FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

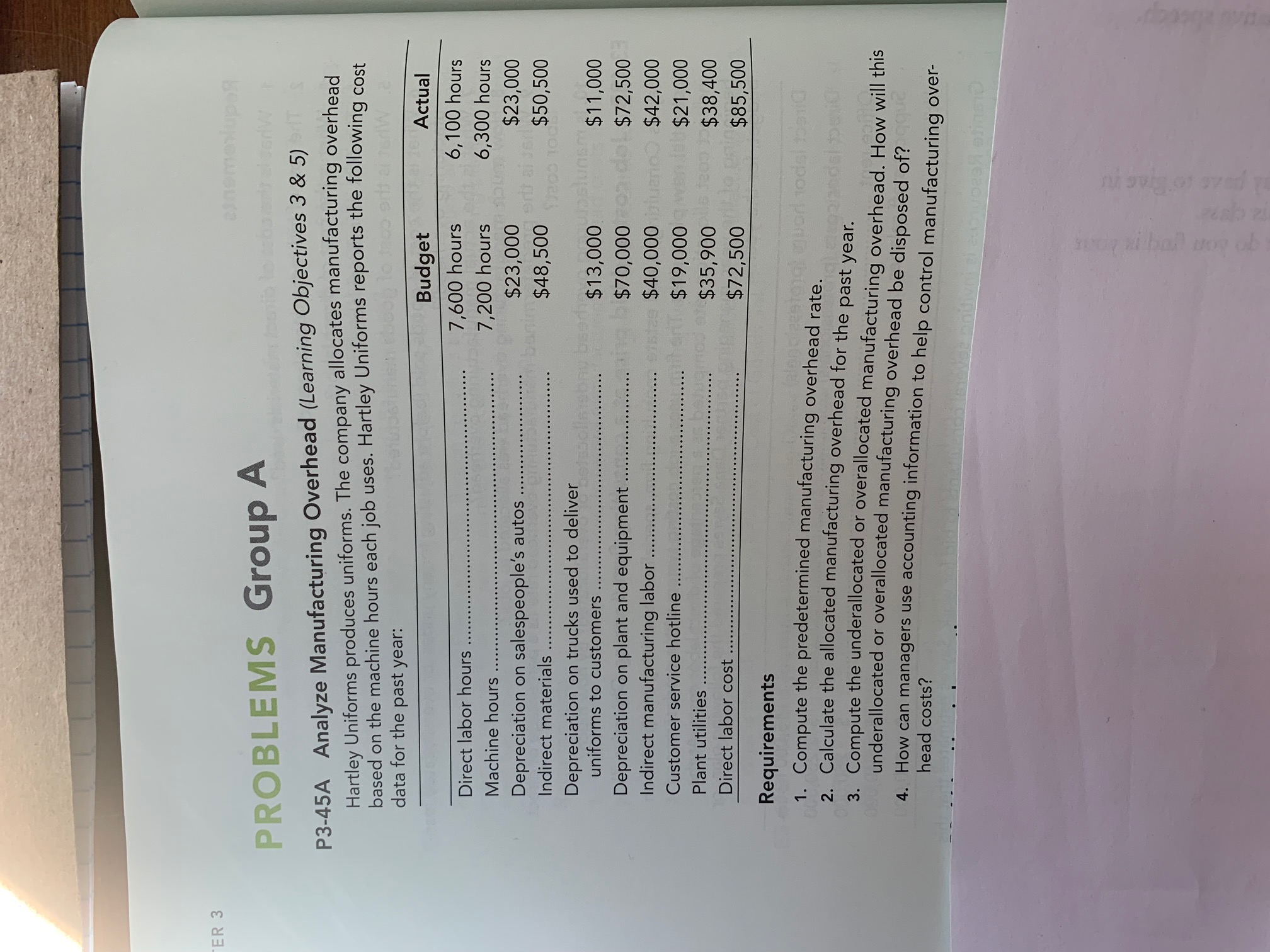

Transcribed Image Text:Hartley Uniforms produces uniforms. The company allocates manufacturing overhead

based on the machine hours each job uses. Hartley Uniforms reports the following cost

data for the past year:

Budget

Actual

7,600 hours

6,100 hours

Direct labor hours

Machine hours

7,200 hours

6,300 hours

Depreciation on salespeople's autos

$23,000

$23,000

Indirect materials

$48,500

$50,500

Depreciation on trucks used to deliver

uniforms to customers

solla

$13,000

$70,000

$40,000

$11,000

Depreciation on plant and equipment

Indirect manufacturing labor

$72,500

$42,000

Customer service hotline

$19,000

$21,000

Plant utilities

$35,900

$38,400

Direct labor cost

$72,500

$85,500

Requirements

1odel tba

1. Compute the predetermined manufacturing overhead rate.

2. Calculate the allocated manufacturing overhead for the past year.

3. Compute the underallocated or overallocated manufacturing overhead. How will this

underallocated or overallocated manufacturing overhead be disposed of?

4.

How can managers usA acco

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Similar questions

- Want helparrow_forwardCornelius Company produces women’s clothing. During the year, the company incurred the following costs: Factory rent $ 380,000 Direct labor 300,000 Utilities—factory 38,000 Purchases of direct materials 555,000 Indirect materials 66,000 Indirect labor 60,000 Inventories for the year were as follows: January 1 December 31 Materials $ 25,000 $ 40,000 Work-in-Process 45,000 40,000 Finished Goods 135,000 75,000 Required: 1&2. Prepare a statement of cost of goods manufactured and calculate cost of goods sold.arrow_forwardJohnston Company cleans and applies powder coat paint to metal items on a job-order basis. Johnston has budgeted the following amounts for various overhead categories in the coming year. Supplies $220,000 Gas 56,000 Indirect labor 172,000 Supervision 75,500 Depreciation on equipment 51,000 Depreciation on the buliding 45,000 Rental of special equipment 11,500 Electricity (for lighting, heating, and air conditioning) 28,300 Telephone 5,000 Landscaping service 1,800 Other overhead 50,000 In the coming year, Johnston expects to powder coat 140,000 units. Each unit takes 1.4 direct labor hours. Johnston has found that supplies and gas (used to run the drying ovens—all units pass through the drying ovens after powder coat paint is applied) tend to vary with the number of units produced. All other overhead categories are considered to be fixed. Required: Question Content Area 1. Calculate the number of direct labor hours Johnston must budget for the coming…arrow_forward

- Custom Creations Furniture Company manufactures furniture at its Akron, Ohio, factory. Some of its costs from the past year include: Depreciation on sales office $ 9,800 Depreciation on factory equipment 16,700. Factory supervisor salary Sales commissions Lubricants used in factory equipment Insurance costs for factory Wages paid to maintenance workers Fabric used to upholster furniture Freight-in (on raw materials) Costs of delivery to customers Wages paid to assembly-line workers Lumber used to build product 50,200 23,400 3,800 21,400 115,600 10,900 3,200 9,200 A. $261,800. OB. $131,700. OC. $236,600. D. $325,100. 115,100 82,100 54,100 26,900 Utilities in factory Utilities in sales office Manufacturing overhead costs for Custom Creations Furniture Company totaledarrow_forwardMemanarrow_forwardBarry Pottery Supplies manufacturers supplies used during the pottery process. They have multiple processes, the first of which is Molding. The following information relates to the Molding beginning balance: 5,300 physical units $184,700 beginning cost During the period, 12,400 additional physical units are started. An additional costs of $77,900 in direct materials and $84,000 in manufacturing overhead are incurred. Additionally, 1,890 direct labor hours were incurred. Factory laborers are paid at a rate of $50 per hour. At the end of the period, 6,900 physical units remained in progress. These physical units were 60% complete. Using the information provided, calculate the work in progress ending balance. Round your answer to the nearest whole dollar.arrow_forward

- Smithson Electric provides residential and business electric... [The following information applies to the questions displayed below.] Smithson Electric provides residential and business electric repair services. While direct labor and materials costs are traced to individual customers, administrative labor and transportation costs are considered overhead and applied as a percentage of direct labor costs. At the beginning of the year, Smithson estimates $10,000 of overhead costs and $50,000 of direct labor costs. Actual costs for the year are $12,000 for overhead and $48,000 for direct labor. Ending balances for WIP Inventory, Finished Goods Inventory, and Cost of Goods Sold are $4,000, $15,000, and $141,000 respectively. PR 4-5 (Static) Questions a-c. Answer the following questions based on the details provided. Question a. What is Smithson's predetermined overhead rate as a percentage of direct labor? Note: Round your answer to the nearest percent. b. The Jackson account accumulated…arrow_forwardCraftmore Machining produces machine tools for the construction industry. The following details about overhead costs were taken from its company records. Production Activity Indirect Labor Indirect Materials Other Overhead Grinding $ 310,000 Polishing $ 145,000 Product modification 550,000 Providing power $ 260,000 System calibration 560,000 Additional information on the drivers for its production activities follows. Grinding 17,000 machine hours Polishing 17,000 machine hours Product modification 1,500 engineering hours Providing power 15,000 direct labor hours System calibration 200 batches Problem C-1A Part 3 Job 3175 Job 4286 Number of units 150 units 1,875 units Machine hours 350 MH 3,500 MH Engineering hours 30 eng. hours 30 eng. hours Batches 10 batches 30 batches Direct labor hours 520 DLH 4,680 DLHarrow_forwardVinubhaiarrow_forward

- The Platter Valley factory of Bybee Industries manufactures field boots. The cost of each boot includes direct materials, direct labor, and manufacturing (factory) overhead. The firm traces all direct costs to products, and it assigns overhead cost to products based on direct labor hours. The company budgeted $15,000 variable factory overhead cost, $90,000 for fixed factory overhead cost and 2,500 direct labor hours (its practical capacity) to manufacture 5,000 pairs of boots in March. The factory used 2,700 direct labor hours in March to manufacture 4,800 pairs of boots and spent $15,600 on variable overhead during the month. The actual fixed overhead cost incurred for the month was $92,000. Required: 1. Compute the factory overhead flexible-budget variance, the factory overhead spending variance, and the efficiency variance for variable factory overhead for March and state whether each variance is favorable (F) or unfavorable (U). 2. Provide the appropriate journal entry to record…arrow_forwardRockwell Collins, headquartered in Cedar Rapids, IA, sells aviation and information technology systems. Rockwell applies manufacturing overhead on the basis of machine-hours. At the beginning of the most recent year, a small division of the company based its predetermined overhead rate on total estimated overhead of $60,600. Actual manufacturing overhead for the year amounted to $59,000 and actual machine-hours were 5,900. The company's predetermined overhead rate for the year was $10.10 per machine-hour. Therefore, the overhead for the year was:arrow_forwardCarib Tings & More does hand-crafted memorabilia for the tourism industry, in which each batch of items is a job. The company has a highly machine intensive production process, so it allocates manufacturing overhead based on machine hours. Carib Tings & More pre-determined overhead application rate for 2024 was computed from the following data: Total estimated factory overheads $2,400,000 Total estimated machine hours 40,000 At the end of May 2024, Carib Tings & More reported work in process inventory of $176,000. During June 2024, Carib Tings & More actually used 3,000 machine hours and recorded the following transactions. Purchased $324,000 worth of materials on account. Separately, Carib Tings & More paid a $2,500 bill for freight in. i) ii) Manufacturing wages incurred $400,000 iii) Materials requisitioned (includes $30,000 of indirect materials) $420,000 iv) Assigned manufacturing wages, 85% direct labour, 15% indirect labour v) Depreciation expense on factory equipment used on…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education