Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

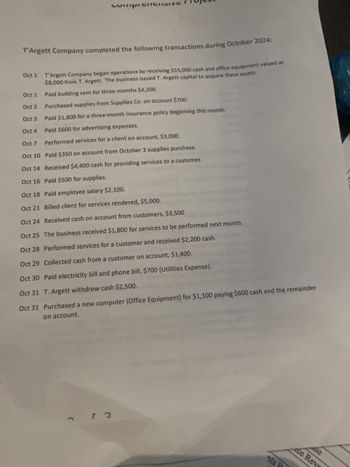

Transcribed Image Text:T'Argett Company completed the following transactions during October 2024:

Oct 1

T'Argett Company began operations by receiving $15,000 cash and office equipment valued at

$8,000 from T. Argett. The business issued T. Argett capital to acquire these assets.

Oct 1

Paid building rent for three months $4,200.

Oct 2

Purchased supplies from Supplies Co. on account $700.

Oct 3

Paid $1,800 for a three-month insurance policy beginning this month.

Oct 4

Paid $600 for advertising expenses.

Oct 7

Performed services for a client on account, $3,000.

Oct 10 Paid $350 on account from October 3 supplies purchase.

Oct 14 Received $4,400 cash for providing services to a customer.

Oct 16 Paid $500 for supplies.

Oct 18 Paid employee salary $2,100.

Oct 21 Billed client for services rendered, $5,000.

Oct 24 Received cash on account from customers, $3,500

Oct 25 The business received $1,800 for services to be performed next month.

Oct 28 Performed services for a customer and received $2,200 cash.

Oct 29 Collected cash from a customer on account, $1,400.

Oct 30 Paid electricity bill and phone bill, $700 (Utilities Expense).

Oct 31 T. Argett withdrew cash $2,500.

Oct 31 Purchased a new computer (Office Equipment) for $1,100 paying $600 cash and the remainder

on account.

г 2

ue

ce Rev

nts

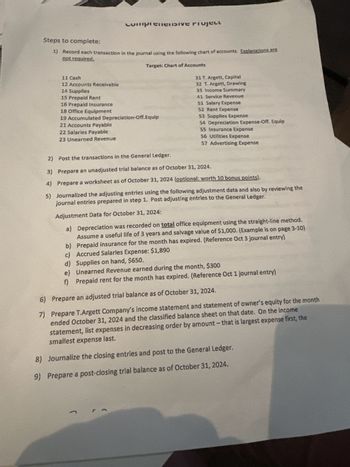

Transcribed Image Text:Comprehensive Project

Steps to complete:

1) Record each transaction in the journal using the following chart of accounts. Explanations are

not required.

Target: Chart of Accounts

11 Cash

12 Accounts Receivable

14 Supplies

15 Prepaid Rent

16 Prepaid Insurance

18 Office Equipment

19 Accumulated Depreciation-Off.Equip

21 Accounts Payable

22 Salaries Payable

23 Unearned Revenue

31 T. Argett, Capital

32 T. Argett, Drawing

33 Income Summary

41 Service Revenue

51 Salary Expense

52 Rent Expense

53 Supplies Expense

54 Depreciation Expense-Off. Equip

55 Insurance Expense

56 Utilities Expense

57 Advertising Expense

2) Post the transactions in the General Ledger.

3) Prepare an unadjusted trial balance as of October 31, 2024.

4) Prepare a worksheet as of October 31, 2024 (optional: worth 10 bonus points)

5) Journalized the adjusting entries using the following adjustment data and also by reviewing the

journal entries prepared in step 1. Post adjusting entries to the General Ledger.

Adjustment Data for October 31, 2024:

a) Depreciation was recorded on total office equipment using the straight-line method.

Assume a useful life of 3 years and salvage value of $1,000. (Example is on page 3-10)

b) Prepaid insurance for the month has expired. (Reference Oct 3 journal entry)

c) Accrued Salaries Expense: $1,890

d) Supplies on hand, $650.

e) Unearned Revenue earned during the month, $300

f) Prepaid rent for the month has expired. (Reference Oct 1 journal entry)

6) Prepare an adjusted trial balance as of October 31, 2024.

7) Prepare T.Argett Company's income statement and statement of owner's equity for the month

ended October 31, 2024 and the classified balance sheet on that date. On the income

statement, list expenses in decreasing order by amount - that is largest expense first, the

smallest expense last.

8) Journalize the closing entries and post to the General Ledger.

9)

Prepare a post-closing trial balance as of October 31, 2024.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Using the information provided in RE17-16, prepare the journal entries to record Year 1s (a) construction costs, (b) partial billings, (c) cash collections, and (d) gross profit.arrow_forwardHD2.arrow_forwardPA9-1 (Algo) Computing Acquisition Cost and Recording Depreciation under Three Alternative Methods [LO 9-2, LO 9-3] [The following information applies to the questions displayed below.] At the beginning of the year, Cruz & Turner Corporation bought three used machines. The machines immediately were overhauled, were installed, and started operating. Because the machines were different, each was recorded separately in the accounts. Details for Machine A are provided below. Cost of the asset Installation costa Renovation costs prior to use Repairs after production began $10,700 970 1,110 850 PA9-1 (Algo) Part 3 3. Prepare the journal entry to record year 2 straight-line depreciation expense for Machine A, assuming an estimated life of 4 years and $1,000 residual value. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forward

- H5.arrow_forwardA nongovernmental, not-for-profit had the following selected account balances on December 31, 2020 prior to closing entries: Revenue-WODR. $1,700,000 Revenue-WDR.. 900,000 Deferred Revenues. ..60,000 Program Expenses. .900,000 Administrative Expenses. 500,000 Fund Raising Expenses.. .180,000 445.000 Net Assets Reclassified to WODR. 445,000 Net Assets Reclassified from WDR 100,000 Prepaid Program Expenses.arrow_forwardRequired: • LEDGER (format/answer sheet provided)arrow_forward

- Question is attached in the screenshot thanks grealty appreciated 420ti2492i409y490idf9ib0fi90iarrow_forwardOpen the file MASTER from the website for this book at cengagebrain.com. Enter all the formulas where indicated on the worksheet. Check to be sure that your balance sheet balances. Enter your name in cell A1. Save the completed file as MASTER2. Print the worksheet when done. Also print your formulas using fit-to-1 page scaling. Check figures: Borrowing (cell B78), $7,280; forecasted net income (cell D95), $40,200; total assets (cell D105), $507,600.arrow_forwardInstructions: Match each account from the box to the choices of proper balance POST ACTIVITY Activity Activity #5: Classification of Balance Sheet Account Instru sheet category: CASE X 1. Patents 2. Building Held for Sale 3. Prepaid Rent 4. Wages Payable 5. Note Payable in Five Years 6. Building Used in Operations 7. Fund Held to Pay Off Long Term Debt • Current Assets • Investments Property, Plant and Equipment Cash Notes • Intangible Assets Accou 8. Inventory Office 9. Prepaid Insurance 10. Depreciation Expense 11. Accounts Receivable • Current Liabilities Intere Land • Long-Term Liabilities Build 12. Interest Expense Accu • Owner's Equity 13. Unearned Revenues Equip 14. Short-Term Investments • Not Applicable ACcu 15. Accumulated Depreciation 16. Owner's Capital Accc Sala Activity #6: AcCounting Er Unearrow_forward

- Please help!arrow_forwardplease help me provide complete and correct answer for all requirements with all working for all parts answer in text please answer correct please remember answer all requirements or skip /leave for other expert thanks million thanksarrow_forwardJournalize the transactions. Refer to the Chart of Accounts for exact wording of account titles. PAGE 10 JOURNAL ACCOUNTING EQUATION DATE DESCRIPTION POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning