Last month, Jim purchased $10,000 of US Treasury Bonds (their face value was $10,000). These bonds have a 30-year maturity period, and they pay 1.5% interest every three months (i.e. the APR is 6% and Jim receives a check for $150 every three months). But interest rates for similar securities have since risen to a 7% APR because of interest rate increases by the Federal Reserve Board. In view of the interest rate increases to 7%, what is the current value of Jim's bonds? 7% = 1.75 or 0.00175% Pmt 1 4(quarter) -> Present Value of Annuity → PV 50 (1 (1 - (1 +/- 1)) r 150 1- PV = 1 (1+0.0175) 0.00175 = 146.4893 150 1 (1 - PV₂ = = 296.793 PV3 = (1+0.0175)² 0.0175 150 (1- (1+0.0175)³) 0.0175 = 429.1239 TPV = PV₁ + PV2 + PV3 = $872.41

Last month, Jim purchased $10,000 of US Treasury Bonds (their face value was $10,000). These bonds have a 30-year maturity period, and they pay 1.5% interest every three months (i.e. the APR is 6% and Jim receives a check for $150 every three months). But interest rates for similar securities have since risen to a 7% APR because of interest rate increases by the Federal Reserve Board. In view of the interest rate increases to 7%, what is the current value of Jim's bonds? 7% = 1.75 or 0.00175% Pmt 1 4(quarter) -> Present Value of Annuity → PV 50 (1 (1 - (1 +/- 1)) r 150 1- PV = 1 (1+0.0175) 0.00175 = 146.4893 150 1 (1 - PV₂ = = 296.793 PV3 = (1+0.0175)² 0.0175 150 (1- (1+0.0175)³) 0.0175 = 429.1239 TPV = PV₁ + PV2 + PV3 = $872.41

Introduction to Chemical Engineering Thermodynamics

8th Edition

ISBN:9781259696527

Author:J.M. Smith Termodinamica en ingenieria quimica, Hendrick C Van Ness, Michael Abbott, Mark Swihart

Publisher:J.M. Smith Termodinamica en ingenieria quimica, Hendrick C Van Ness, Michael Abbott, Mark Swihart

Chapter1: Introduction

Section: Chapter Questions

Problem 1.1P

Related questions

Question

is this right?

Transcribed Image Text:Last month, Jim purchased $10,000 of US Treasury Bonds (their face value was $10,000). These bonds

have a 30-year maturity period, and they pay 1.5% interest every three months (i.e. the APR is 6% and

Jim receives a check for $150 every three months). But interest rates for similar securities have since

risen to a 7% APR because of interest rate increases by the Federal Reserve Board. In view of the

interest rate increases to 7%, what is the current value of Jim's bonds?

7%

4(quarter)

= 1.75 or 0.00175%

1

Pmt (1

(1+r)",

r

Present Value of Annuity → PV

PV =

PV2

=

PV3

=

1

150 (1 − (1 + 0.0175).

0.00175

1

(150 (1 − (1 + 0.0175)²

-

0.0175

1

150 (1 − (1 + 0.0175)³

0.0175

= 146.4893

=

296.793

= 429.1239

TPV = PV₁ + PV2 + PV3 = $872.41

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 18 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

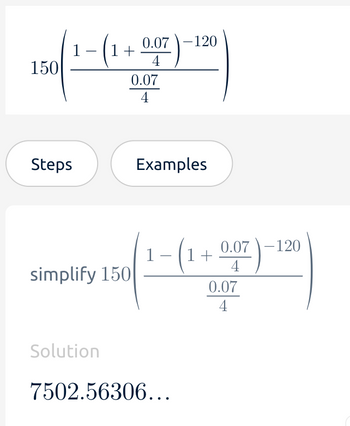

i am having a hard time coming up with the same calculations. can u plz expand

Transcribed Image Text:150

1

-

(1+0.07)-

4

0.07

4

-120

Steps

Examples

0.07-120

1+

simplify 150

4

0.07

4

Solution

7502.56306...

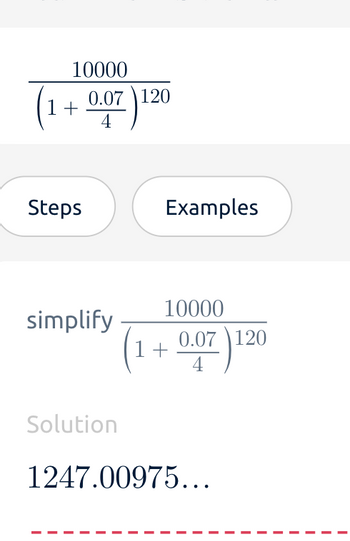

Transcribed Image Text:10000

(1 + 0.07) 120

Steps

Examples

simplify

Solution

10000

(1 + 0.07) 120

1247.00975...

Solution

Recommended textbooks for you

Introduction to Chemical Engineering Thermodynami…

Chemical Engineering

ISBN:

9781259696527

Author:

J.M. Smith Termodinamica en ingenieria quimica, Hendrick C Van Ness, Michael Abbott, Mark Swihart

Publisher:

McGraw-Hill Education

Elementary Principles of Chemical Processes, Bind…

Chemical Engineering

ISBN:

9781118431221

Author:

Richard M. Felder, Ronald W. Rousseau, Lisa G. Bullard

Publisher:

WILEY

Elements of Chemical Reaction Engineering (5th Ed…

Chemical Engineering

ISBN:

9780133887518

Author:

H. Scott Fogler

Publisher:

Prentice Hall

Introduction to Chemical Engineering Thermodynami…

Chemical Engineering

ISBN:

9781259696527

Author:

J.M. Smith Termodinamica en ingenieria quimica, Hendrick C Van Ness, Michael Abbott, Mark Swihart

Publisher:

McGraw-Hill Education

Elementary Principles of Chemical Processes, Bind…

Chemical Engineering

ISBN:

9781118431221

Author:

Richard M. Felder, Ronald W. Rousseau, Lisa G. Bullard

Publisher:

WILEY

Elements of Chemical Reaction Engineering (5th Ed…

Chemical Engineering

ISBN:

9780133887518

Author:

H. Scott Fogler

Publisher:

Prentice Hall

Industrial Plastics: Theory and Applications

Chemical Engineering

ISBN:

9781285061238

Author:

Lokensgard, Erik

Publisher:

Delmar Cengage Learning

Unit Operations of Chemical Engineering

Chemical Engineering

ISBN:

9780072848236

Author:

Warren McCabe, Julian C. Smith, Peter Harriott

Publisher:

McGraw-Hill Companies, The