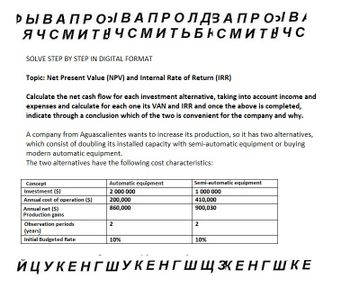

РЫ В А ПРО В А П Р О Л ДЗАПРОВА ЯЧСМИТНЧСМИТЬБНСМИТНЧС SOLVE STEP BY STEP IN DIGITAL FORMAT Topic: Net Present Value (NPV) and Internal Rate of Return (IRR) Calculate the net cash flow for each investment alternative, taking into account income and expenses and calculate for each one its VAN and IRR and once the above is completed, indicate through a conclusion which of the two is convenient for the company and why. A company from Aguascalientes wants to increase its production, so it has two alternatives, which consist of doubling its installed capacity with semi-automatic equipment or buying modern automatic equipment. The two alternatives have the following cost characteristics: Concept Investment ($) Annual cost of operation ($) Annual net ($) Production gains Observation periods (years) Initial Budgeted Rate Automatic equipment 2 000 000 200,000 860,000 2 10% Semi-automatic equipment 1 000 000 410,000 900,030 2 10% ЙЦУКЕНГШУКЕНГ Ш ЩЗКЕНГШКЕ

РЫ В А ПРО В А П Р О Л ДЗАПРОВА ЯЧСМИТНЧСМИТЬБНСМИТНЧС SOLVE STEP BY STEP IN DIGITAL FORMAT Topic: Net Present Value (NPV) and Internal Rate of Return (IRR) Calculate the net cash flow for each investment alternative, taking into account income and expenses and calculate for each one its VAN and IRR and once the above is completed, indicate through a conclusion which of the two is convenient for the company and why. A company from Aguascalientes wants to increase its production, so it has two alternatives, which consist of doubling its installed capacity with semi-automatic equipment or buying modern automatic equipment. The two alternatives have the following cost characteristics: Concept Investment ($) Annual cost of operation ($) Annual net ($) Production gains Observation periods (years) Initial Budgeted Rate Automatic equipment 2 000 000 200,000 860,000 2 10% Semi-automatic equipment 1 000 000 410,000 900,030 2 10% ЙЦУКЕНГШУКЕНГ Ш ЩЗКЕНГШКЕ

Oh no! Our experts couldn't answer your question.

Don't worry! We won't leave you hanging. Plus, we're giving you back one question for the inconvenience.

Submit your question and receive a step-by-step explanation from our experts in as fast as 30 minutes.

You have no more questions left.

Message from our expert:

It looks like you may have submitted a graded question that, per our Honor Code, experts cannot answer. We've credited a question to your account.

Your Question:

Transcribed Image Text:РЫ В А ПРО В А П Р О Л ДЗАПРОВА

ЯЧСМИТНЧСМИТЬБНСМИТНЧС

SOLVE STEP BY STEP IN DIGITAL FORMAT

Topic: Net Present Value (NPV) and Internal Rate of Return (IRR)

Calculate the net cash flow for each investment alternative, taking into account income and

expenses and calculate for each one its VAN and IRR and once the above is completed,

indicate through a conclusion which of the two is convenient for the company and why.

A company from Aguascalientes wants to increase its production, so it has two alternatives,

which consist of doubling its installed capacity with semi-automatic equipment or buying

modern automatic equipment.

The two alternatives have the following cost characteristics:

Concept

Investment ($)

Annual cost of operation ($)

Annual net ($)

Production gains

Observation periods

(years)

Initial Budgeted Rate

Automatic equipment

2 000 000

200,000

860,000

2

10%

Semi-automatic equipment

1 000 000

410,000

900,030

2

10%

ЙЦУКЕНГШУКЕНГ Ш ЩЗКЕНГШКЕ

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning