The common stock of the C.A.L.L. Corporation has been trading in a narrow range around $105 per share for months, and you believe it is going to stay in that range for the next 3 months. The price of a 3-month put option with an exercise price of $105 is $12.86. a. If the risk-free interest rate is 5% per year, what must be the price of a 3-month call option on C.A.L.L. stock at an exercise price of $105 if it is at the money? (The stock pays no dividends.) (Do not round intermediate calculations. Round your answer to 2 decimal places.) Price of a 3-month call option

The common stock of the C.A.L.L. Corporation has been trading in a narrow range around $105 per share for months, and you believe it is going to stay in that range for the next 3 months. The price of a 3-month put option with an exercise price of $105 is $12.86. a. If the risk-free interest rate is 5% per year, what must be the price of a 3-month call option on C.A.L.L. stock at an exercise price of $105 if it is at the money? (The stock pays no dividends.) (Do not round intermediate calculations. Round your answer to 2 decimal places.) Price of a 3-month call option

Chapter20: Financing With Derivatives

Section20.A: The Black-scholes Option Pricing Model

Problem 1P

Related questions

Question

Transcribed Image Text:The common stock of the C.A.L.L. Corporation has been trading in a narrow range around $105 per share for months, and you believe

it is going to stay in that range for the next 3 months. The price of a 3-month put option with an exercise price of $105 is $12.86.

a. If the risk-free interest rate is 5% per year, what must be the price of a 3-month call option on C.A.L.L. stock at an exercise price of

$105 if it is at the money? (The stock pays no dividends.) (Do not round intermediate calculations. Round your answer to 2 decimal

places.)

Price of a 3-month call option

Transcribed Image Text:b-2. What is the most money you can make on this position? (Do not round intermediate calculations. Round your answer to 2

decimal places.)

Amount

b-3. How far can the stock price move in either direction before you lose money? (Do not round intermediate calculations. Round

your answer to 2 decimal places.)

Stock price

c. How can you create a position involving a put, a call, and riskless lending that would have the same payoff structure as the stock at

expiration? What is the net cost of establishing that position now? (Enter the absolute value. Do not round intermediate calculations.

Round your answers to 2 decimal places. Leave no cells blank - be certain to enter "0" wherever required.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 6 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

the answer was partially incorrect, entered it in as positive and negative, see attached

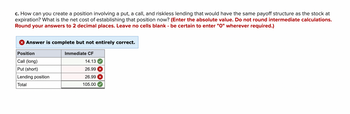

Transcribed Image Text:c. How can you create a position involving a put, a call, and riskless lending that would have the same payoff structure as the stock at

expiration? What is the net cost of establishing that position now? (Enter the absolute value. Do not round intermediate calculations.

Round your answers to 2 decimal places. Leave no cells blank - be certain to enter "0" wherever required.)

> Answer is complete but not entirely correct.

Position

Call (long)

Put (short)

Lending position

Total

Immediate CF

14.13

26.99 X

26.99 X

105.00

Transcribed Image Text:c. How can you create a position involving a put, a call, and riskless lending that would have the same payoff structure as the stock at

expiration? What is the net cost of establishing that position now? (Enter the absolute value. Do not round intermediate calculations.

Round your answers to 2 decimal places. Leave no cells blank - be certain to enter "0" wherever required.)

X Answer is complete but not entirely correct.

Position

Call (long)

Put (short)

Lending position

Total

Immediate CF

14.13

(26.99) X

(26.99) X

105.00

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT