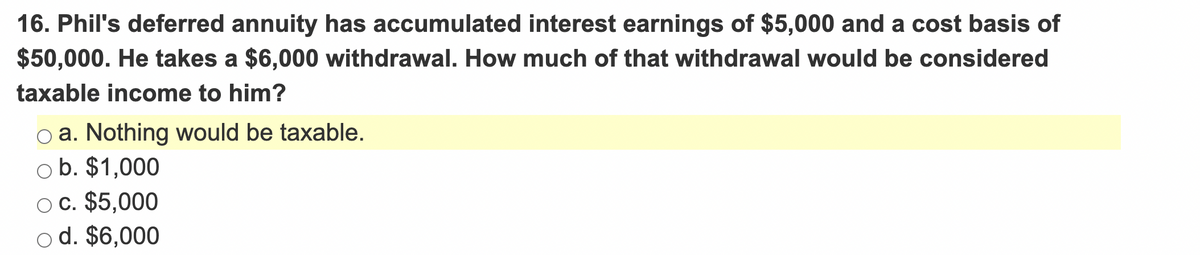

16. Phil's deferred annuity has accumulated interest earnings of $5,000 and a cost basis of $50,000. He takes a $6,000 withdrawal. How much of that withdrawal would be considered taxable income to him? oa. Nothing would be taxable. ob. $1,000 OC. $5,000 od. $6,000

Q: During its first year of operations, Silverman Company paid $11,440 for direct materials and $9,900…

A: Production cost is the total cost incurred in the manufacturing of product during the period. It is…

Q: Assume an investee has the following financial statement information for the three years ending…

A: Under the cost method, the investment is shown as a separate asset and the income received from the…

Q: Prepare the December 31 adjusting entry to report these investments at fair value. Complete this…

A: A fair value adjustment on the available for sale securities or financial instruments is the…

Q: Pablo Company calculates the cost for an equivalent unit of production using process costing. Data…

A: The equivalent units are calculated on the basis of the percentage of the work completed. The unit…

Q: Potaw Company reported the following data at the end of 2019: Sales revenue (80% on credit) Expenses…

A: Days to collect receivables is calculated by dividing number of days in a year by account receivable…

Q: Quilcene Oysteria farms and sells oysters in the Pacific Northwest. The company harvested and sold…

A: Revenue and spending variance :— It is the difference between actual results and flexible budget.…

Q: Splish Inc. incurred a net operating loss of $515,000 in 2025. The tax rate for all years is 20%.…

A: A corporation experiences a net operational loss during the tax year in which its deductions (such…

Q: ABC Company segments its income statement into its North and South Divisions. The company's overall…

A: An income statement shows the financial position of the company It is an important statement that…

Q: How to prepare a statement comprehensive income and statement of financial position The following…

A: Financial statement is prepared from the trial balance which include :-a) Profit and loss and…

Q: On January 1, 2020, Pronghorn Company purchased 6% bonds, having a maturity value of $550,000 for…

A: Investment means an asset purchased in expectation of earning a return on such investment in future…

Q: Selected financial data for Wilmington Corporation is presented below. WILMINGTON CORPORATION…

A: The ratio is the technique used by the prospective investor or an individual or strategist to read…

Q: What are six (6) transaction-related audit objectives for sales? Give examples of tests of controls…

A: Audit objectives are specific, measurable pretensions that adjudicators aim to achieve when…

Q: Sage Hill Inc. traded a used vehicle (cost $25,000, accumulated depreciation $22,000) for another…

A: JOURNAL ENTRY A journal entry records a business transaction in the accounting system of an…

Q: Which of the following items are included when calculating the carrying cost of inventory? (Select…

A: 1. Warehousing costs: These are expenses related to storing and managing inventory in a warehouse,…

Q: Key figures for Apple and Google follow. $ millions. Operating cash flows Total assets Current Year…

A: Lets understand the basics.Cashflow on total assets ratio shows how much operating cash generated on…

Q: Silver Company makes a product that is very popular as a Mother's Day gift. Thus, peak sales occur…

A: Accounts Receivable: It refers to the amount that is owed by the customers of a business for the…

Q: Can you please provide me some examples or practice problems to calculate allocation rate?

A: Activity based costing (ABC) is the modern method for the classification of various expenses to…

Q: Rutland Business Services (RBS) provides miscellaneous consulting and services to local businesses.…

A: Revenue: Revenue, often referred to as sales or income, is the total amount of money earned by a…

Q: Cloud obtained a 60% holding in the 100,000 GHS1 shares of Mist on 1 January 2018, when the retained…

A: Goodwill is an intangible asset that comes into consideration during the acquisition of a company.It…

Q: Silver Company makes a product that is very popular as a Mother's Day gift. Thus, peak sales occur…

A: The cash collection schedule is prepared to estimate the cash to be collected from the customers.…

Q: Company A wants to earn R5, 000 profit in the month of January. If their fixed costs are R10,000 and…

A: The break even sales are the sales where business earns no profit or loss during the period. The…

Q: Sara-Jayne Parsons is an architect who operates her own business. The accounts and transactions for…

A: As per dual concept of accounting, every transaction has dual impact on the books of accounts.The…

Q: Assume an investee has the following financial statement information for the three years ending…

A: If a company holds more then 50% of voting rights in another company, the holding company requires…

Q: Assume that the Oslo Ice Cream Company is considering the costs of two of their product lines-ice…

A: The overhead is assigned to the production on the basis of the pre-determined overhead rate. The…

Q: Liang Company began operations in Year 1. During its first two years, the company completed a number…

A: The allowance for doubtful accounts has normal credit balance. The bad debt expense is recorded to…

Q: Crane Corporation is preparing earnings per share data for 2023. The net income for the year ended…

A: Dividends are paid either on common shares or preferred shares. The preference shareholders have a…

Q: The following events pertain to the Zabel Soccer Supply Shop for February 2004, its first month of…

A: The journal entries are prepared to record the transactions on regular basis. The cost of goods sold…

Q: E3-10 (Algo) Preparing an Income Statement LO3-5 Stacey's Piano Rebuilding Company has been…

A: Income Statement : It is a part of financial statement of a company in which revenue and expenses…

Q: Sarah is a cash-method, calendar-year taxpayer, and she is considering making the following cash…

A: A cash-method, calendar-year taxpayer is that tax payer who will report income and deductions in…

Q: age Rapide owns and operates a large automatic car wash facility near Montreal. The following table…

A: Revenue and spending variance :— It is the difference between actual results and flexible budget.…

Q: In its first month of operations, Literacy for the Illiterate opened a new bookstore and bought…

A: Weighted Average Method is one of the methods of inventory valuation in which it is assumed that…

Q: XYZ, Incorporated, makes foam seat cushions for the automotive and aerospace industries. The…

A: Activity-based costing is a cost allocation method that identifies and assigns overhead expenses to…

Q: XYZ Corporation issued $20,000,000 of 5 year, 9% bonds on April 1 of the current year at face value,…

A: Basically bonds are issued to raise money from investors to fulfill the capital requirements of the…

Q: answer complete question, answer in text form please (without image)

A: The cost of goods sold is calculated as the difference between sales and gross profit. The ending…

Q: At the end of 2021, Skysong, Inc. has accounts receivable of $775,800 and an allowance for doubtful…

A: Journal Entry :— It is an act of recording transactions in books of account when transaction…

Q: Sheridan Company bottles and distributes B-Lite, a diet soft drink. The beverage is sold for 50…

A: BREAKEVEN POINTBreak Even means the volume of production or sales where there is no profit or…

Q: Required information Exercise 6-14 (Algo) Calculate inventory using lower of cost and net realizable…

A: Cost of Inventories - includes the purchase cost of raw materials (i.e, purchase cost, taxes,…

Q: The following information is available for Shanika Company for 20Y6: Inventories Materials Work in…

A: The cost of goods manufactured includes the cost of goods that are finished during the period. The…

Q: in production. he effect of each variance by selecting "Favorable" or "Unfavorable". Select "None"…

A: Lets understand the basics.The variance is calculated as difference between actual data and standard…

Q: Flying Tomato sells a snowboard, WhiteOut, that is popular with snowboard enthusiasts. Presented…

A: Gross profit of the company is the amount earned after deducting all the costs related to…

Q: In keeping with a modernization of corporate statutes in its home state, UMC Corporation decided in…

A: Journal entries are the first process in the accounting cycle. All the transactions which occur…

Q: Assume a company has two manufacturing departments - Assembly and Fabrication. The company considers…

A: The overhead allocation is a method of allocating indirect costs to the goods produced. It can be…

Q: Marvel Parts, Incorporated, manufactures auto accessories including a set of seat covers that can be…

A: The variance is the difference between the actual and standard production data. The variance can be…

Q: Specialty Store uses a periodic inventory system. The following are some inventory transactions for…

A: Under a periodic inventory system cost of goods sold will be calculated at the end of the period…

Q: Gatto, Incorporated, has declared a $5.40 per share dividend. Suppose capital gains are not taxed,…

A: When a company declares a dividend, it typically sets a specific date known as the "ex-dividend…

Q: pare the cash flows from operating activities section of the statement of cash flows for Parnell…

A: Lets understand the basics.Cashflow statement gets prepared to know cash inflow and cash outflow and…

Q: Hanmi Financial Corporation is the parent company of Hanmi Bank. The company’s stock split was…

A: Stock split refers to the existing number of common shares increasing without issuing additional…

Q: at the bottom of all its February sales receipts, Seifert Stores Inc. printed $2-off coupons. The…

A: Sales promotion refers to marketing activities designed to temporarily boost sales of a product or…

Q: Pine Street Inc. makes unfinished bookcases that it sells for $57. Production costs are $38 variable…

A: Variable costs are those costs which changes along with change in sales activity level. Fixed costs…

Q: Key figures for Apple and Google follow. $ millions Operating cash flows Total assets Current Year $…

A: Lets understand the basics.Cashflow on total assets ratio shows how much operating cash generated on…

9

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

- N2 Linton transferred his fixed annuity to his sister for $1. He had paid $25,000 into the contract and at the time of the transfer, the annuity's surrender value had grown to $40,000. How much, if any, of this transfer is taxable to Linton? a. $0 b. $1 c. $15,000 d. $40,000Alex gross income is $104,000. He contributes $7,000 per year to a 401k plan. He takes the standard deduction of $ 6,350 and an exemption of $4,050. What is Alex's adjusted gross income? What is Alex's taxable income?Suppose you made $70,390 of income from wages and $178 of taxable interest. You also made contributions of $6400 to a tax deferred retirement account. You have 2 dependents and file as single. The standard deduction is 3900 and the exemption is 5900 per exemption. What is your Taxable Income? Answer to the nearest dollar.

- Matt is age 75. He received $4,000 from an annuity in 2021. He paid $40,000 for that annuity in 2010. The annuity will pay Matt $4,000 a year, for 15 years, starting in 2011. How much of the $4,000 is included in Matt’s taxable income in 2021? ( ) $0 ( ) $4,000 ( ) $2,668 ( ) $1,332An individual has taxable general income of £70,000 (before deducting the personal allowance). He also has savings income of £1,000. How much Income Tax will be payable on the savings income? £0 £200 £400 £30014. In the following ordinary annuity, the interest is compounded with each payment, and the payment is made at the end of the compounding period.An individual retirement account, or IRA, earns tax-deferred interest and allows the owner to invest up to $5000 each year. Joe and Jill both will make IRA deposits for 30 years (from age 35 to 65) into stock mutual funds yielding 9.1%. Joe deposits $5000 once each year, while Jill has $96.15 (which is 5000/52) withheld from her weekly paycheck and deposited automatically. How much will each have at age 65? (Round your answer to the nearest cent.) Joe $ Jill $ 16. Calculate the present value of the annuity. (Round your answer to the nearest cent.) $11,000 annually at 5% for 10 years.

- N4 Samuel invested $10,000 a year into his retirement plan from his before tax earnings (that is, he received a deduction for these contributions and was not taxed on the income). His employer contributed $5,000 a year to Samuel’s retirement fund. After 30 years of contributions, Samuel retires and receives a distribution of $900,000, the balance in his retirement fund. Samuel must include what amount in gross income? Group of answer choices $ 0 $450,000 $600,000 $900,000Suppose you made $98,296 of income from wages and $567 of taxable interest. You also made contributions of $4200 to a tax deferred retirement account. You have 2 dependents and file as single. The standard deduction is 12900 and the exemption is 3400 per exemption. What is your Gross Income? Answer to the nearest dollar.2-Hamed was granted a loan of £40,000 by his employer on 1st April 2019 and interest is payable on the loan at 1% p.a. On 31st May 2019, Hamed repaid £5,000 and on 30th November 2019 he repaid a further £15,000. The remaining £20,000 was still outstanding on 5 April 2020. The official rate of interest is 2.5 % p.a. for the tax year 2019/20. What will be the taxable benefit on beneficial loans as per the average method of interest calculation? a. £308 b. £750 c. £435 d. None of the options

- Suppose you made $92,747 of income from wages and $386 of taxable interest. You also made contributions of $6000 to a tax deferred retirement account. You have 1 dependents and file as single. The standard deduction is 11400 and the exemption is 3000 per exemption. What is your Adjusted Gross Income? Answer to the nearest dollar.An individual has an RSP that they are drawing money out of during 2020. TheRRSP has earned dividends of $10,000. The individual withdraws $32,000 from theRRSP. To obtain that much cash, the RSP sells investments worth $32,000 thathave a cost basis of $20,000. What is the individual's 2020 taxable income as aresult of the RRSP? A) 42000 B) 16000 C)19800 D)32000Julian used $90,000 of his savings to purchase a single premium annuity, which pays him $600 per month. If his life expectancy was 25 years at the time he purchased the annuity, how much of each payment is subject to tax? A) $500 at his current age. B) $200 C) $350 D) $300