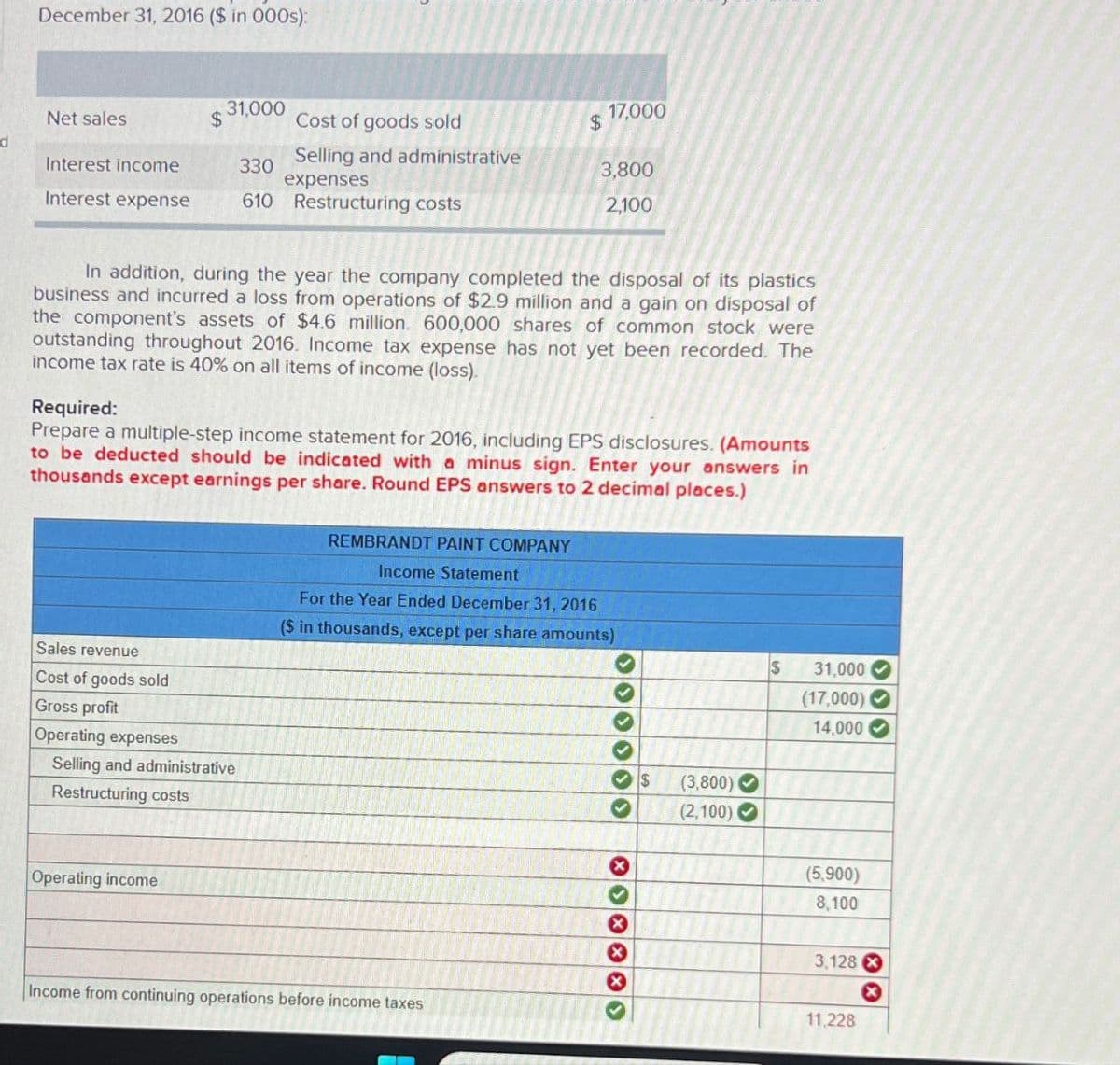

31,000 17,000 Net sales $ Cost of goods sold $ Selling and administrative Interest income 330 expenses Interest expense 610 Restructuring costs 3,800 2,100 In addition, during the year the company completed the disposal of its plastics business and incurred a loss from operations of $2.9 million and a gain on disposal of the component's assets of $4.6 million. 600,000 shares of common stock were outstanding throughout 2016. Income tax expense has not yet been recorded. The income tax rate is 40% on all items of income (loss). Required: Prepare a multiple-step income statement for 2016, including EPS disclosures. (Amounts to be deducted should be indicated with a minus sign. Enter your answers in thousands except earnings per share. Round EPS answers to 2 decimal places.)

31,000 17,000 Net sales $ Cost of goods sold $ Selling and administrative Interest income 330 expenses Interest expense 610 Restructuring costs 3,800 2,100 In addition, during the year the company completed the disposal of its plastics business and incurred a loss from operations of $2.9 million and a gain on disposal of the component's assets of $4.6 million. 600,000 shares of common stock were outstanding throughout 2016. Income tax expense has not yet been recorded. The income tax rate is 40% on all items of income (loss). Required: Prepare a multiple-step income statement for 2016, including EPS disclosures. (Amounts to be deducted should be indicated with a minus sign. Enter your answers in thousands except earnings per share. Round EPS answers to 2 decimal places.)

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 9P: LIFO Liquidation Profit Hammond Company adopted LIFO when it was formed on January 1, 2017. Since...

Related questions

Question

Transcribed Image Text:December 31, 2016 ($ in 000s):

31,000

17,000

Net sales

$

Cost of goods sold

$

d

Interest income

Selling and administrative

330

3,800

expenses

Interest expense

610 Restructuring costs

2,100

In addition, during the year the company completed the disposal of its plastics

business and incurred a loss from operations of $2.9 million and a gain on disposal of

the component's assets of $4.6 million. 600,000 shares of common stock were

outstanding throughout 2016. Income tax expense has not yet been recorded. The

income tax rate is 40% on all items of income (loss).

Required:

Prepare a multiple-step income statement for 2016, including EPS disclosures. (Amounts

to be deducted should be indicated with a minus sign. Enter your answers in

thousands except earnings per share. Round EPS answers to 2 decimal places.)

Sales revenue

Cost of goods sold

Gross profit

Operating expenses

Selling and administrative

Restructuring costs

Operating income

REMBRANDT PAINT COMPANY

Income Statement

For the Year Ended December 31, 2016

($ in thousands, except per share amounts)

$

31,000

(17,000)

14,000

$

(3,800)

(2,100)

(5,900)

8,100

3,128

Income from continuing operations before income taxes

11,228

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning