FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

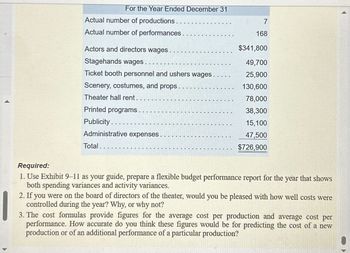

Transcribed Image Text:For the Year Ended December 31

Actual number of productions..

7

Actual number of performances.

168

Actors and directors wages.

$341,800

Stagehands wages

49,700

Ticket booth personnel and ushers wages.....

25,900

Scenery, costumes, and props..

130,600

Theater hall rent. . .

78,000

Printed programs.

38,300

Publicity...

15,100

Administrative expenses.

Total..

47,500

$726,900

Required:

1. Use Exhibit 9-11 as your guide, prepare a flexible budget performance report for the year that shows

both spending variances and activity variances.

2. If you were on the board of directors of the theater, would you be pleased with how well costs were

controlled during the year? Why, or why not?

3. The cost formulas provide figures for the average cost per production and average cost per

performance. How accurate do you think these figures would be for predicting the cost of a new

production or of an additional performance of a particular production?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Consider the following information: Budgeted overhead Actual overhead $ 250,000 $ 240,000 Budgeted machine hours 8,000 Actual machine hours 7,800 Net income before overhead adjustment $ 75,000 Compute the ADJUSTED Net Incomearrow_forward6arrow_forwardFor Year Ended December 31 Direct materials Direct labor Department manager salaries Supplies used Utilities Rent Totals Budget Snowmobile $ 20,590 11,500 ATV $ 28,600 Snowmobile $ 20,520 Actual ATV $ 30,030 11,870 22,450 5,500 5,500 21,600 5,400 6,300 4,510 1,010 470 6,800 650 7,400 4,270 440 6,400 $ 49,270 $ 65,560 $ 49,000 1,070 610 7,400 $ 67,060 s Exercise 22-1 (Algo) Responsibility accounting performance report LO P1 Prepare a responsibility accounting performance report for the snowmobile department. Note: Under budget amounts should be indicated by a minus sign. Responsibility Accounting Performance Report Manager, Snowmobile Department For Year Ended December 31 Totals Controllable Costs Budgeted Actual Over (Under) Budgetarrow_forward

- Factory maintenance costs $90,000 Direct labor, wages 352,000 Direct labor, health insurance 32,000 Indirect labor, health insurance 15,000 Health insurance for production supervisor 6,500 Administrative costs 55,000 Rental of office space for administrative staff 17,500 Sales commissions 52,500 Direct material 1,230,000 Indirect materials 632,000 Advertising expense 39,000 Depreciation on factory building 62,000 Indirect labor, wages 70,000 Production supervisor's salary 32,000 Use the data to determine the total product cost.arrow_forwardThe following represents the financial information for Plaza Plastics for May and June: May June Sales revenue $ 747,000 $ 540,000 Costs Scrap $ 2,000 $ 1,710 Process inspection 2,880 1,760 Quality training 23,780 11,720 Product testing equipment 5,180 4,340 Field testing 8,420 6,320 Warranty repairs 3,380 3,080 Rework 19,780 16,670 Preventive maintenance 16,220 8,570 Legal expense for warranty claims 7,820 4,340 Materials inspection 11,300 11,180 Required: Classify these items into Prevention, Appraisal, Internal failure, or External failure costs. Calculate the ratio of the prevention, appraisal, internal failure, and external failure costs to sales for May and Junearrow_forwardDepartment Personnel Custodial Services Maintenance Printing Binding Personnel Custodial Services Maintenance Printing Binding Total budgeted cost Total Labor- Square Feet of Space Occupied Printing Department Binding Department Total hours Hours 16,000 8,200 14,300 30,600 108,000 177,100 Budgeted overhead costs in each department for the current year are shown below: $ 300,000 66,000 93,400 Req 1 Req 2 12,400 3,100 10,500 40,400 20,900 87,300 Machine-Hours 2,400 500 2,900 414,000 170,000 $ 1,043,400 Number of Employees 22 49 69 Req 3A 105 300 545 Because of its simplicity, the company has always used the direct method to allocate service department costs to the two operating departments. Machine- Hours Required: 1. Using the step-down method, allocate the service department costs to the consuming departments. Then compute predetermined overhead rates in the two operating departments. Use machine-hours as the allocation base in the Printing Department and direct labor-hours as the…arrow_forward

- Answer question Darrow_forwardFinch Company began its operations on March 31 of the current year. Finch has the following projected costs: May $198,000 April $156,000 a. $49,500 b. $252,000 c. $202,500 d. $153,000 Manufacturing costs* Insurance expense** Depreciation expense Property tax expense*** *Of the manufacturing costs, three-fourths is paid for in the month they are incurred; one-fourth is paid in the following month. **Insurance expense is $900 a month; however, the insurance is paid four times yearly in the first month of the quarter (i.e., January, April, July, and October). ***Property tax is paid once a year in November. The cash payments for Finch Company expected in the month of June are 900 1,850 500 900 1,850 June 500 $204,000 900 1,850 500 Previous Nextarrow_forwardA partial listing of costs incurred at Backer Corporation during November appears below: Direct materials $157,000 Direct labor Manufacturing Overhead Selling Expenses Administrative Expenses 114,000 77,000 145,000 99,000 Calculate the total conversion costs for the month: Question 6 options: $234,000 $191,000 $271,000 $244,000 $348,000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education