Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

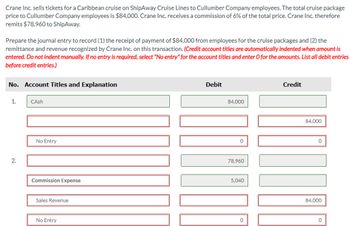

Transcribed Image Text:Crane Inc. sells tickets for a Caribbean cruise on ShipAway Cruise Lines to Cullumber Company employees. The total cruise package

price to Cullumber Company employees is $84,000. Crane Inc. receives a commission of 6% of the total price. Crane Inc. therefore

remits $78,960 to ShipAway.

Prepare the journal entry to record (1) the receipt of payment of $84,000 from employees for the cruise packages and (2) the

remittance and revenue recognized by Crane Inc. on this transaction. (Credit account titles are automatically indented when amount is

entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries

before credit entries.)

No. Account Titles and Explanation

1.

CAsh

2.

No Entry

Commission Expense

Sales Revenue

No Entry

Debit

84,000

0

78,960

5,040

0

Credit

84,000

0

84,000

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Travel Inc. sells tickets for a Caribbean cruise on ShipAway Cruise Lines to Carla Vista Company employees. The total cruise package price to Carla Vista Company employees is $ 79,000. Travel Inc. receives a commission of 6% of the total price. Travel Inc. therefore remits $ 74,260 to ShipAway.Prepare the journal entry to record (1) the receipt of payment of $ 79,000 from employees for the cruise packages and (2) the remittance and revenue recognized by Travel Inc. on this transaction.arrow_forwardFocarrow_forwardSandhill Inc. sells tickets for a Caribbean cruise on ShipAway Cruise Lines to Sunland Company employees. The total cruise package price to Sunland Company employees is $78,000. Sandhill Inc. receives a commission of 6% of the total price. Sandhill Inc. therefore remits $73,320 to ShipAway. Prepare the journal entry to record (1) the receipt of payment of $78,000 from employees for the cruise packages and (2) the remittance and revenue recognized by Sandhill Inc. on this transaction. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) No. Account Titles and Explanation 1. 2. Cash Accounts Payable Accounts Payable Sales Revenue cs eTextbook and Media Debit Creditarrow_forward

- Travel Inc. sells tickets for a Caribbean cruise on ShipAway Cruise Lines to Oriole Company employees. The total cruise package price to Oriole Company employees is $64,000. Travel Inc. receives a commission of 6% of the total price. Travel Inc. therefore remits $60,160 to ShipAway.Prepare the journal entry to record (1) the receipt of payment of $64,000 from employees for the cruise packages and (2) the remittance and revenue recognized by Travel Inc. on this transaction. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.)arrow_forwardCullumber Inc. sells tickets for a Caribbean cruise on ShipAway Cruise Lines to Blossom Company employees. The total cruise package price to Blossom Company employees is $60,000. Cullumber Inc. receives a commission of 5% of the total price. Cullumber Inc. therefore remits $57,000 to ShipAway. Prepare the journal entry to record (1) the receipt of payment of $60,000 from employees for the cruise packages and (2) the remittance and revenue recognized by Cullumber Inc. on this transaction. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) No. Account Titles and Explanation 1. 2. Debit Credit TAMIarrow_forwardPharoah Inc. sells tickets for a Caribbean cruise on ShipAway Cruise Lines to Ivanhoe Company employees. The total cruise package price to Ivanhoe Company employees is $63,000. Pharoah Inc. receives a commission of 5% of the total price. Pharoah Inc. therefore remits $59,850 to ShipAway. Prepare the journal entry to record (1) the receipt of payment of $63,000 from employees for the cruise packages and (2) the remittance and revenue recognized by Pharoah Inc. on this transaction. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) No. Account Titles and Explanation 1. 2. Cash Accounts Payable No Entry Accounts Payable Cash sales Debit 63,000 63,000 Credit 63,000 0 59,850arrow_forward

- Pharoah Inc. sells tickets for a Caribbean cruise on ShipAway Cruise Lines to Ivanhoe Company employees. The total cruise package price to Ivanhoe Company employees is $74,000. Pharoah Inc. receives a commission of 6% of the total price. Pharoah Inc. therefore remits $69,560 to ShipAway. 4440 Prepare the journal entry to record (1) the receipt of payment of $74,000 from employees for the cruise packages and (2) the remittance and revenue recognized by Pharoah Inc. on this transaction. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)arrow_forwardCullumber Inc. sells tickets for a Caribbean cruise on ShipAway Cruise Lines to Bonita Company employees. The total cruise package price to Bonita employees is $62,000. Cullumber receives a commission of 6% of the total price. Cullumber therefore remits $58,280 to ShipAway. Prepare the journal entry to record (1) the receipt of payment of $60,000 from employees for the cruise ship package and (2) the remittance and revenue recognized by Cullumber Inc. on this transaction. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. List all debit entries before credit entries.arrow_forwardYour answer is partially correct. Cullumber Inc. sells tickets for a Caribbean cruise on ShipAway Cruise Lines to Blossom Company employees. The total cruise package price to Blossom Company employees is $60,000. Cullumber Inc. receives a commission of 5% of the total price. Cullumber Inc. therefore remits $57,000 to ShipAway. Prepare the journal entry to record (1) the receipt of payment of $60,000 from employees for the cruise packages and (2) the remittance and revenue recognized by Cullumber Inc. on this transaction. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) No. Account Titles and Explanation 1. Debit Credit Cash Accounts Payable Accounts Payable Sales Revenue Cash 60,00 60,000 60,00 3,000 57,000arrow_forward

- Please see the attachment for detailsarrow_forwardDONT GIVE ANSWER IN IMAGE FORMATarrow_forwardOn December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning