FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Blossom Company prepared the tabulation below at December 31, 2022

Net Income=$307,100

Adjustments to reconcile net income to net cash provided by operating activities

Decrease in

Increase in inventory=$12.100

Decrease in accounts payable=$8,700

Increase in income taxes payable:$1,600

Loss on sale of land=$5,100

Net cash provided (used) by operating activities

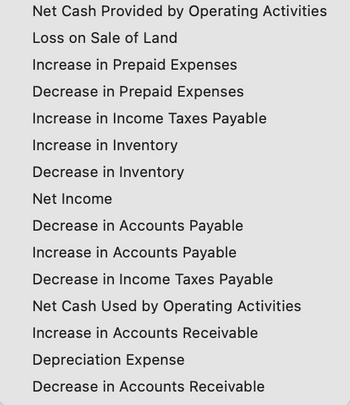

Transcribed Image Text:Net Cash Provided by Operating Activities

Loss on Sale of Land

Increase in Prepaid Expenses

Decrease in Prepaid Expenses

Increase in Income Taxes Payable

Increase in Inventory

Decrease in Inventory

Net Income

Decrease in Accounts Payable

Increase in Accounts Payable

Decrease in Income Taxes Payable

Net Cash Used by Operating Activities

Increase in Accounts Receivable

Depreciation Expense

Decrease in Accounts Receivable

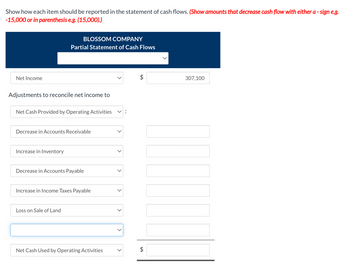

Transcribed Image Text:Show how each item should be reported in the statement of cash flows. (Show amounts that decrease cash flow with either a - sign e.g.

-15,000 or in parenthesis e.g. (15,000).)

Net Income

Adjustments to reconcile net income to

BLOSSOM COMPANY

Partial Statement of Cash Flows

Net Cash Provided by Operating Activities V:

Decrease in Accounts Receivable

Increase in Inventory

Decrease in Accounts Payable

Increase in Income Taxes Payable

Loss on Sale of Land

Net Cash Used by Operating Activities

>

>

>

tA

307,100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Current Attempt in Progress Lee Enterprises reports the following information: Net income Depreciation expense Increase in accounts payable Increase in accounts receivable $5180000 $3979520. $5180000. $6380480. $5706480. 704480 159000 337000 Lee should report cash provided by operating activities ofarrow_forwardApex Company prepared the statement of cash flows shown below: Apex Company Statement of Cash Flows—Indirect Method Operating activities: Net income $ 40,800 Adjustments to convert net income to cash basis: Depreciation $ 20,900 Increase in accounts receivable (61,300) Increase in inventory (25,300) Decrease in prepaid expenses 10,000 Increase in accounts payable 53,700 Decrease in accrued liabilities (11,200) Increase in income taxes payable 4,300 (8,900) Net cash provided by (used in) operating activities 31,900 Investing activities: Proceeds from the sale of equipment 14,900 Loan to Thomas Company (40,400) Additions to plant and equipment (120,000) Net cash provided by (used in) investing activities (145,500) Financing activities: Increase in bonds payable 89,400 Increase in common stock 40,000 Cash dividends (28,700) Net cash provided by (used in) financing activities 100,700 Net…arrow_forwardThe net income reported on the income statement for the current year was $255000. Depreciation was $39600. Account receivable and inventories decreased by $12300 and $35300, respectively. Prepaid expenses and accounts payable increased, respectively, by $1200 and $7600. How much cash was provided by operating activities? $305700 O $321100 $348600 O $333400arrow_forward

- Hampton Company reports the following information for its recent calendar year. Selected Year-End Balance Sheet Data Accounts receivable increase $ 77,000 Inventory decrease 41,000 Salaries payable increase 12,000 4,000 $ 20,000 Income Statement Data Sales Expenses: Cost of goods sold Salaries expense Depreciation expense Net income Required: Prepare the operating activities section of the statement of cash flows using the indirect method. Note: Amounts to be deducted should be indicated with a minus sign. Statement of Cash Flows (partial) Cash flows from operating activities-indirect method Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash $ 5,000 5,000 900 Changes in current operating assets and liabilitiesarrow_forwardvint.pohaarrow_forwardReporting Net Cash Flow from Operating Activities The following information is available for Bernard Corporation for 2019: Net income $199,000 Decrease in accounts receivable 6,400 Increase in inventory 18,300 Decrease in prepaid rent 2,100 Increase in salaries payable 4,410 Decrease in income taxes payable 4,270 Increase in notes payable (due 2023) 50,000 Depreciation expense 44,700 Loss on disposal of equipment 11,000 Required: Compute the net cash flows from operating activities using the indirect method.arrow_forward

- Cash Flows from (Used for) Operating Activities The net income reported on the income statement for the current year was $137,500. Depreciation recorded on store equipment for the year amounted to $22,700. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: Endof Year Beginningof Year Cash $53,350 $48,550 Accounts receivable (net) 38,250 35,880 Merchandise inventory 52,230 54,620 Prepaid expenses 5,870 4,610 Accounts payable (merchandise creditors) 49,990 45,930 Wages payable 27,320 30,000 a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments.arrow_forwardCash Flows from (Used for) Operating Activities The net income reported on the income statement for the current year was $154,700. Depreciation recorded on store equipment for the year amounted to $25,500. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: Endof Year Beginningof Year Cash $61,730 $56,790 Accounts receivable (net) 44,260 41,970 Merchandise inventory 60,430 63,890 Prepaid expenses 6,790 5,400 Accounts payable (merchandise creditors) 57,840 53,720 Wages payable 31,610 35,100 a. Prepare the Cash Flows from (used for) Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Statement of Cash Flows (partial) Cash flows from operating activities: - Net income $ Adjustments to reconcile net income to net cash flows from (used for) operating…arrow_forwardThe balance sheet data of Blossom Company at the end of 2025 and 2024 are shown below. 2025 2024 Cash $7,500 $9,900 Accounts receivable (net) 80,500 87,700 Merchandise inventory 85,800 79,600 Prepaid expenses 9,000 12,000 Equipment 171,500 145,500 Accumulated depreciation-equipment (45,100) (36,500) Land 30,200 50,100 Total assets $339,400 $348,300 Accounts payable $45,200 $57,600 Accrued expenses 11,100 9,000 Notes payable-bank, short-term -0- 49,100 Bonds payable 19,900 -0- Common stock, $1 par 181,000 161,000 Retained earnings 82,200 71,600 Total liabilities and shareholders' equity $339,400 $348,300 Equipment was purchased for $20,000 in exchange for common stock, par $20,000, during the year; all other equipment purchased was for cash. Land was sold for $31,700. Cash dividends of $7,100 were declared and paid during the year. Compute net cash provided (used) by: (Show amounts that decrease cash flow with either a - sign e.g. -12,000 or in parenthesis e.g. (12,000).) (a) Net cash…arrow_forward

- Net income Depreciation expense Accounts receivable increase (decrease) Inventory increase (decrease) Accounts payable increase (decrease) Accrued liabilities increase (decrease) Twix $ 7,200 54,000 72,000 (36,000) 43,200 (79,200) Dots $ 180,000 14,400 36,000 (18,000) (39,600) 21,600 Cash Flows from Operating Activities (Indirect) Twix Adjustments to reconcile net income to net cash provided by operating activities: Income statement items not affecting cash Changes in current operating assets and liabilities Skor $ 129,600 43,200 (7,200) 18,000 For each separate company, compute cash flows from operations using the indirect method. Note: Amounts to be deducted should be indicated by a minus sign. 25, 200 (14,400) Dots Skorarrow_forwardNeed Help.arrow_forwardNet Cash Flow From Operating Activities Verna Company's records provided the following information for 2019: decrease in accounts payable, $4,000 loss on sale of land, $1,100 increase in inventory, $7,100 increase in income taxes payable, $2,800 net income, $68,500 patent amortization expense, $1,200 ordinary loss, $6,300 decrease in deferred taxes payable, $2,200 amortization of discount on bonds payable, $1,800 payment of cash dividends, $22,000 depletion expense, $4,800 decrease in salaries payable, $1,900 decrease in accounts receivable, $3,800 gain on sale of equipment, $6,900 proceeds from issuance of stock, $62,000 ordinary gain, $4,000 depreciation expense, $10,000 amortization of discount on investment in bonds, $1,700 Required Prepare the operating activities section of Verna's 2019 statement of cash flows using the indirect method. Use a minus sign to indicate cash outflows or decreases in cash.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education