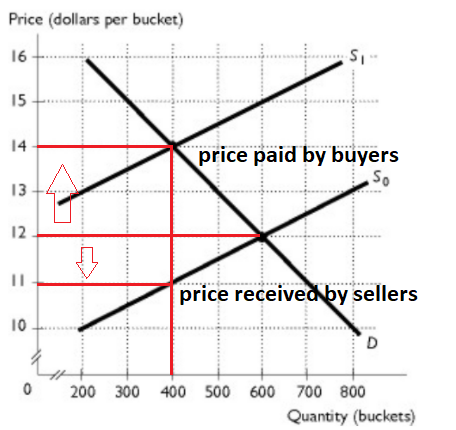

Price (dollars per bucket) 16 15 14 13 12 10 200 300 400 500 600 700 800 Quantity (buckets) The above figure shows the market for buckets of golf balls at the driving range. A new leisure time tax is placed on suppliers in this market, shifting the supply curve from So to S1. The tax incidence is A) such that buyers pay $1 per bucket and sellers pay $2 per bucket. B) split equally between buyers and sellers, each paying $1 per bucket. C) such that buyers pay $2 per bucket and sellers pay $1 per bucket. D) split equally between buyers and sellers, each paying $2 per bucket. %3D

Price (dollars per bucket) 16 15 14 13 12 10 200 300 400 500 600 700 800 Quantity (buckets) The above figure shows the market for buckets of golf balls at the driving range. A new leisure time tax is placed on suppliers in this market, shifting the supply curve from So to S1. The tax incidence is A) such that buyers pay $1 per bucket and sellers pay $2 per bucket. B) split equally between buyers and sellers, each paying $1 per bucket. C) such that buyers pay $2 per bucket and sellers pay $1 per bucket. D) split equally between buyers and sellers, each paying $2 per bucket. %3D

Chapter6: Elasticities

Section: Chapter Questions

Problem 5P

Related questions

Question

100%

Transcribed Image Text:Price (dollars per bucket)

16

15

14

13

12

10

200 300

400

500

600

700

800

Quantity (buckets)

The above figure shows the market for buckets of golf balls at the driving range. A

new leisure time tax is placed on suppliers in this market, shifting the supply curve

from So to S1. The tax incidence is

A) such that buyers pay $1 per bucket and sellers pay $2 per bucket.

B) split equally between buyers and sellers, each paying $1 per bucket.

C) such that buyers pay $2 per bucket and sellers pay $1 per bucket.

O D) split equally between buyers and sellers, each paying $2 per bucket.

%3D

Expert Solution

Step 1

Answer:

According to the above figure, due to tax the supply curve shifts to the left from S0 to S1. The new equilibrium price is $14. $14 is the price paid after tax by the buyers. The corresponding price on the old supply curve i.e. $11 is the price received by sellers after tax.

Incidence of tax on buyers = Price paid after-tax - Equilibrium price

Incidence of tax on buyers = 14 -12 = $2

The price paid by buyers has increased by $2.

And,

Incidence of tax on sellers = Equilibrium price - Price received by sellers

Incidence of tax on sellers = 12 - 11 = $1

The price received by sellers has decreased by $1.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax