FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:c. Which profitability measures (from part a or part b) better reflect the company's profit levels during the two years?

Of the three measures, which one is least influenced by the company's stock repurchase activity?

→

Check

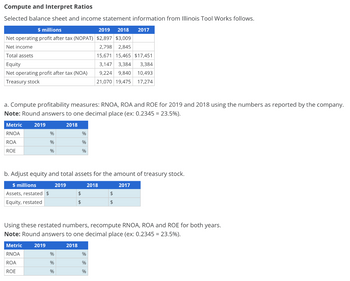

Transcribed Image Text:Compute and Interpret Ratios

Selected balance sheet and income statement information from Illinois Tool Works follows.

$ millions

Net operating profit after tax (NOPAT) $2,897 $3,009

Net income

2,798 2,845

Total assets

15,671 15,465 $17,451

3,147 3,384 3,384

10,493

9,224 9,840

21,070 19,475

17,274

Equity

Net operating profit after tax (NOA)

Treasury stock

a. Compute profitability measures: RNOA, ROA and ROE for 2019 and 2018 using the numbers as reported by the company.

Note: Round answers to one decimal place (ex: 0.2345 = 23.5%).

2018

Metric

RNOA

ROA

ROE

2019

$ millions

Assets, restated $

Equity, restated

Metric

RNOA

b. Adjust equity and total assets for the amount of treasury stock.

2019

2018

2017

ROA

ROE

%

%

%

2019

%

%

%

$

$

Using these restated numbers, recompute RNOA, ROA and ROE for both years.

Note: Round answers to one decimal place (ex: 0.2345 = 23.5%).

2018

%

%

%

2019 2018 2017

%

%

%

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Uramilabenarrow_forwardCalculate the following ratios, follow the steps and must interpret your answers , Current ratio Earning per share ratio Current assets=$89000 Current liabilities= 61000 Net income/profit=$18000 Number of shares common stock=76262 Total asset=770000arrow_forwardN1. Account Calculate the following ratios for Lake of Egypt Marina, Inc. as of year-end 2021. (Use sales when computing the inventory turnover and use total stockholders' equity when computing the equity multiplier. Round your answers to 2 decimal places. Use 365 days a year.)arrow_forward

- Compute and Interpret Ratios Selected balance sheet and income statement information from Illinois Tool Works follows. $ millions 2019 2018 2017 Net operating profit after tax (NOPAT) $2,480 $2,575 Net income 2,395 2,435 Total assets 13,561 13,383 $15,102 Equity 2,723 2,929 2,929 Net operating profit after tax (NOA) 7,982 8,516 9,080 Treasury stock 18,033 16,668 14,784 Compute profitability measures: RNOA, ROA and ROE for 2019 and 2018 using the numbers as reported by the company. Note: Round answers to one decimal place (ex: 0.2345 = 23.5%). b. Adjust equity and total assets for the amount of treasury stock. Using these restated numbers, recompute RNOA, ROA and ROE for both years.Note: Round answers to one decimal place (ex: 0.2345 = 23.5%).arrow_forwardAbhaliyaarrow_forwardBelow is financial information ($ values are in millions) in a model. Net income during the year for this company would be: Revenues SG&A Expenses Interest Expense Select one: OA. $4.5 million OB. $3.6 million O C. $16.6 million OD. $0.9 million $67.30 $4.70 $8.10 Cost of Goods Sold Depreciation Tax Rate $43.20 $6.80 20%arrow_forward

- Please helparrow_forwardVery important please be correct thank youarrow_forwardAssume you are given the following relationships for the Haslam Corporation: Sales/total assets 1.7 Return on assets (ROA) 4% Return on equity (ROE) 6% Calculate Haslam's profit margin and liabilities-to-assets ratio. Do not round intermediate calculations. Round your answers to two decimal places. Profit margin: % Liabilities-to-assets ratio: % Suppose half of its liabilities are in the form of debt. Calculate the debt-to-assets ratio. Do not round intermediate calculations. Round your answer to two decimal places. %arrow_forward

- The most recent financial statements for Mixton, Incorporated, are shown here: INCOME STATEMENT Sales Costs Taxable income Taxes (22%) Net income $ 52,000 Assets 42,400 $ 9,600 2,112 $ 7,488 Total BALANCE SHEET Debt Equity Total Answer is complete but not entirely correct. External financing needed s 11,990 X $ 115,700 $ 115,700 $ 34,500 81,200 $ 115,700 Assets and costs are proportional to sales. Debt and equity are not. A dividend of $2,900 was paid, and the company wishes to maintain a constant payout ratio. Next year's sales are projected to be $61,360. What is the external financing needed? Note: Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.arrow_forwardSales Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes. Income tax expense Net income Assets Current assets Long-term investments Plant assets, net Total assets Sin Comparative Income Statements For Years Ended December 31 2021 $ 420,027 252,856 167,171 59,644 37,802 97,446 69,725 12,969 $ 56,756 Liabilities and Equity Current liabilities Common stock Other paid-in capital Retained earnings Total liabilities and equity Assets Current assets Long-term investments Plant assets, net. Total assets Liabilities and Equity Current liabaties Common stock Other paid-in capital Retained earnings Total liabilities and equity 2020 $ 321,775 202,718 KORBIN COMPANY Comparative Balance Sheets December 31 2021 119,057 44,405 28,316 72,721 46,336 9,499 $ 36,837 $ 55,286 0 102,674 $ 157,960 2020 3. Complete the below table to calculate the balance sheet data in trend percents with 2019 as answers to 2 decimal places.) 111.77 % 0.00 $ 37,003 700…arrow_forwardBhupatbhaiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education