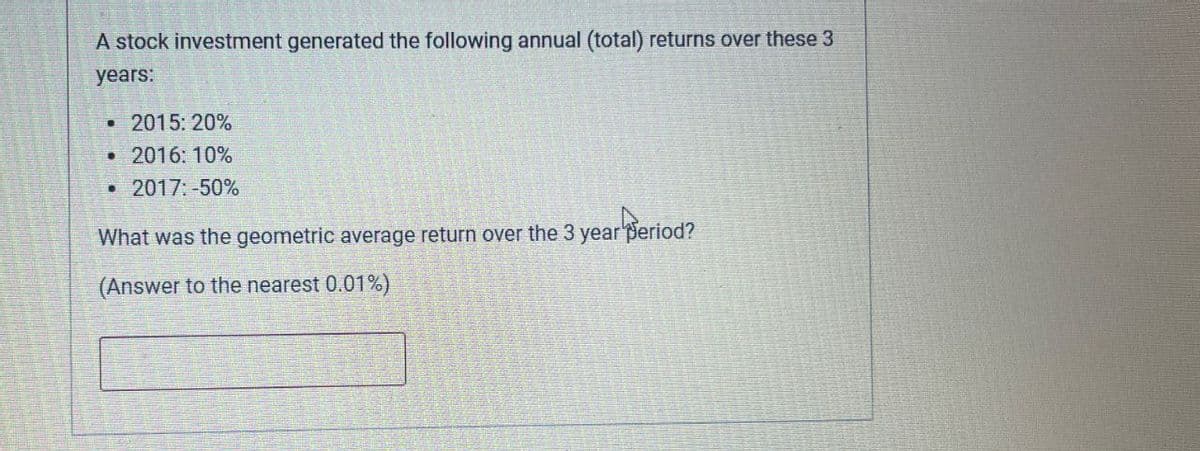

A stock investment generated the following annual (total) returns over these 3 years: • 2015: 20% • 2016: 10% ⚫ 2017: -50% What was the geometric average return over the 3 year Period? (Answer to the nearest 0.01%)

Q: Under the NBA deferred compensation plan, payments made at the end of each year accumulate up to…

A: Time value of money is a financial concept which is used to analyze various investments and…

Q: Prepare an amortization schedule for a three-year loan of $63,000. The interest rate is 10 percent…

A: The problem case wants to create the loan amortization schedule for the loan that is to be repaid in…

Q: Consider four different stocks, all of which have a required return of 18 percent and a most recent…

A: Here,Current Dividend is $3.55Required Return is 18%

Q: You want to buy a $215,000 home. You plan to pay 5% as a down payment, and take out a 30 year loan…

A: The loan amount represents the money borrowed from a lender, whereas the monthly payment encompasses…

Q: Problem 7-4 Bond Yields [LO2] A Japanese company has a bond outstanding that sells for 94 percent of…

A: Price of the bond at time 0 = 94,000 (i.e. 100,000 * 94%)Annual coupon payment = 5300Maturity period…

Q: Megan Ross holds the following portfolio: Stock Investment Beta A $150,000 1.40…

A: The portfolio's beta is approximately `1.17`.Explanation:Certainly. The calculation of the…

Q: a. Calculate the payback period. (Do not round intermediate calculations and round your answer to 3…

A: Internal Rate of Return (IRR) : It is used the company wants to decide whether to accept the…

Q: Quimby Corp. purchased ten $1,000 7% bonds of Circuit Corporation when the market rate of interest…

A: Face value or maturity value = Z = $1,000Semiannual coupon amount = C = $35 (i.e. $1000 * 0.07 /…

Q: You work as a loan officer for Auburn Bank. A couple has financed their mortgage with your bank. The…

A: To compute the amount of loan we can use PV(rate, nper, pmt) function of excel and value of the loan…

Q: Assume that the risk-free rate is 5%. Which of the following statements is CORRECT? a. If a…

A: The objective of the question is to identify the correct statement about the relationship between a…

Q: 9 eBook References Gaston Company is considering a capital budgeting project that would require a…

A: Net present value refers to the capital budgeting technique helps to evaluate the profitability and…

Q: We are evaluating a project that costs $520,000, has a life of 6 years, and has no salvage value.…

A: Initial investment = $520,000Life = 6 yearsUnit sales = 73,000 UnitsSelling price per unit = $45…

Q: An insurance company is offering a new policy to its customers. Typically the policy is bought by a…

A: To calculate the present value of the deposits when the policy matures, we need to discount each…

Q: should the project be accepted

A: )The appropriate discount rate will be 15.15%2) Initial investment will be 321000003) Earnings…

Q: What is the profitability index of a project that costs $8,000 and provides cash flows of $2,400 in…

A: The relationship between cash inflows and outflows at their current values is known as the…

Q: Portfolio Beta Your retirement fund consists of a $7,000 investment in each of 12 different common…

A: New portfolio's beta = 1.59Explanation:Step 1: Calculate the initial portfolio's weighted average…

Q: Wontaby Ltd. is extending its credit terms from 30 to 45 days. Sales are expected to increase from…

A: Annual financing cost is the annual expense of borrowing funds that the company incurs on a periodic…

Q: Using the following information, what is the cost to lease a car? (Assume there are no charges for…

A: Variables in the question:Monthly lease payment=$300 per month for a five year leaseOpportunity cost…

Q: If the current rate of interest is 10% and interest is compounded semiannually, what is the present…

A: Compound = Semiannually = 2Interest Rate = r = 10 / 2 = 5%Future Value = fv = $10,000Time = t = 7 *…

Q: Which of the following cash flows has the highest future value? A. $1000 invested for two years in…

A: Option a.Option b.Option c.Option d.Amount invested$1,000$1,000$1,000$1,000Interest…

Q: You are the loan department supervisor for a bank. This installment loan is being paid off early,…

A: Finance charge rebate:A finance charge rebate refers to a reimbursement or credit provided to a…

Q: Which of the following statements is CORRECT? (Assume that the risk-free rate is a constant.) a.…

A: The objective of the question is to identify the correct statement about the effect of a change in…

Q: Royal Company holds a loan with an interest rate of 7.00% compounded semi-annually. Calculate the…

A: Effective interest rate also known as the annual equivalent rate, is an interest rate on a loan or…

Q: How much would you have to invest today to receive: Use Appendix B and Appendix D. (Round "PV…

A: Present value is the equivalent value of money today based on the time value of money that is going…

Q: For project A, the cash flow effect from the change in net working capital is expected to be $490.00…

A: Answer: None of the above is within $10 of the correct answer (but the closest option is $1,360.00).…

Q: beatrice invest 1350 $ in an account that pays 4 percent simple interest how much more could she…

A: Simple interest future balance and compound interest future balance are calculated using the…

Q: Compute the appropriate rate for discounting the cash flows of the project 2. Compute the initial…

A: A new project that Rare Agri-Products Ltd. is thinking about might last seven (7) years. The project…

Q: Carl is the beneficiary of a $ 20,000 trust fund set up for him by his grandparents. Under the terms…

A: Present Value =$20,000Period = 5 yearsInterest rate = 5% per annum compouned annually

Q: President Joe Biden signed the $1. 9 trillion. stimulus into law. Eligible individuals would receive…

A: Maturity of a simple discount note is given by the formula as follows,.Our time is equal to 1 full…

Q: Amanda Rice has just arranged to purchase a $540,000 vacation home in the Bahamas with a 30 percent…

A: Balloon payment refers to a payment of huge amount that is paid at end of the loan at one time which…

Q: 1. Answer the below questions for bond A. Bond A Coupon 8% Yield to maturity 10% Maturity (years) 10…

A: Coupon rate = 8%Yield to maturity = 10% Maturity = 10 yearsPar value = $100Bond price = $87.5378To…

Q: At the annual family barbeque, your Uncle John told you that he deposited $50,000 in a bank account.…

A: Inflation is increase in prices over the period and due to this there is decrease in purchasing…

Q: Duo Corporation is evaluating a project with the following cash flows: Year Cash Flow -$ 30,000…

A: MIRR stands for modified internal rate of return. It should be higher than the cost of capital to…

Q: coupons. If you require a return of 3.50% on this instrument, how much would you offer to pay for it…

A: The price at which a bond is currently traded on the market is its market value. It represents the…

Q: You would like to have $6,000.00 in 11 years for a special vacation following graduation by making…

A: Variables in the question:FV=$6000N=11 yearsRate=5.7% (compounded quarterly)

Q: Help Chancellor Limited sells an asset with a $3.0 million fair value to Sophie Incorporated. Sophie…

A: Sale value (S) = $3,000,000Interest rate (r) = 0.06Number of payments (n) = 6Annual payment = ?Since…

Q: outhern Power just paid an annual dividend of $7.7 per share. Because of increasing competition from…

A: Value of the stock can be determined by discounting the series of earnings or dividends with the…

Q: Suppose a ten-year, $ 1 comma 000$1,000 bond with an 8.9 % 8.9% coupon rate and semiannual coupons…

A: Bonds are financial instruments through which corporations, governments, and other entities borrow…

Q: You want to buy a house and will need to borrow $210,000 the interest rate in your loan is 5.35…

A: Present Value of Borrowing (PV) = $210,000Annual interest rate = 5.35%Monthly rate (r) = 5.35% / 12…

Q: Marin Corporation issued $470,400 of 7% bonds on November 1, 2025, for $499,520. The bonds were…

A: Par value of the bonds issued = $470,400Issue price of the bonds = $499,520Stated interest rate =…

Q: You have just purchased a new warehouse. To finance the purchase, you've arranged for a 25-year…

A: APR is the Annual Percentage Rate refers to the percentage of financial charges and fees charged on…

Q: you are paying of a purchase made with a down payment of 50000 usd. you will pay the rest of 245000…

A: Interest Rate = (Total Interest / Principal) / (1 / Number of Periods) 100Principal= $245,000Total…

Q: Consider a project to supply Detroit with 20,000 tons of machine screws annually for automobile…

A: Net present value is computed by deducting the initial cost from the current value of cash flows. It…

Q: stock has just paid the last dividend at $2.5 per share. Its dividenc st year? a. Dividend…

A: Given Details:Dividend paid = $ 2.5 per shareGrowth rate = 6%Stock Return = 11%Dividend Yield…

Q: A company plans to purchase a computer network control (CNC) machine for $650,000.00. If the company…

A: Future Value refers to the compounded value of the future cash flows at a interest rate for a given…

Q: 6. You are obligated to pay $10,000 in a year. There are two bonds with the following information…

A: The objective of the question is to construct a portfolio of bonds A and B using the immunization…

Q: Parker & Stone, Incorporated, is looking at setting up a new manufacturing plant in South Park to…

A: Initial Investment cash flow amount includes all costs that are required to establish a working or…

Q: McKernan Inc. imposes a payback cutoff of three years for its international investment projects. The…

A: The payback period measures how quickly an investment recoups its initial cost through generated…

Q: A Company is considering a proposal of installing a drying equipment. The equipment would involve a…

A: The Payback Period tracks the duration for an investment to recover its initial cost, while the…

Q: Dave borrowed $1,300 on January 1, 2022. The bank charged him a $5.00 service charge, and interest…

A: When a borrower takes out a loan from a lender, they are required to pay interest on the borrowed…

Step by step

Solved in 3 steps with 2 images

- Using the Value Line Investment Survey report in Exhibit 11.5, find the following information for Apple. What was the amount of revenues (i.e., sales) generated by the company in 2017? What were the latest annual dividends per share and dividend yield? What is the earnings per share (EPS) projection for 2019? How many shares of common stock were outstanding? What were the book value per share and EPS in 2017? How much long-term debt did the company have in the third quarter of 2018?CALCULATING THE WACC Here is the condensed 2019 balance sheet for Skye Computer Company (in thousands of dollars): Skyes earnings per share last year were 3.20. The common stock sells for 55.00. last years dividend (D0) was 2.10, and a flotation cost of 10% would be required to sell new common stock. Security analysts are projecting that the common dividend will grow at an annual rate of 9%. Skyes preferred stock pays a dividend of 3.30 per share, and its preferred stock sells for 30.00 per share. The firms before-lax cost of debt is 10%, and its marginal tax rate is 25%. The firms currently outstanding 10% annual coupon rate, long-term debt sells at par value. The market risk premium is 5%, the risk-free rate is 6%, and Skyes beta is 1.516. The firms total debt, which is the sum of the companys short-term debt and long-term debt, equals 1.2 million. a. Calculate the cost of each capital component, that is, the after-tax cost of debt, the cost of preferred stock, the cost of equity from retained earnings, and the cost of newly issued common stock. Use the DCF method to find the cost of common equity. b. Now calculate the cost of common equity from retained earnings, using the CAPM method. c. What is the cost of new common stock based on the CAPM? (Hint: Find the difference between r1 and rs as determined by the DCF method, and add that differential to the CAPM value for rs.) d. If Skye continues to use the same market-value capital structure, what is the firms WACC assuming that (1) it uses only retained earnings for equity and (2) if it expands so rapidly that it must issue new common stock?During the period from 2011 through 2015 the annual returns on small U.S. stocks were -3.76 percent, 18.79 percent, 46.82 percent, 3.39 percent, and -3.40 percent, respectively.What would a $1 investment, made at the beginning of 2011, have been worth at the end of 2015? (Round answer to 3 decimal places, e.g. 52.750.) Value in 2015 $enter a dollar amount of the investment at the end of 2015 rounded to 3 decimal places What average annual return would have been earned on this investment? (Round answer to 2 decimal places, e.g. 52.75.) Average annual return enter the average annual return per year rounded to 2 decimal places percent per year.

- You inverted $10,000 in a large U.S. stocks at the beginning of 2016 and earned 6% in 2016, 2.0% in 2017, 4.5% in 2018, and 1.6% in 2019. What average return did you earn during the 2016-2019 period?Returns for the Alcoff Company over the last 3 years are shown below. What's the standard deviation of the firm's returns? Year Return2010 21.00%2009 −12.50%2008 25.00%a. RAK Ceramic is currently paying dividend Tk. 3.70 per share, which is expected to grow at aconstant rate per year. Investors required rate of return is 18 percent. Calculate the price of the stockbased on average growth of the stock, and justify your findings to take stock investment decisions.(CMP=77.50 Tk.)Year Dividend per share Growth rate2014 3.25 Tk.2015 3.65 Tk.2016 3.95 Tk.2017 4.25 Tk.2018 5.30 Tk.2019 4.40 Tk.b. Explain different types of common stocks with basic features in light of BD stock market and majorchallenges of DSE to build up investors’ confidence.c. Briefly explain the steps in capital budgeting decision making process with constraints ofimplementation stage.

- During the last four years, you owned two stocks that have had the following annual rates of return. Year KEX KW 2014 0.13 -0.08 2015 0.05 0.21 2016 0.07 0.06 2017 0.09 0.15 Compute the arithmetic mean annual return for EACH stock Compute the standard deviation of the annual rate of return for EACH stock Taking the results of (i) and (ii) into consideration, which stock is preferable? Why? Compute the geometric mean annual return for EACH stockCampbell Supper Co. paid a $0.672 dividend per share in 2013, which grew to $0.82 in 2016. This growth is expected to continue.What is the value of this stock at the beginning of 2017 when the required return is 8.4 percent? (Round the growth rate, g, to 4 decimal places. Round your final answer to 2 decimal places.) Stock value _____.__The realized return of Talkie share and Stock M for the past 5 years are detailed below:Year Talkie Stock M2020 15% 30%2019 5% 7%2018 -5% -3%2017 2% -8%2016 9% 20% Compute the arithmetic mean and standard deviation of returns over the past 5 years for each stock?

- The stock of Z-Tech Plc is currently selling for £10 per share. Earnings per share in the coming year are expected to be £1.50. The company has a policy of paying out 20% of its earnings each year in dividends. The rest is retained and invested in projects that earn a 7% internal rate of return per year. This situation is expected to continue indefinitely. a. Assuming the current market price of the stock reflects its intrinsic value as computed using the constant-growth DDM, what rate of return do Z-Tech’s investors require? b. By how much does Z-Tech’s stock price change if all its earnings are paid as dividends and nothing is reinvested? c. If the company were to increase its dividend payout ratio from 20% to 60%, what would happen to its stock price?a.RAK Ceramic is currently paying dividend Tk. 4.40 per share, which is expected to grow at a constant rate per year. Investors required rate of return is 15 percent. Calculate the price of the stock based on average growth of the stock, and justify your findings to take stock investment decisions.(CMP=77.50 Tk.) year devident groth rate 2014 3.25 TK. 2015 3.65 TK. 2016 3.95 TK. 2017 4.25 TK. 2018 5.30 TK 2019 4.40 TK b. Explain different types of common stocks with basic features in light of BD stock market and majorchallenges of DSEc. Briefly explain the steps in capital budgeting decision making process with constraints of mplementation stage.Assume that the required return for Four Season's stock is 12 percent, and the company has paid the following dividends. Under the constant growth model valuation, what is the value of Four Season's stock? Year Dividend per share 2020 $1.32 2019 $1.21 2018 $1.16 2017 $1.12 a. $21.82 b. $11.00 c. $15.11 d. $19.80