ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:11. Applying the AD-AS model

Aa Aa

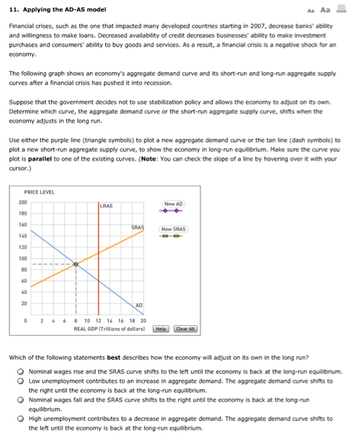

Financial crises, such as the one that impacted many developed countries starting in 2007, decrease banks' ability

and willingness to make loans. Decreased availability of credit decreases businesses' ability to make investment

purchases and consumers' ability to buy goods and services. As a result, a financial crisis is a negative shock for an

economy.

The following graph shows an economy's aggregate demand curve and its short-run and long-run aggregate supply

curves after a financial crisis has pushed it into recession.

Suppose that the government decides not to use stabilization policy and allows the economy to adjust on its own.

Determine which curve, the aggregate demand curve or the short-run aggregate supply curve, shifts when the

economy adjusts in the long run.

Use either the purple line (triangle symbols) to plot a new aggregate demand curve or the tan line (dash symbols) to

plot a new short-run aggregate supply curve, to show the economy in long-run equilibrium. Make sure the curve you

plot is parallel to one of the existing curves. (Note: You can check the slope of a line by hovering over it with your

cursor.)

PRICE LEVEL

200

LRAS

180

160

140

120

100

80

60

40

20

New AD

SRAS

New SRAS

AD

°

2

6 8 10 12 14 16 18 20

REAL GDP (Trillions of dollars)

Help

Clear All

Which of the following statements best describes how the economy will adjust on its own in the long run?

Nominal wages rise and the SRAS curve shifts to the left until the economy is back at the long-run equilibrium.

Low unemployment contributes to an increase in aggregate demand. The aggregate demand curve shifts to

the right until the economy is back at the long-run equilibrium.

Nominal wages fall and the SRAS curve shifts to the right until the economy is back at the long-run

equilibrium.

High unemployment contributes to a decrease in aggregate demand. The aggregate demand curve shifts to

the left until the economy is back at the long-run equilibrium.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Question: A recent article (federalreserve.gov/econres/feds/files/2020049pap.pdf) published by the Federal Reserve (the central bank of the USA), suggests "the massive lockdown of the economy" has led to "a large negative demand shock. However, an accompanying increase in unemployment benefits has increased the income of some low-and middle-income households at least temporarily, which could helpfully support aggregate demand". The excerpt above suggests an increase in household income, which might lead to improved aggregate demand. a. Draw a diagram to explain the above situation to show the impact of increased income and how it affects aggregate demand.arrow_forwardStart with a brief introduction that explains use of Government policy to control the economy. When is it appropriate to use monetary and fiscal policy to stimulate or stabilize the economy? Look at both. When is it inappropriate to use monetary and fiscal policy to stimulate or stabilize the economy? Look at both. What specific fiscal policy tools would you use to stimulate aggregate demand and how? What specific monetary policy tools would you use to stimulate aggregate demand and how? What is your conclusion, should policymakers use the monetary and or fiscal policy, or a combination of both, to stimulate aggregate demand? Explain your reasoning.arrow_forwardThe following graph shows the economy in long-run equilibrium at the expected price level of 120 and the natural level of output of $600 billion. Suppose a stock market boom increases household wealth and causes consumers to spend more. Shift the short-run aggregate supply (AS) curve or the aggregate demand (AD) curve to show the short-run impact of the stock market boom. 240 AS 200 AD 160 AS 120 80 AD 40 200 400 600 800 1000 1200 OUTPUT (Billions of dollars) In the short run, the increase in consumption spending associated with the stock market expansion causes the price level to the price level people expected and the quantity of output to the natural level of output. The stock market boom will cause the unemployment rate to the natural rate of unemployment in the short run. Again, the following graph shows the economy in long-run equilibrium at the expected price level of 120 and the natural level of output of $600 billion, before the increase in consumption spending associated with…arrow_forward

- 6arrow_forwardConsider an economy currently in recession. Which is NOT a policy move that could assist the economy, as discussed in class? Raising the money supply Raising government spending Lowering bank reserves Lowering interest ratesarrow_forwardSuppose the economy is currently in equilibrium, with unemployment equal to the natural rate, and that people form expectations rationally. If the Federal Reserve announces that it is going to decrease the money supply, then: the economy will move to a lower price level but remain at potential GDP. the economy will permanently move to a higher level of output and a higher price level. the economy will permanently move to a lower level of output and a lower price level. the economy will move to a higher GDP level but remain at a constant price level.arrow_forward

- Suppose that the following equations represent an entire economy. What size output shock will send the economy into a liquidity trap? t = y0.5 (r - 3%) r = 2% + (πt - 2%) + 2.9t πt = 2% + tarrow_forwardThe last personal savings rate recorded by the Federal Reserve database was 2.4%. Assume your average tax rate is 35%. The Federal Government recently spent $1.2T on “infrastructure”. Assuming this stands, answer the following question. 1. How much disposable income would the third iteration of this spending generate? 1.1A. What is the estimated increase in aggregate demand as a result of this bill assuming no tax increase?arrow_forwardIn order to stimulate the sagging European economy, the European Central Bank (ECB) decides to engage in expansionary monetary policy. Your job as one of the advisors to the ECB is to explain to the public what this policy expects to accomplish. Using a short run aggregate supply and aggregate demand graph, illustrate what happens to the overall economy as a result of this monetary policy. Which curve shifts? What happens to the following (up, down, stay the same): Output: Employment: Price levels:arrow_forward

- Question 76 During the 2020 campaign, Joe Biden proposed raising income taxes on those earning more than $400,000 per year and raising corporate taxes from about 21 percent to 28 percent. Consider the aggregate demand-aggregate supply diagram below, which represents the macroeconomy. Suppose the market is initially at an equilibrium at point A. What effect will a tax increase have on this graph? Question 76 options: 1.The long-run aggregate supply curve will shift to the left. 2.The aggregate demand curve will shift to the right. 3.The aggregate demand curve will shift to the left. 4.The short-run aggregate supply curve will shift to the left. Question 77 During the 2020 campaign, Joe Biden proposed raising income taxes on those earning more than $400,000 per year and raising corporate taxes from about 21 percent to 28 percent. Consider the market for money illustrated in the figure below. Assume the market initially is in equilibrium at point A. What effect will the tax increase…arrow_forward8arrow_forwardBriefly explain how each of the following events would affect the aggregate demand curve a) an increase in the price level b) an increase in government purchases c) higher federal corporate income taxesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education