Part 1 and Part 2: Palisade Creek Co. is a retail business that uses the perpetual inventory system. The account balances for Palisade Creek as of May 1, 2016 (unless otherwise indicated), are as follows. Assume all accounts have normal balances. 110 Cash 112 Accounts Receivable 115 Inventory 116 Estimated Returns Inventory 117 Prepaid Insurance 118 Store Supplies 123 Store Equipment 124 Accumulated Depreciation-Store Equipment 210 Accounts Payable 211 Salaries Payable 212 Customers Refunds Payable 310 Common Stock 311 Retained Earnings 312 Dividends 410 Sales 510 Cost of Goods Sold 520 Sales Salaries Expense 521 Advertising Expense 522 Depreciation Expense 523 Store Supplies Expense 529 Miscellaneous Selling Expense 530 Office Salaries Expense 531 Rent Expense 532 Insurance Expense 539 Miscellaneous Administrative Expense May 1 Rent Expense $83,600 233,900 ✓ 624,400 28,000 16,800 11,400 569,500 56,700 96,600 50,000 100,000 585,300 $135,000 5,069,000 2,823,000 664,800 281,000 12,600 382,100 83,700 7,800 Part 1: Journalize the transactions below for May, the last month of the fiscal year. If an amount box does not require an entry, leave it blank. May 1: Paid rent for May, $5,000. Date Description A Post. Ref. Debit Credit ✓ 5,000

Reporting Cash Flows

Reporting of cash flows means a statement of cash flow which is a financial statement. A cash flow statement is prepared by gathering all the data regarding inflows and outflows of a company. The cash flow statement includes cash inflows and outflows from various activities such as operating, financing, and investment. Reporting this statement is important because it is the main financial statement of the company.

Balance Sheet

A balance sheet is an integral part of the set of financial statements of an organization that reports the assets, liabilities, equity (shareholding) capital, other short and long-term debts, along with other related items. A balance sheet is one of the most critical measures of the financial performance and position of the company, and as the name suggests, the statement must balance the assets against the liabilities and equity. The assets are what the company owns, and the liabilities represent what the company owes. Equity represents the amount invested in the business, either by the promoters of the company or by external shareholders. The total assets must match total liabilities plus equity.

Financial Statements

Financial statements are written records of an organization which provide a true and real picture of business activities. It shows the financial position and the operating performance of the company. It is prepared at the end of every financial cycle. It includes three main components that are balance sheet, income statement and cash flow statement.

Owner's Capital

Before we begin to understand what Owner’s capital is and what Equity financing is to an organization, it is important to understand some basic accounting terminologies. A double-entry bookkeeping system Normal account balances are those which are expected to have either a debit balance or a credit balance, depending on the nature of the account. An asset account will have a debit balance as normal balance because an asset is a debit account. Similarly, a liability account will have the normal balance as a credit balance because it is amount owed, representing a credit account. Equity is also said to have a credit balance as its normal balance. However, sometimes the normal balances may be reversed, often due to incorrect journal or posting entries or other accounting/ clerical errors.

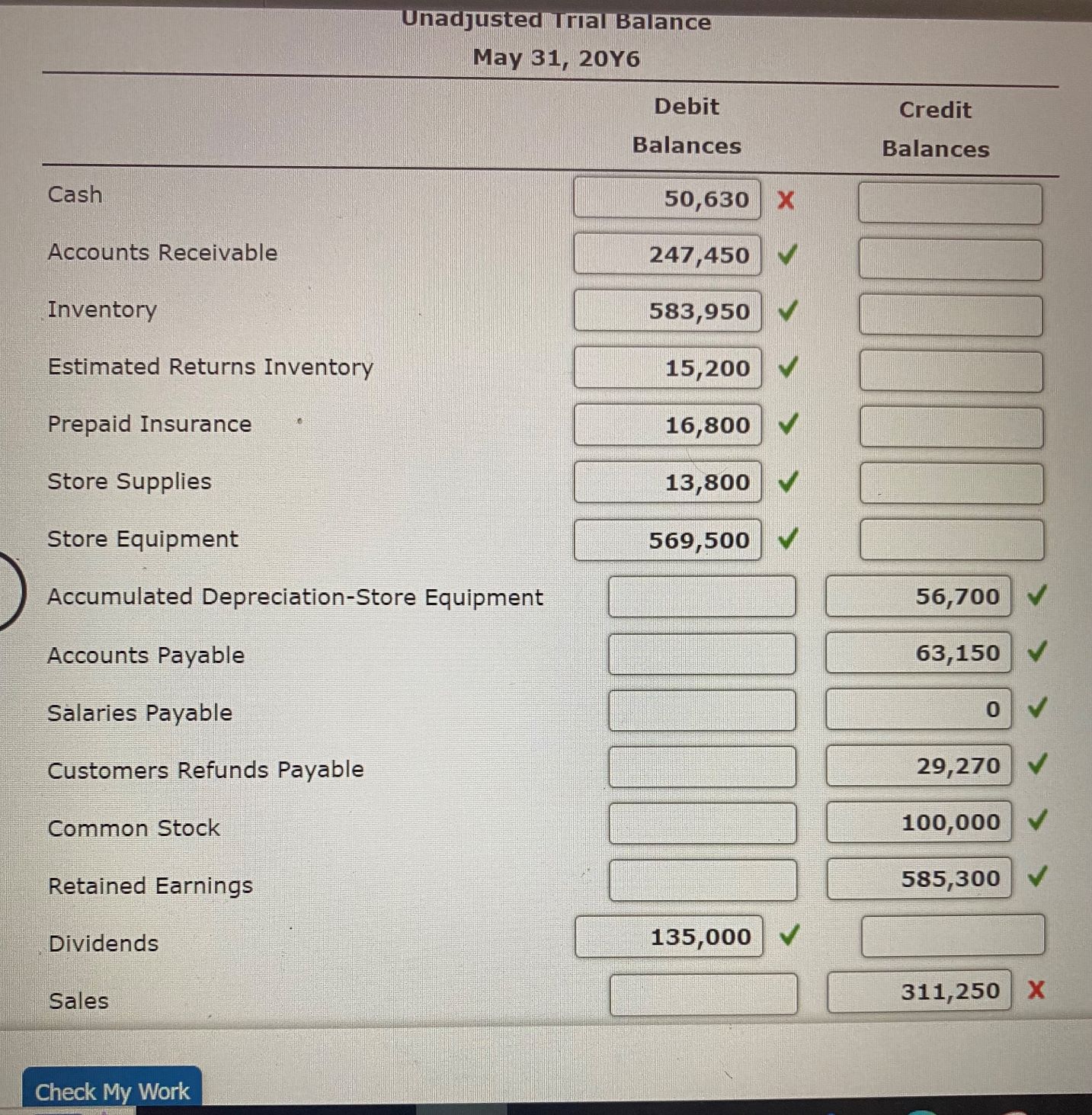

What is the cash and sale on adjust. trail bal.?

May 1: Paid rent for May, $5,000.

Date Description Post. Ref. Debit Credit

May 1

Rent Expense 5,000

Cash 5,000

May 2: Sold merchandise on account to Korman Co., terms n/15, FOB shipping point, $68,500. The cost of the goods sold was $41,000.

Date Description Post. Ref. Debit Credit

May 2 Accts Receivable-Korman Co.68,500

Sales 68,500

May 2 Cost of Goods Sold 41,000

Inventory 41,000

May 3: Purchased merchandise on account from Martin Co., terms 2/10, n/30, FOB shipping point, $36,000.

Date Description Post. Ref. Debit Credit

May 3 Inventory 36,000

Accts Payable-Martin Co. 36,000

May 4: Paid freight on purchase of May 3, $600.

Date Description Post. Ref. Debit Credit

May 4 Inventory 600

Cash 600

May 7: Received $22,300 cash from Halstad Co. on account.

Date Description Post. Ref. Debit Credit

May 7 Cash 22,300

Accts Receivable-Halstad Co. 22,300

May 10: Sold merchandise with a list price of $61,500 to customers who used VISA and who redeemed $7,500 of point-of-sale coupons. The cost of the goods sold was $32,000.

Date Description Post. Ref. Debit Credit

May 10-Sales Cash 54,000

Sales 54,000

May 10-Cost Cost of Goods Sold 32,000

Inventory 32,000

May 13: Paid for merchandise purchased on May 3.

Date Description Post. Ref. Debit Credit

May 13 Accts Payable-Martin Co. 36,000

Cash 35,280

Inventory 720

May 15: Paid advertising expense for last half of May, $11,000.

Date Description Post. Ref. Debit Credit

May 15 Advertising Expense 11,000

Cash 11,000

May 17: Received cash from sale of May 2.

Date Description Post. Ref. Debit Credit

May 17 Cash 68,500

Accts Receivable—Korman Co. 68,500

May 19: Purchased merchandise for cash, $18,700.

Date Description Post. Ref. Debit Credit

May 19 Inventory 18,700

Cash 18,700

May 19: Paid $33,450 to Buttons Co. on account.

Date Description Post. Ref. Debit Credit

May 19 Accts Payable-Buttons Co. 33,450

Cash 33,450

May 20: Paid Korman Co. a cash refund of $13,230 for returned merchandise from sale of May 2. The cost of the returned merchandise was $8,000.

Date Description Post. Ref. Debit Credit

May 20-Refund Cust. Refunds Payable 13,230

Cash 13,230

May 20-Cost Inventory 8,000

Esti Returns Inventory 8,000

May 21: Sold merchandise on account to Crescent Co., terms n/eom, FOB shipping point, $110,000. The cost of the goods sold was $70,000.

Date Description Post. Ref. Debit Credit

May 21-Sales Accts Receivable-Crescent Co. 110,000

Sales 110,000

May 21-Cost Cost of Goods Sold 70,000

Inventory 70,000

May 21: For the convenience of Crescent Co., paid freight on sale of May 21, $2,300.

Date Description Post. Ref. Debit Credit

May 21 Accts Receivable-Crescent Co. 2,300

Cash 2,300

May 21: Received $42,900 cash from Gee Co. on account.

Date Description Post. Ref. Debit Credit

May 21 Cash 42,900

Accts Receivable-Gee Co. 42,900

May 21: Purchased merchandise on account from Osterman Co., terms 1/10, n/30, FOB destination, $88,000.

Date Description Post. Ref. Debit Credit

May 21 Inventory 88,000

Accts Payable-Osterman Co. 88,000

May 24: Returned damaged merchandise purchased on May 21, receiving a credit memo from the seller for $5,000.

Date Description Post. Ref. Debit Credit

May 24 Accts Payable-Osterman Co.5,000

Inventory 5,000

May 26: Refunded cash on sales made for cash, $7,500. The cost of the merchandise returned was $4,800.

Date Description Post. Ref. Debit Credit

May 26-Refund Cust. Refunds Payable 7,500

Cash 7,500

May 26-Cost Inventory 4,800

Esti Returns Inventory 4,800

May 28: Paid sales salaries of $56,000 and office salaries of $29,000.

Date Description Post. Ref. Debit Credit

May 28 Sales Salaries Expense 56,000

Office Salaries Expense 29,000

Cash 85,000

May 29: Purchased store supplies for cash, $2,400.

Date Description Post. Ref. Debit Credit

May 29 Store Supplies 2,400

Cash 2,400

May 30: Sold merchandise on account to Turner Co., terms n/30, FOB shipping point, $78,750. The cost of the goods sold was $47,000.

Date Description Post. Ref. Debit Credit

May 30-Sales Accts Receivable-Turner Co. 78,750

Sales 78,750

May 30-Cost Cost of Goods Sold 47,000

Inventory 47,000

May 31: Received cash from sale of May 21 plus freight.

Date Description Post. Ref. Debit Credit

May 31 Cash 112,300

Accts Receivable-Crescent Co. 112,300

May 31: Paid for purchase of May 21, less return of May 24.

Date Description Post. Ref. Debit Credit

May 31 Accts Payable-Osterman Co.83,000

Cash 82,170

Inventory 830

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

I typed in the answers provided and the system responded incorrect.