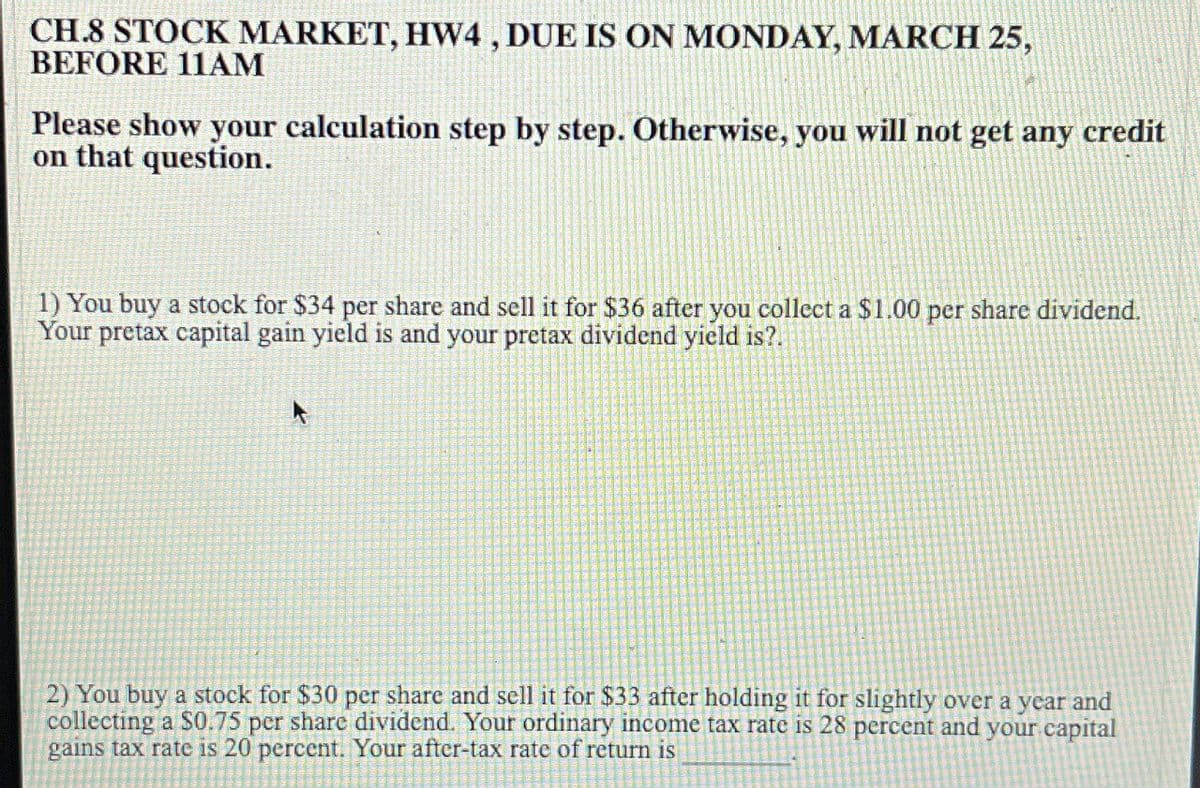

CH.8 STOCK MARKET, HW4, DUE IS ON MONDAY, MARCH 25, BEFORE 11AM Please show your calculation step by step. Otherwise, you will not get any credit on that question. 1) You buy a stock for $34 per share and sell it for $36 after you collect a $1.00 per share dividend. Your pretax capital gain yield is and your pretax dividend yield is?. 2) You buy a stock for $30 per share and sell it for $33 after holding it for slightly over a year and collecting a $0.75 per share dividend. Your ordinary income tax rate is 28 percent and your capital gains tax rate is 20 percent. Your after-tax rate of return is

CH.8 STOCK MARKET, HW4, DUE IS ON MONDAY, MARCH 25, BEFORE 11AM Please show your calculation step by step. Otherwise, you will not get any credit on that question. 1) You buy a stock for $34 per share and sell it for $36 after you collect a $1.00 per share dividend. Your pretax capital gain yield is and your pretax dividend yield is?. 2) You buy a stock for $30 per share and sell it for $33 after holding it for slightly over a year and collecting a $0.75 per share dividend. Your ordinary income tax rate is 28 percent and your capital gains tax rate is 20 percent. Your after-tax rate of return is

Chapter7: Stocks (equity) - Characterstics And Valuation

Section: Chapter Questions

Problem 5PROB

Related questions

Question

Transcribed Image Text:CH.8 STOCK MARKET, HW4, DUE IS ON MONDAY, MARCH 25,

BEFORE 11AM

Please show your calculation step by step. Otherwise, you will not get any credit

on that question.

1) You buy a stock for $34 per share and sell it for $36 after you collect a $1.00 per share dividend.

Your pretax capital gain yield is and your pretax dividend yield is?.

2) You buy a stock for $30 per share and sell it for $33 after holding it for slightly over a year and

collecting a $0.75 per share dividend. Your ordinary income tax rate is 28 percent and your capital

gains tax rate is 20 percent. Your after-tax rate of return is

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning