FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

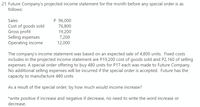

Transcribed Image Text:21. Future Company's projected income statement for the month before any special order is as

follows:

P 96,000

76,800

19,200

Sales

Cost of goods sold

Gross profit

Selling expenses

Operating income

7,200

12,000

The company's income statement was based on an expected sale of 4,800 units. Fixed costs

includes in the projected income statement are P19,200 cost of goods sold and P2,160 of selling

expenses. A special order offering to buy 480 units for P17 each was made to Future Company.

No additional selling expenses will be incurred if the special order is accepted. Future has the

capacity to manufacture 480 units

As a result of the special order, by how much would income increase?

*write positive if increase and negative if decrease, no need to write the word increase or

decrease.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The MER-92566 merchandising company reported the following information for last year: Amount $. 1,312,000 $ 410 $ 46 $ 18 $ 150,000 $ 105,000 $ 75,000 $ 115,000 $310,000 Sales Selling price per unit Variable selling expense per unit Variable administrative expense per unit Total fixed selling expense Total fixed administrative expense Beginning merchandise inventory Ending merchandise inventory Merchandise purchases The MER-92566 company's contribution margin per unit is closest to: (Carry out your calculations up to 2 decimal places) O $392 O $346 O $262 O $364arrow_forward5. A company has £8.00 per unit in variable production cost and £3.00 per unit in variable selling and administrative cost. The annual fixed production cost is £300,000. The annual fixed selling and administrative cost is £50,000. a. Complete the table below for the number of units and dollar value of ending inventory for each year. Assume a FIFO flow. Units Produced Units Sold Units in ending inventory Ending inventory using variable costing Ending inventory using full costing b. 2004 120,000 110,000 2005 150,000 120,000 2006 100,000 140,000 2007 100,000 100,000 Assume that the selling price and cost structure stayed the same over the 4-year period. How would the total income compare over the period between variable and full costing?arrow_forwardDetermine the amount of sales (units) that would be necessary under Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 108,000 units at a price of $66 per unit during the current year. Its income statement for the current year is as follows: Sales $7,128,000 Cost of goods sold 3,520,000 Gross profit $3,608,000 Expenses: Selling expenses $1,760,000 Administrative expenses 1,760,000 Total expenses 3,520,000 Income from operations $88,000 The division of costs between fixed and variable is as follows: Variable Fixed Cost of goods sold 70% 30% Selling expenses 75% 25% Administrative expenses 50% 50% Management is considering a plant expansion program that will permit an increase of $594,000 in yearly sales. The expansion will increase fixed costs by $59,400, but will not affect the relationship between sales and variable costs. Required: 1. Determine the…arrow_forward

- Please answer questions #2-7, Thank you!! :) Determine the amount of sales (units) that would be necessary under Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 90,450 units at a price of $48 per unit during the current year. Its income statement for the current year is as follows: Sales $4,341,600 Cost of goods sold 2,144,000 Gross profit $2,197,600 Expenses: Selling expenses $1,072,000 Administrative expenses 1,072,000 Total expenses 2,144,000 Income from operations $53,600 The division of costs between fixed and variable is as follows: Variable Fixed Cost of goods sold 70% 30% Selling expenses 75% 25% Administrative expenses 50% 50% Management is considering a plant expansion program that will permit an increase of $384,000 in yearly sales. The expansion will increase fixed costs by $38,400, but will not affect the relationship between sales and…arrow_forwardXYZ, Inc. reports the following information for November: Sales Revenue $800,000 Variable Cost of Goods Sold 110,000 Fixed Cost of Goods Sold 45,000 Variable Selling and Administrative Costs 100,000 Fixed Selling and Administrative Costs 70,000 Calculate the gross profit for November using absorption (traditional) costing. Question 18Select one: A. $ 730,000 B. $690,000 C. $700,000 D. $645,000arrow_forwardDetermine the amount of sales (units) that would be necessary under Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 101,250 units at a price of $84 per unit during the current year. Its income statement for the current year is as follows: Sales $8,505,000 Cost of goods sold 4,200,000 Gross profit $4,305,000 Expenses: Selling expenses $2,100,000 Administrative expenses 2,100,000 Total expenses 4,200,000 Income from operations $105,000 The division of costs between fixed and variable is as follows: Variable Fixed Cost of goods sold 70% 30% Selling expenses 75% 25% Administrative expenses 50% 50% Management is considering a plant expansion program that will permit an increase of $672,000 in yearly sales. The expansion will increase fixed costs by $67,200, but will not affect the relationship between sales and variable costs. Required: 1. Determine the…arrow_forward

- Whirly Corporation's contribution format income statement for the most recent month is shown below: Per Unit $31.00 18.00 $ 13.00 Sales (8,600 units) Variable expenses Contribution, margin Fixed expenses Net operating income Total $ 266,600 154,800 111,800 Required: (Consider each case independently): 1. Revised net operating income 2. Revised net operating income 3. Revised net operating income 56,000 $ 55,800 1. What would be the revised net operating income per month if the sales volume increases by 90 units? 2. What would be the revised net operating income per month if the sales volume decreases by 90 units? 3. What would be the revised net operating income per month if the sales volume is.7,600 units?arrow_forwardDetermine the amount of sales (units) that would be necessary under Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 83,700 units at a price of $48 per unit during the current year. Its income statement for the current year is as follows: Sales $4,017,600 Cost of goods sold 1,984,000 Gross profit $2,033,600 Expenses: Selling expenses $992,000 Administrative expenses 992,000 Total expenses 1,984,000 Income from operations $49,600 The division of costs between fixed and variable is as follows: Variable Fixed Cost of goods sold 70% 30% Selling expenses 75% 25% Administrative expenses 50% 50% Management is considering a plant expansion program that will permit an increase of $336,000 in yearly sales. The expansion will increase fixed costs by $33,600, but…arrow_forwardAssume the following information for a merchandising company: Number of units sold 20,000 Selling price per unit $ 30 Variable selling expense per unit $ 3.60 Variable administrative expense per unit $ 3.10 Fixed administrative expenses $ 50,000 Beginning merchandise inventory $ 24,000 Ending merchandise inventory $ 19,000 Merchandise purchases $ 340,000 What is the contribution margin?arrow_forward

- Todrick Company is a merchandiser that reported the following information based on 1,000 units sold: Sales $ 300,000 Beginning merchandise inventory $ 20,000 Purchases $ 200,000 Ending merchandise inventory $ 7,000 Fixed selling expense ?question mark Fixed administrative expense $ 12,000 Variable selling expense $ 15,000 Variable administrative expense ?question mark Contribution margin $ 60,000 Net operating income $ 18,000 3. Calculate the selling price per unit. 4. Calculate the variable cost per unit. 5. Calculate the contribution margin per unit.arrow_forwardSolve the incorrectarrow_forwardDetermine the amount of sales (units) that would be necessary under Break-Even Sales Under Present and Proposed Conditions Darby Company, operating at full capacity, sold 105,300 units at a price of $105 per unit during the current year. Its income statement for the current year is as follows: Sales $11,056,500 Cost of goods sold 5,460,000 Gross profit $5,596,500 Expenses: Selling expenses $2,730,000 Administrative expenses 2,730,000 Total expenses 5,460,000 Income from operations $136,500 The division of costs between fixed and variable is as follows: Variable Fixed Cost of goods sold 70% 30% Selling expenses 75% 25% Administrative expenses 50% 50% Management is considering a plant expansion program that will permit an increase of $840,000 in yearly sales. The expansion will increase fixed costs by $84,000, but will not affect the relationship between sales and variable costs. Required: 1. Determine the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education