FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

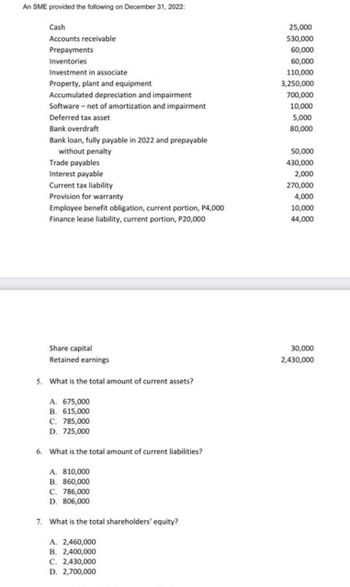

Transcribed Image Text:An SME provided the following on December 31, 2022:

Cash

Accounts receivable

Prepayments

Inventories

Investment in associate

Property, plant and equipment

Accumulated depreciation and impairment

Software - net of amortization and impairment

Deferred tax asset

Bank overdraft

Bank loan, fully payable in 2022 and prepayable

without penalty

Trade payables

Interest payable

Current tax liability

Provision for warranty.

Employee benefit obligation, current portion, P4,000

Finance lease liability, current portion, P20,000

Share capital

Retained earnings

5. What is the total amount of current assets?

A. 675,000

B. 615,000

C. 785,000

D. 725,000

6. What is the total amount of current liabilities?

A. 810,000

B. 860,000

C. 786,000

D. 806,000

7. What is the total shareholders' equity?

A. 2,460,000

B. 2,400,000

C. 2,430,000

D. 2,700,000

25,000

530,000

60,000

60,000

110,000

3,250,000

700,000

10,000

5,000

80,000

50,000

430,000

2,000

270,000

4,000

10,000

44,000

30,000

2,430,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Problem 2-15 (AICPA Adapted) Brite Company provided the following data on December 31, 2021: 550,000 4,000,000 350,000 450,000 250,000 5,000,000 The contingent liability is an accrual for possible loss on a Accounts payable Note payable, 8% unsecured, due July 1, 2023 Accrued expenses Contingent liability Deferred tax biability Bonds payable, 7%, due December 31, 2022 Premium on bonds payable nces 900,00 400,00 200,00 400,00 500,00 900,00 600,00 500,000 P1,000,000 lawsuit filed against the entity. The deferred tax liability is not related to an asset for financial reporting and is expected to reverse in 2022. When total amount should be reported as current liabilities on December 31, 2021? porte! a. 4,900,000 b. 5,350,000 c. 6,400,000 d. 6,850,000 63arrow_forwardvroll taxes LO 4 layed below.} at Lukancic Inc., the firm's accountant neglected to ayrolls for the year then ended. that should have been made as of March 31, 2019. Indicate the to indicate a negative financial statement effect.) Answer is not complete. Income Statement Stockholders' Equity ties Net Income Revenues (6,370) Cash 6,370 Xarrow_forwardPROBLEM 3 The following information was extracted from the records of Aloha Company on December 31, 2021:Carrying amount Tax baseAccounts receivable P 1,500,000 P 1,750,000Motor vehicle 1,650,000 1,250,000Provision for warranty 120,000 NilDeposits received in advance 150,000 NilThe depreciation rates for accounting and taxation are 15% and 25% respectively. The deposits are taxable when received and warranty costs are deductible when paid. An allowance for doubtful accounts of P250,000 has been raised against accounts receivable for accounting purposes but such accounts are deductible only when written off as uncollectible. Alpha Company showed net income of P8,000,000 in its 2021 income statement. There are no temporary differences at the beginning of the current year. The tax rate is 30%. a. Determine the deferred tax liability on December 31, 2021. b.Determine the deferred tax asset on December 31, 2021. c. Determine the current income tax expense.arrow_forward

- rmn.2arrow_forwardProblem 1-2 (IAA) Easy Company provided the following information on December 31, 2020: Notes payable: Trade Bank loans Advances from officers Accounts payable - trade Bank overdraft Dividends payable Withholding tax payable Mortgage payable Income tax payable Estimated warranty liability Estimated damages payable by reason of breach of contract Accrued liabilities Estimated premium liability Claim for increase in wages by employees covered in a pending lawsuit Contract entered into for the construction of building 3,000,000 2,000,000 500,000 4,000,000 300,000 1,000,000 100,000 3,800,000 800,000 600,000 700,000 900,000 200,000 3,500,000 5,000,000 Required: Compute the total current liabilities on December 31, 2020.arrow_forwardInstructions Labels and Amount Descriptions Labels The information below was taken from the records of the Piper Company for the year ended Financing Activities December 31, 2020: Investing Activities Operating Activities Acquisition of building $250,000 Amount Descriptions Amortization of premium on bonds payable 2,000 Amortization of premium on bonds payable Decrease in deferred income tax liability 8,000 Acquisition of building Decrease in inventories 6,000 Cash, January 1, 2020 Decrease in salaries payable 2,000 Cash, December 31, 2020 Depreciation expense 24,000 Converted bonds to preferred stocks Dividends paid 11,000 Depreciation expense Loss on sale of land 18,000 Decrease in inventories Increase in accounts payable 14,000 Decrease in deferred income tax liability Increase in accounts receivable 5,000 Decrease in salaries payable Issuance of long-term bonds payable 150,000 Increase in accounts payable Net income 240,000 Increase in accounts receivable Patent amortization…arrow_forward

- Finance Assume that Tim Corporation has 2020 taxable income of $240,000 for purposes of computing the $179 expense. It acquired the following assets in 2020: (Use MACRS Table 1, Table 2, Table 3, Table 4 and Table 5.) ASSET PURCHASE DATE BASIS Furniture (7-year) December 1$ 450,000 Computer equipment (5-year) February 28 $90,000 Copier (5-year) July 15 $30,000 Machinery (7-year) May 22 480,000 Total $ 1,050,000 c. What would Tim's maximum depreciation expense deduction be for 2020 if the machinery cost $3,500,000 instead of 480,000 and assuming no bonus depreciation?arrow_forwardInterest payable 79,000 Show how the above accounts should be presented on the December 31, 2020, balance sheet, including the proper classif (Enter account name only and do not provide descriptive information.) V Kingbird Corporation Balance Sheet (Partial) $ $arrow_forwardGeneral Computers Inc. purchased a computer server by taking a loan of $35,000 at 4.50% compounded semi-annually. It made payments of $2,950 at the end of every half-year to settle the loan. a. How many payments are required to settle the loan?arrow_forward

- Accrued Expenses: Entity D acquired a piece of land on April 1, 20x1. The purchase price was reduced by a credit for the real property taxes accrued during the year. Entity D records real property taxes at each month-end by adjusting the prepaid tax or tax payable account as appropriate On May 1, 20x1 Entity D paid the first of two equal installments of P72,000 for real property taxes. Requirement: What is the entry to record the payment on May 1?arrow_forwardProblem 2-15 (AICPA Adapted) Brite Company provided the following data on December 31, 2020: Accounts payable Note payable, 8% unsecured, due July 1, 2021 Accrued expenses Contingent liability Deferred tax liability Bonds payable, 7%, due March 31, 2021 Premium on bonds payable 550,000 4,000,000 350,000 450,000 250,000 5,000,000 500,000 The contingent liability is an accrual for possible loss on a P1,000,000 lawsuit filed against the entity. The deferred tax liability is not related to an asset for financial reporting and is expected to reverse in 2021. When total amount should be reported as current liabilities on December 31, 2020? a. 10,350,000 b. 10,150,000 c. 10,400,000 d. 10,950,000arrow_forwardI need help with this question for accounting.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education