FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

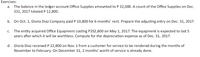

Transcribed Image Text:Exercises:

а.

The balance in the ledger account Office Supplies amounted to P 32,000. A count of the Office Supplies on Dec.

331, 2017 totaled P 12,800.

b. On Oct. 1, Gloria Diaz Company paid P 10,800 for 6-months' rent. Prepare the adjusting entry on Dec. 31, 2017.

The entity acquired Office Equipment costing P352,800 on May 1, 2017. The equipment is expected to last 5

years after which it will be worthless. Compute for the depreciation expense as of Dec. 31, 2017.

С.

d. Gloria Diaz received P 22,800 on Nov. 1 from a customer for service to be rendered during the months of

November to February. On December 31, 2 months' worth of service is already done.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- R&B Electrical began operations on 1/1/2017. Their annual reporting period ends 12/31. The trial balance on 1/1/2019 follows: Account title Debit Credit Cash 6,000 Accounts receivable 6,000 Allowance for uncollectable accounts 1,000 Supplies 13,000 Materials 7,000 Equipment 78,000 Accumulated Depreciation 8,000 Land Accounts payable Wages payable Interest payable Income taxes payable Long-term notes payable Common stock (8,000 shares, $0.50 par value 4,000 Additional paid-in capital 80,000 Retained earnings 17,000 Service revenue Wages expense Supplies expense Bad debt expense Interest expense Depreciation expense Income tax expense Misc. expenses Totals 110,000 110,000 Create an adjusted trial…arrow_forwardA business has the following balances at the beginning of the year: Accounts receivable: 235000 Allowance for doubtful accounts: -15250The following summary transactions occurred during the year.Sales for the year, 100% on credit: 450000Cash collected on accounts receivable for the year: 445200Write-offs of uncollectable accounts receivable : 28200Received a cheque from a customer whose account was previously written off: 2820The overall rate used to estimate the allowance for doubtful accounts at year end: 8%Using the information above, answer the following questions.What is the balance in the accounts receivable account at year end? 1. What is the balance in the accounts receivable account at year end? 2. What is the balance in the allowance for doubtful accounts at year end? 3. What is the balance in the bad debt expense account at year end?arrow_forwardBenwick Company borrowed $56,000 cash on October 1, 2022, and signed a nine-month, 9% interest-bearing note payable with interest payable at maturity. Assuming that adjusting entries have not been made during the year, the amount of accrued interest payable to be reported on the December 31, 2022 balance sheet is which of the following? Group of answer choices $630. $756. $1,260. $1,890.arrow_forward

- During the course of your examination of the financial statements of the Hales Corporation for the year endedDecember 31, 2016, you discover the following:a. An insurance policy covering three years was purchased on January 1, 2016, for $6,000. The entire amountwas debited to insurance expense and no adjusting entry was recorded for this item.b. During 2016, the company received a $1,000 cash advance from a customer for merchandise to be manufacturedand shipped in 2017. The $1,000 was credited to sales revenue. No entry was recorded for the cost ofmerchandise.c. There were no supplies listed in the balance sheet under assets. However, you discover that supplies costing$750 were on hand at December 31.d. Hales borrowed $20,000 from a local bank on October 1, 2016. Principal and interest at 12% will be paid onSeptember 30, 2017. No accrual was recorded for interest.e. Net income reported in the 2016 income statement is $30,000 before reflecting any of the above items.Required:Determine…arrow_forwardThe following transactions occurred during December 31, 2021, for the Microchip Company. On October 1, 2021, Microchip lent $90,000 to another company. A note was signed with principal and 8% interest to be paid on September 30, 2022. On November 1, 2021, the company paid its landlord $6,000 representing rent for the months of November through January. Prepaid rent was debited. On August 1, 2021, collected $12,000 in advance rent from another company that is renting a portion of Microchip’s factory. The $12,000 represents one year’s rent and the entire amount was credited to deferred rent revenue. Depreciation on office equipment is $4,500 for the year. Vacation pay for the year that had been earned by employees but not paid to them or recorded is $8,000. The company records vacation pay as salaries expense. Microchip began the year with $2,000 in its asset account, supplies. During the year, $6,500 in supplies were purchased and debited to supplies. At year-end, supplies costing…arrow_forwardGwynn Incorporated had the following transactions involving current assets and current liabilities during February 2017 Additional information: As of February 1, 2017, current assets were $120,000 and current liabilities were $40,000. Instructions Compute the current ratio as of the beginning of the month and after each transactionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education