What is the tax revenue using the graph?

A market is a place where the buyers and the sellers interact with each other and the exchange of goods and services takes place between them at a mutually agreed price level. The price level in the market will be determined at the intersection of the demand and supply curves in the economy and this point of intersection is known as the point of equilibrium and the price and quantity corresponding to this point of equilibrium are known as the equilibrium price and equilibrium quantity.

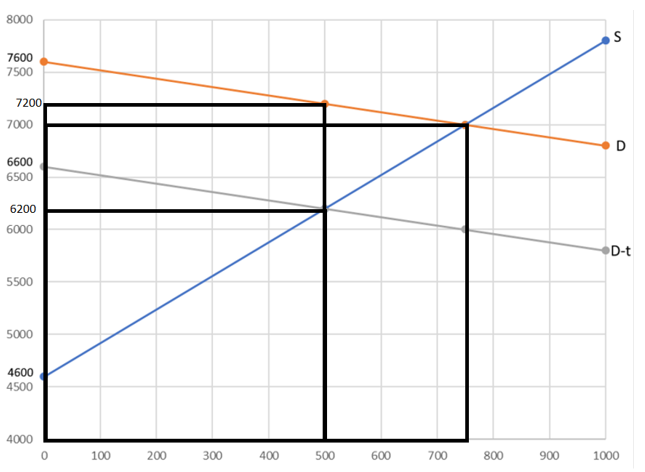

In this case, the tax levied on the consumers will generate tax revenue for the government. The new equilibrium price is identified to be at $6.200. The tax rate is $1,000 which is the difference between the parallel demand curves. The market condition can be illustrated as follows:

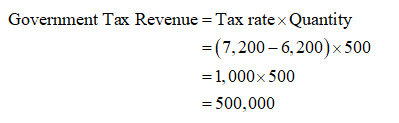

The new quantity is identified to be 500 and the total government revenue can be calculated by multiplying the difference in price with the quantity as follows:

Step by step

Solved in 3 steps with 3 images