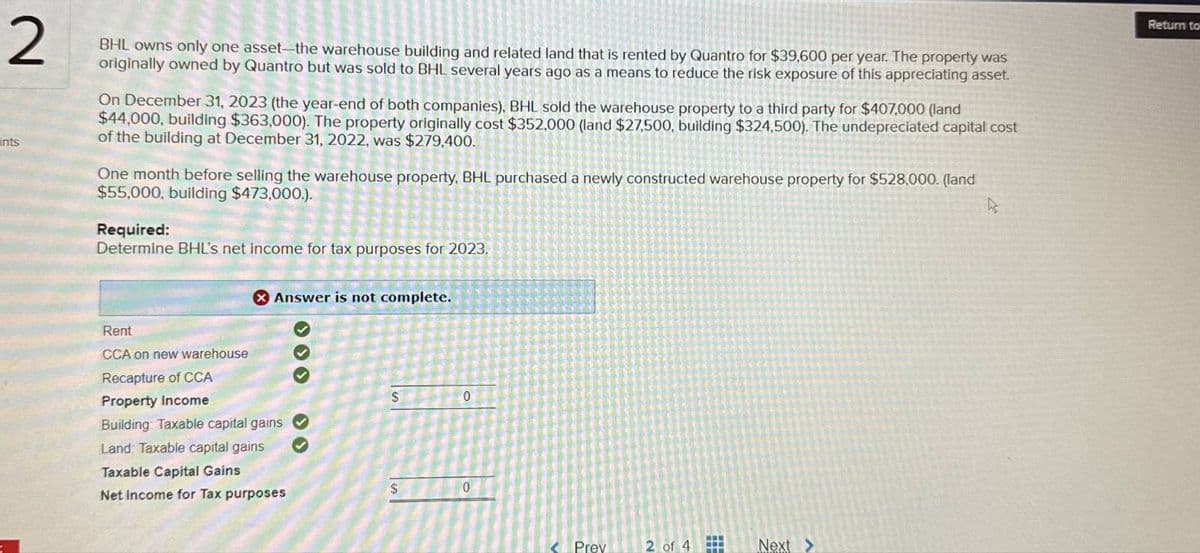

BHL owns only one asset-the warehouse building and related land that is rented by Quantro for $39,600 per year. The property was originally owned by Quantro but was sold to BHL several years ago as a means to reduce the risk exposure of this appreciating asset. On December 31, 2023 (the year-end of both companies), BHL sold the warehouse property to a third party for $407,000 (land $44,000, building $363,000). The property originally cost $352,000 (land $27,500, building $324,500). The undepreciated capital cost of the building at December 31, 2022, was $279,400. One month before selling the warehouse property, BHL purchased a newly constructed warehouse property for $528,000. (land $55,000, building $473,000.). Required: R Determine BHL's net income for tax purposes for 2023.

BHL owns only one asset-the warehouse building and related land that is rented by Quantro for $39,600 per year. The property was originally owned by Quantro but was sold to BHL several years ago as a means to reduce the risk exposure of this appreciating asset. On December 31, 2023 (the year-end of both companies), BHL sold the warehouse property to a third party for $407,000 (land $44,000, building $363,000). The property originally cost $352,000 (land $27,500, building $324,500). The undepreciated capital cost of the building at December 31, 2022, was $279,400. One month before selling the warehouse property, BHL purchased a newly constructed warehouse property for $528,000. (land $55,000, building $473,000.). Required: R Determine BHL's net income for tax purposes for 2023.

Chapter8: Depreciation, Cost Recovery, Amortization, And Depletion

Section: Chapter Questions

Problem 43P: LO.2, 3, 9 On June 5, 2018, Javier Sanchez purchased and placed in service a new 7-year class asset...

Related questions

Question

Transcribed Image Text:2

nts

BHL owns only one asset-the warehouse building and related land that is rented by Quantro for $39,600 per year. The property was

originally owned by Quantro but was sold to BHL several years ago as a means to reduce the risk exposure of this appreciating asset.

On December 31, 2023 (the year-end of both companies), BHL sold the warehouse property to a third party for $407,000 (land

$44,000, building $363,000). The property originally cost $352,000 (land $27.500, building $324,500). The undepreciated capital cost

of the building at December 31, 2022, was $279,400.

One month before selling the warehouse property, BHL purchased a newly constructed warehouse property for $528,000. (land

$55,000, building $473,000.).

Required:

Determine BHL's net income for tax purposes for 2023,

B

Answer is not complete.

Rent

CCA on new warehouse

Recapture of CCA

Property Income

Building Taxable capital gains

Land: Taxable capital gains

Taxable Capital Gains

$

0

S

0

Net Income for Tax purposes

Prev

2 of 4

#

Next >

Return to

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT