FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Current Attempt in Progress

Sheffield Corp. purchased for $8,719,200 a mine that is estimated to have 48,440,000 tons of ore and no salvage value. In the first

year, 8,350,000 tons of ore are extracted.

(a1)

Your answer is correct.

Calculate depletion cost per unit. (Round answer to 2 decimal places, e.g. 0.50.)

Depletion cost per unit

.18 per ton

eTextbook and Media

List of Accounts

Attempts: unlimited

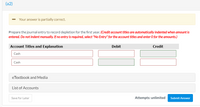

Transcribed Image Text:(a2)

Your answer is partially correct.

Prepare the journal entry to record depletion for the first year. (Credit account titles are automatically indented when amount is

entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.)

Account Titles and Explanation

Debit

Credit

Cash

Cash

eTextbook and Media

List of Accounts

Save for Later

Attempts: unlimited

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following are the job cost related accounts for the law firm of Cullumber Associates and their manufacturing equivalents: Law Firm Accounts Supplies Salaries and Wages Payable Operating Overhead Service Contracts in Process Cost of Completed Service Contracts Cost data for the month of March follow. 1. 2. 3. 4. 5. 6. Manufacturing Firm Accounts Raw Materials Factory Wages Payable Manufacturing Overhead Work in Process Cost of Goods Sold Purchased supplies on account $2,400. Issued supplies $1,680 (60% direct and 40% indirect). Assigned labor costs based on time cards for the month which indicated labor costs of $89,600 (80% direct and 20% indirect). Operating overhead costs incurred for cash totaled $51,200. Operating overhead is applied at a rate of 90% of direct labor cost. Work completed totaled $96,000.arrow_forwardDo not give answer in imagearrow_forwardThe intangible assets section of Riverbed Company at December 31, 2022, is presented here. Patents ($70,000 cost less $7,000 amortization) Franchises ($44,800 cost less $17,920 amortization) Total Jan. 2 Sept. 1 The patent was acquired in January 2022 and has a useful life of 10 years. The franchise was acquired in January 2019 and also has a useful life of 10 years. The following cash transactions may have affected intangible assets during 2023. Oct. 1 $63,000 Nov.- Dec. 26,880 $89,880 Paid $21,600 legal costs to successfully defend the patent against infringement by another company. Paid $50,000 to an extremely large defensive lineman to appear in commercials advertising the company's products. The commercials aired in September and October. Acquired a franchise for $111,600. The franchise has a useful life of 50 years. Developed a new product, incurring $145,000 in research and development costs during December. A patent was granted for the product on January 1, 2024.arrow_forward

- (b) To record estimated liability. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) Period 1 Account Titles and Explanation Period 2 Account Titles and Explanation Save for Later Debit Debit Credit Credit Attempts: 0 of 1 used Submit Answerarrow_forwardPharoah Stores is a new company that started operations on March 1, 2024. The company has decided to use a perpetual inventory system. The following purchase transactions occurred in March: Pharoah Stores purchases $9,200 of merchandise for resale from Octagon Wholesalers, terms 2/10, n/30, FOB shipping point. Mar. 1 2 The correct company pays $140 for the shipping charges. 3 21 22 23 30 31 Pharoah returns $1,100 of the merchandise purchased on March 1 because it was the wrong colour. Octagon gives Pharoah a $1,100 credit on its account. Pharoah Stores purchases an additional $11,500 of merchandise for resale from Octagon Wholesalers, terms 2/10, n/30, FOB destination. The correct company pays $160 for freight charges. Pharoah returns $500 of the merchandise purchased on March 21 because it was damaged. Octagon gives Pharoah a $500 credit on its account. Pharoah paid Octagon the amount owing for the merchandise purchased on March 1. Pharoah paid Octagon the amount owing for the…arrow_forwardYour new company paid the invoice for their account with Alli's Broom Supply Company. What would your journal entry look like when you record this transaction? a) Debit Cash; Credit Accounts Payable b) Debit Cash; Credit Supplies Expense c) Debit Accounts Receivable; Credit Cash d) Debit Accounts Payable; Credit Casharrow_forward

- H1.arrow_forwardOn July 15, 2024, the Niche Car Company purchased 2,800 tires from the Treadwell Company for $35 each. The terms of the sale were 2/10, ¹/30 . Niche uses a perpetual inventory system and the net method of accounting for purchase discounts.arrow_forwardA £500 cash sale was entered as a debit in the sales account and a credit in the bank account. What type of error is this? Select one: A. Compensating B. Ommission C. Reversal of entries O D. Original entry E. Commission O F. Principlearrow_forward

- If a $335.00 debit item in the general journal is posted as a credit: By how much will the trial balance be out of balance? Explain how you might detect such an error.arrow_forwardUsing the Allowance method supply the journal entries to bring back the written off Account Receivable and the payment for it. Direct Write Off Method Allowance Method Bad debt expense $500 Allowance for doubtful accounts $500 Accounts Receivable $500 Accounts Receivable $500arrow_forwardSuppose a co-worker has recorded a cash disbursement twice (Supplies Expense was debited twice for $100 and Cash was credited twice for $100) and wants you to record a correcting entry that will reverse the mistake. The correcting entry will record a debit to the Cash account and a credit to the Supplies account. Would you make this correcting entry? What should you investigate before making a decision about the correcting entry? Are there any other steps you would take to address this issue?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education