Entries for sale of fixed asset Equipment acquired on January 8 at a cost of $189,200 has an estimated useful life of 20 years, has an estimated residual value of $9,000, and is depreciated by the straight-line method. a. What was the book value of the equipment at December 31 the end of the fourth year? $ 153,160 Feedback Check My Work Book value is the initial cost of the fixed asset minus the accumulated depreciation. b. Assuming that the equipment was sold on April 1 of the fifth year for $145,157. 1. Journalize the entry to record depreciation for the 3 months until the sale date. If an amount box does not require an entry, leave it blank. Round your answers to the nearest whole dollar if required. Account Depreciation Expense-Equipment Accumulated Depreciation-Equipment Debit Credit x X 2. Journalize the entry to record the sale of the equipment. If an amount box does not require an entry, leave it blank. Do not round intermediate calculations. Cash Accumulated Depreciation-Equipment Loss on Sale of Equipment Equipment

Entries for sale of fixed asset Equipment acquired on January 8 at a cost of $189,200 has an estimated useful life of 20 years, has an estimated residual value of $9,000, and is depreciated by the straight-line method. a. What was the book value of the equipment at December 31 the end of the fourth year? $ 153,160 Feedback Check My Work Book value is the initial cost of the fixed asset minus the accumulated depreciation. b. Assuming that the equipment was sold on April 1 of the fifth year for $145,157. 1. Journalize the entry to record depreciation for the 3 months until the sale date. If an amount box does not require an entry, leave it blank. Round your answers to the nearest whole dollar if required. Account Depreciation Expense-Equipment Accumulated Depreciation-Equipment Debit Credit x X 2. Journalize the entry to record the sale of the equipment. If an amount box does not require an entry, leave it blank. Do not round intermediate calculations. Cash Accumulated Depreciation-Equipment Loss on Sale of Equipment Equipment

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 8MC: On July 1, 2018, Mundo Corporation purchased factory equipment for 50,000. Residual value was...

Related questions

Question

help pls

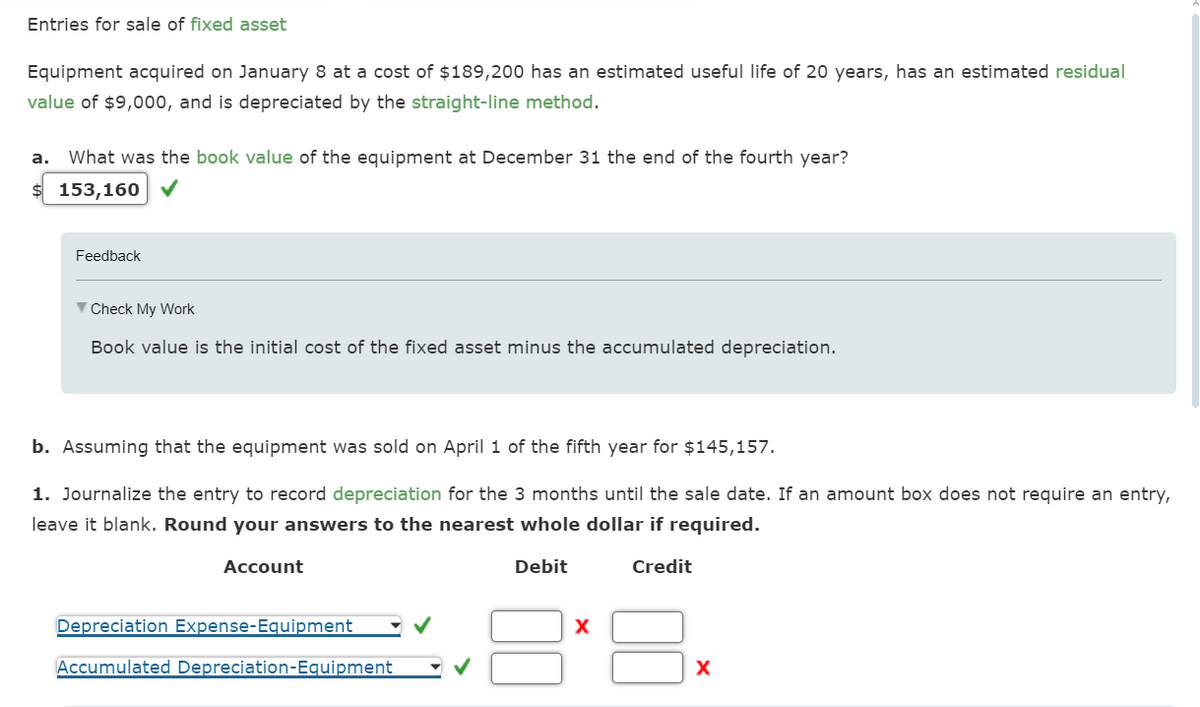

Transcribed Image Text:Entries for sale of fixed asset

Equipment acquired on January 8 at a cost of $189,200 has an estimated useful life of 20 years, has an estimated residual

value of $9,000, and is depreciated by the straight-line method.

a. What was the book value of the equipment at December 31 the end of the fourth year?

$ 153,160

Feedback

Check My Work

Book value is the initial cost of the fixed asset minus the accumulated depreciation.

b. Assuming that the equipment was sold on April 1 of the fifth year for $145,157.

1. Journalize the entry to record depreciation for the 3 months until the sale date. If an amount box does not require an entry,

leave it blank. Round your answers to the nearest whole dollar if required.

Account

Depreciation Expense-Equipment

Accumulated Depreciation-Equipment

Debit

Credit

x

X

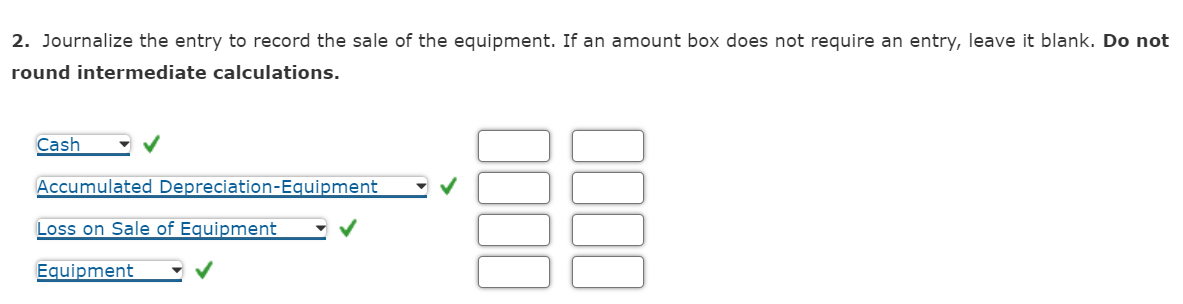

Transcribed Image Text:2. Journalize the entry to record the sale of the equipment. If an amount box does not require an entry, leave it blank. Do not

round intermediate calculations.

Cash

Accumulated Depreciation-Equipment

Loss on Sale of Equipment

Equipment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning