Edsel Research Labs has $28.20 million in assets. Currently half of these assets are financed with long-term debt at 5 percent and half with common stock having a par value of $10. Ms. Edsel, the Vice President of Finance, wishes to analyze two refinancing plans, one with more debt (D) and one with more equity (E). The company earns a return on assets before interest and taxes of 5 percent. The tax rate is 30 percent. Under Plan D, a $7.05 million long-term bond would be sold at an interest rate of 7 percent and 705,000 shares of stock would be purchased in the market at $10 per share and retired. Under Plan E, 705,000 shares of stock would be sold at $10 per share and the $7,050,000 in proceeds would be used to reduce long-term debt. a-1. How would each of these plans affect earnings per share? Consider the current plan and the two new plans. (Round your answers to 2 decimal places.) Earnings per Share Current Plan D Plan E a-2. Which plan(s) would produce the highest EPS? Note that due to tax loss carry-forwards and carry-backs, taxes can be a negative number. multiple choice The Current Plan and Plan E Plan D Plan E Current Plan b. Which plan would be most favorable if return on assets increased to 8 percent? Compare the current plan and the two new plans. multiple choice Current Plan Plan D Plan E Current Plan and Plan D c. Assuming return on assets is back to the original 5 percent, but the interest rate on new debt in Plan D is 4 percent, which of the three plans will produce the highest EPS? multiple choice Plan D The plans Current and E Plan E The Plan Current and D

Edsel Research Labs has $28.20 million in assets. Currently half of these assets are financed with long-term debt at 5 percent and half with common stock having a par value of $10. Ms. Edsel, the Vice President of Finance, wishes to analyze two refinancing plans, one with more debt (D) and one with more equity (E). The company earns a

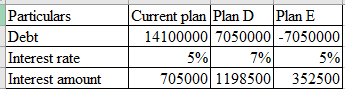

Under Plan D, a $7.05 million long-term bond would be sold at an interest rate of 7 percent and 705,000 shares of stock would be purchased in the market at $10 per share and retired. Under Plan E, 705,000 shares of stock would be sold at $10 per share and the $7,050,000 in proceeds would be used to reduce long-term debt.

a-1. How would each of these plans affect earnings per share? Consider the current plan and the two new plans. (Round your answers to 2 decimal places.)

|

a-2. Which plan(s) would produce the highest EPS? Note that due to tax loss carry-forwards and carry-backs, taxes can be a negative number.

multiple choice

-

The Current Plan and Plan E

-

Plan D

-

Plan E

-

Current Plan

b. Which plan would be most favorable if return on assets increased to 8 percent? Compare the current plan and the two new plans.

multiple choice

-

Current Plan

-

Plan D

-

Plan E

-

Current Plan and Plan D

c. Assuming return on assets is back to the original 5 percent, but the interest rate on new debt in Plan D is 4 percent, which of the three plans will produce the highest EPS?

multiple choice

-

Plan D

-

The plans Current and E

-

Plan E

-

The Plan Current and D

Given:

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 7 images