FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

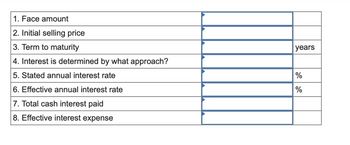

Transcribed Image Text:1. Face amount

2. Initial selling price

3. Term to maturity

4. Interest is determined by what approach?

5. Stated annual interest rate

6. Effective annual interest rate

7. Total cash interest paid

8. Effective interest expense

years

%

%

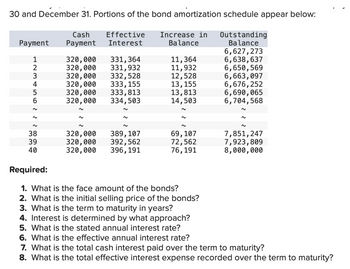

Transcribed Image Text:30 and December 31. Portions of the bond amortization schedule appear below:

Payment

Cash

Payment Interest

Effective

Increase in

Balance

Outstanding

Balance

6,627,273

12345622

320,000

331,364

11,364

6,638,637

320,000

331,932

11,932

6,650,569

320,000 332,528

12,528

6,663,097

320,000 333,155

13,155

6,676,252

320,000 333,813

13,813

6,690,065

320,000

334,503

14,503

6,704,568

~

~

38

320,000 389,107

69,107

7,851,247

39

40

320,000

392,562

72,562

320,000 396,191

76,191

7,923,809

8,000,000

Required:

1. What is the face amount of the bonds?

2. What is the initial selling price of the bonds?

3. What is the term to maturity in years?

4. Interest is determined by what approach?

5. What is the stated annual interest rate?

6. What is the effective annual interest rate?

7. What is the total cash interest paid over the term to maturity?

8. What is the total effective interest expense recorded over the term to maturity?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Exercise 14-15 Allocation of interest for bonds sold at a premium LO6 Tahoe Tent Ltd. issued bonds with a par value of $802,000 on January 1, 2020. The annual contract rate on the bonds was 13.00%, and the interest is paid semiannually. The bonds mature after three years. The annual market interest rate at the date of issuance was 11.00%, and the bonds were sold for $842,064. a. What is the amount of the original premium on these bonds? (Use financial calculator for calculating PV's. Round the final answer to the nearest whole dollar.) Premium b. How much total bond interest expense will be recognized over the life of these bonds? (Do not round intermediate calculations. Round the final answer to the nearest whole dollar.) Total interest expensearrow_forward1arrow_forwardRecord bond issue record the first semiannual interest payment record the second semiannual interest paymentarrow_forward

- On 31 December 20X7, Dunder Mifflin has the following bond on the statement of financial position: Bond payable, 8%, interest due semi-annually on 31 March and 30 September; maturity date, 30 September 20X10 $16,000,000 Discount on bonds payable (83,000) $15,917,000 Accrued interest payable of $400,000 was recorded on 31 December 20X7 ($16,000,000 × 10% × 3/12) and the bond discount was correctly amortized to 31 December 20X7. On 31 March 20X8, semi-annual interest was paid and the bond discount was amortized by a further $8,400. Then, 35% of the bond was retired at a cost of $5,488,000 (exclusive of interest). Required: Provide the entries to record the bond interest and retirement on 31 March 20X8.arrow_forward3arrow_forwardLopez Plastics Co. (LPC) issued callable bonds on January 1, 2021. LPC's accountant has projected the following amortizatic schedule from issuance until maturity: Cash Effective Decrease in Date Outstanding interest interest balance balance 1/1/2021 24 207,020 6/30/2021 2$ 7,000 $4 6,211 24 789 206,230 12/31/2021 7,000 6,187 813 205,417 6/30/2022 7,000 6,163 837 204,580 12/31/2022 7,000 6,137 863 203,717 6/30/2023 7,000 6,112 888 202,829 12/31/2023 7,000 6,085 915 201,913 943 200,971 6/30/2024 7,000 6,057 971 200,000 7,000 6,029 12/31/2024 LPC issued the bonds:arrow_forward

- 4. What is the carrying value of the bonds at the end of the second period (third number)? Premium 57,913.01 Carrying value (bonds) 432,913.01 Face Rate Market Rate Semiannual payments a. b. Cash Payment C. d. e. 14% 10% 0 or 1 2 or 3 4 or 5 6 or 7 8 or 9 Interest Expense Today Period #1 26,250.00 Period #2 26,250.00 Carrying value at end of second period (third number) ___________?__ 2. Disc. or Prem. Amort. 21,645.65 21,415.43 Disc. or Prem. 4,604.35 4,834.57 57,913.01 53,308.66 48,474.10 Face Value 375,000.00 375,000.00 375,000.00 Carrying Value 432,913.01 428,308.66 423,474.10arrow_forwardA $300,000 bond was redeemed at 104 when the carrying amount of the bond was $316,000. The entry to record the redemption would include a Oa. loss on bond redemption of $3,000 Ob. gain on bond redemption of $3,000 Oc. loss on bond redemption of $4,000 Od. gain on bond redemption of $4,000 7 a I' B in 20 D W 14 Previous Next ^04) Oarrow_forwardWhat is the correct choice? A $200,000 bond issue with a carrying value of $194,000 is called at 101 and retired. The entry to record the retirement of bonds is: a. Bonds Payable 200,000 Gain on Retirement of Bonds 6,000 Cash 194,000 b. Bonds Payable 200,000 Cash 200,000 c. Bonds Payable 200,000 Loss on Retirement of Bonds 8,000 Unamortised Bond Discount 6,000 Cash 202,000 d. Bonds Payable 194,000 Loss on Retirement of Bonds 8,000 Cash…arrow_forward

- Period Cash Paid Interest Expense Interest in Carrying Value Carrying Value Issue Date $85,940 1 $4,100 $ 3,438 $662 85,278 2 4,100 3,411 689 84,589 1. & 2. Record the bond issue assuming the face value of bonds payable is $79,000 and first interest payment. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) Record the bond issue. Event General Journal Debit Credit 1 Record the first interest payment. Event General Journal Debit Credit 2arrow_forward7arrow_forwardProblem 5-15 (AICPA Adapted) On July 1, 2020, Carol Company issued at 104, five thousand 10% bonds with face amount of P1,000 per bond. The bonds were issued through an underwriter to whom the entity paid bond issue cost of P125,000. On July 1, 2020, what is the carrying amount of the bonds payable? a. 4,875,000 b. 5,075,000 c. 5,200,000 d. 5,325,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education