe ratio, which is used to help investors…

Q: You have run two regressions of ADIDAS "AD" returns. In the first, you regressed ADIDAS monthly…

A: The cost of equity: The cost of equity of a multinational corporation differs in different…

Q: ou’ve observed the following returns on SkyNet Data Corporation’s stock over the past five years: 11…

A: We are provided with data of last 5 years in terms of rate of returns. This is for SkyNet's stock…

Q: a) Historical nominal returns for Coca-Cola have been 8% and -20%. The nominal returns for the…

A: Part (a): Calculation of beta for Coca-Cola: Answer: The value of beta for Coca-Cola is -0.65

Q: The returns of Oman Bottling Company is as follows. Year 1=12, Year 2=(-10), Year 3=18, Year4=20.…

A: In finance, the standard deviation is a risk analysis tool that helps investors to measure how risky…

Q: The returns on the common stock of New Image Products are quite cyclical. In a boom economy, the…

A: Standard Deviation of the return is the square root of variance Variance = sum of (Probability *…

Q: Historical nominal returns for Coca-Cola have been 8% and -20%. The nominal returns for the market…

A: Capital asset pricing model (CAPM) is utilized to calculate the required return of a stock by using…

Q: Aluminum maker Alcoa has a beta of about 1.07, whereas Hormel Foods has a beta of 0.84. If the…

A: The capital asset pricing model describes the relationship between systematic risk and the expected…

Q: ou are analyzing a regression of DePaolo Foods, a manufacturer of spaghetti and olive oil, against…

A: The question is to find cost of equity for this firm using the implied equity risk premium by…

Q: Suppose your company uses a 2-factor macroeconomic factor model to evaluate stocks and has derived…

A: According to the macroeconomic model, the returns on asset are explained by the surprises in the…

Q: You forecast to have a ROE of 14%, and dividend payout ratio of 12%. Currently the company has a…

A: PEG ratio is the ratio of price by earning divided by growth of earning . formula: PEG=P/E…

Q: Historical nominal returns for Company A have been 8% and -20%. The nominal returns for the market…

A: Expected return on company stock A Where Rf is risk-free return and Rm is the market return Let’s…

Q: You’ve observed the following returns on Yamauchi Corporation’s stock over the past five years:…

A: Period Return 1 -28.2% 2 15.8% 3 34.6% 4 3.4% 5 22.4%

Q: Historical nominal returns for Coca-Cola have been 8% and -20%. The nominal returns for the market…

A: Capital asset pricing model (CAPM) is used to calculate the required return of a stock by using beta…

Q: What was the arithmetic average return on the stock over this five-year period? (Do not round…

A: Arithmetic Average: Also known as the simple average is computed by dividing the sum of individual…

Q: An index model regression applied to past monthly returns in Ford’s stock price produces the…

A: Given: Market index = 10.2% Rise of ford stock = 10%

Q: "The market capitalization rate on the stock of Aberdeen Wholesale Company is 11%, Its expected ROE…

A: Financial accounting: Financial accounting is the process of recording, summarizing, and reporting…

Q: a) Historical nominal returns for Coca-Cola have been 8% and -20%. The nominal returns for the…

A: “Since you have asked multiple questions, we will solve the one question for you. If you want any…

Q: The returns on the common stock of New Image Products are quite cyclical. In a boom economy, the…

A: To Find:- Standard deviation of the returns on this stock

Q: The market capitalization rate on the stock of Aberdeen Wholesale Company is 14%. Its expected ROE…

A: A ratio that provides information regarding the share price of a company by relating it to the…

Q: You’ve observed the following returns on Pine Computer’s stock over the past five years: 14 percent,…

A: Let Rn be the return in year n. R1 = 14% R2 = - 14% R3 = 16% R4 = 26% R5 = 10%

Q: Returns for the Alcoff Company over the last 3 years are shown below. What's the standard deviation…

A: Solution: Year Return 2010 21% 2009 -12.50% 2008 25% Mean X¯= 21%-12.50%+25%/3 = 11.17%…

Q: Historical nominal returns for Coca-Cola have been &8% and -20%. The nominal returns for the market…

A: Beta is the measure of stock’s volatility in relation to the overall market.

Q: Church Inc. is presently enjoying relatively high growth because of a surge in the demand for its…

A: Expected rate of return = Risk free rate + (Beta*market risk premium) Expected rate of return =3% +…

Q: a) Historical nominal returns for Coca-Cola have been 8% and -20%. The nominal returns for the…

A: “Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: a) Historical nominal returns for Coca-Cola have been 8% and -20%. The nominal returns for the…

A: Beta= Change in security return/ Change in market return = (-20%-8%)/(28%-(-15%)) = -28%/43% =…

Q: An index model regression applied to past monthly returns in Ford’s stock price produces the…

A: Here, Forecast monthly return is ‘rF’ The market return is ‘rM’

Q: Estimate the beta value of your company using CAPM model and check the adequacy of the model…

A: The beta is a measure of the stock's sensitivity to change in the market return. A beta value…

Q: The following table contains monthly returns for Cola Co. and Gas Co. for 2010 E (the returns are…

A: To calculate standard deviation of each stock excel function STDEV.S is used. Standard deviation of…

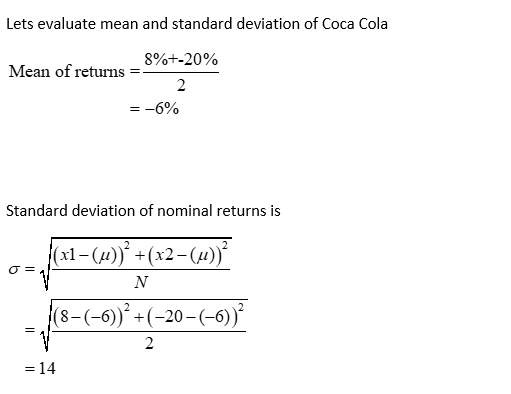

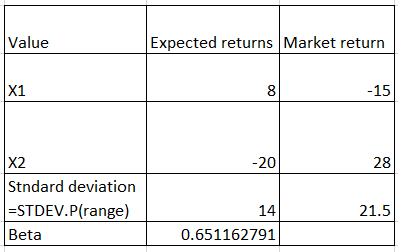

Historical nominal returns for Coca-Cola have been 8% and -20%. The nominal returns for the market index S&P500 over the same periods were -15% and 28%. Calculate the beta for Coca-cola.

Can you do this with Excel and without Excel (using formulae please)

Beta value is the ratio of the standard deviation of nominal returns to the standard deviation of the market index.

Step by step

Solved in 2 steps with 3 images

- Historical nominal returns for Coca-Cola have been 8% and -20%. The nominal returns for the market index S&P500 over the same periods were -15% and 28%. Calculate the beta for Coca-cola. Can you do this with Excel and without Excel (using formulae please) corresponding to the formula attached. The other image shows previous answer from an expert but I think the formula used for Beta seems wrong.Historical nominal returns for Coca-Cola have been 8% and -20%. The nominal returns for themarket index S&P500 over the same periods were -15% and 28%. Calculate the beta for Coca-cola. please solve without excel and in detail1. The annual net income of MAC Industries since 2005 is given below. Years t (since 2005) Net Income 1 4 6 12 15 $1,500 $2,500 $2,875 $2,850 $2,250 a. Create a scatter plot that includes your curve of best fit on top of the data. You should try several functions and make your choice based on best r-squared value. b. Find the year that Net Income was at its highest point. c. What was the income in that year?

- Required- Could you answer both of these questions in detail, as I have previously sent these questions, I have got the answers but I dont understand how and where the numbers have come from as for example for part A you multiplied the Second equation by -1 why? for part B the steps were not detailed enough to understand what had been done a) ) Historical nominal returns for Coca-Cola have been 8% and -20%. The nominal returns for the market index S&P500 over the same periods were -15% and 28%. Calculate the beta for Coca-cola. b) Assume that using the Security Market Line (SML) the required rate of return (RA) on stock A is found to be half of the required return (RB) on stock B. The risk-free rate (Rf) is one-fourth of the required return on A. Return on market portfolio is denoted by RM. Find the ratio of beta of A (βA) to beta of B (βB)Here are data on two companies. The T-bill rate is 4% and the market risk premium is 6%. Company $1 Discount Store Everything $5 Actual return 12% 11% Standard deviation of returns 8% 10% Beta 1.5 1.0 What would be the required return for $1 Discount Store according to the capital asset pricing model (CAPM)? Enter your answer as a decimal.he following data represents the annual sales of a Digitech Automation products SAOG. Year 2014 2015 2016 2017 2018 Sales (in Millions) OMR 380 440 520 396 514 Use method of least squares to calculate the trend values and the forecast for the future period. Which of the following is the annual sales forecast for the year 2019 using least squares method? a. 539.6 Million OMR b. 584.4 Million OMR c. 606.8 Million OMR d. 562 Million OMR

- Required: Compute the following: (For Requirements 1 to 4, enter your percentage answers rounded to 2 decimal places (i.e., 0.1234 should be entered as 12.34).) 1. Gross margin percentage. 2. Net profit margin percentage. 3. Return on total assets. 4. Return on equity. 5. Was financial leverage positive or negative for the year? 1. Gross margin percentage % 2. Net profit margin percentage % 3. Return on total assets % 4. Return on equity % 5. Financial LeverageThe Ashwood Company has a long-term debt ratio of 0.50 and a current ratio of 1.60. Current liabilities are $970, sales are $5,175, profit margin is 9.80 percent, and ROE is 17.60 percent. What is the amount of the firm's net fixed assets? Hint: This is another complex problem that requires a number of steps. Remember that CA + NFA=TA. So, if you find CA and TA, then you can solve for NFA Helpful Equations: Long-term debt ratio - LTD/(LTD + TE) CR-CA/CL PM-NI / Sales ROE-NI/TE O $3,851.53 O $3,601.92 O $5,181.07 O $6.733.07 O $2.881.53You've collected the following information about Groot, Inc.: Profit margin Total asset turnover Total debt ratio Payout ratio = 4.44% = 3.50 = .25 = 29% a. What is the sustainable growth rate for the company? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the ROA? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) a. Sustainable growth rate b. ROA % 15.54 %

- Here are data on two companies. The T-bill rate is 4% and the market risk premium is 6%. Company $1 Discount Store Everything $5 Forecast return 12% 11% Standard deviation of returns 8% 10% Beta 1.5 1.0 What would be the fair return for $1 Discount Store according to the capital asset pricing model (CAPM)? Enter your answer as a decimal.Consider the following returns and states of the economy for TZ.Com.: EconomyProbabilityReturn 2% Weak 40% Normal 50% 8% Strong 10% 15% What is the standard deviation of TZ's returns? 4.05% 4.85% 4.49% 4.99% 4.60%Select one company of the 30 companies that make up the Dow Jones Industrial Average (DJIA). a. Provide a brief history of the company chosen from the 30 companies of the DJIA.b.Describe the Dividend Discount Model (DDM). Using the DDM value the companyc.Provide a brief description of the Residual Income Model. Using the RIM value, the companyd.Describe the Free Cash Flow Model (FCF). Using the FCF value the companye. Describe the P/E ratio for the company and determine the expected price of the company using Earnings, Cash Flow and Salesf.summary of the detailed fundamental analysis for the company, provide a current status of the company and then explain if you would invest in the company at the current price. Explain why you made the investment decision and at what price range you would invest money in this company.